- Major currencies led by the British pound are rallying amid weakness in the dollar following a disappointing NFP report.

- Major indices are flirting with all-time highs in the wake of weak employment data averting concerns of rate hikes.

- Bitcoin and Ethereum have regained their upward momentum even as Dogecoin remains under pressure.

The British pound rallied to two and half months’ highs against the US dollar even as Scotland threatened to hold another independence referendum. The GBP/USD pair remains bullish on the dollar weakening to more than two-month lows following a disappointing employment report that raised concerns about the health of the world’s biggest economy.

The cable is currently trading at a key resistance level. The 1.4100 is the immediate resistance level, a breach of which could pave the way for further gains back to three-month highs. The pair trading above 9-period EMA and 21-period EMA appears increasingly bullish and well-poised for further upside action.

However, bears defending the 1.4100 resistance level could result in the pair pulling lower. The immediate support on any pullback would be in the 1.3900 level and 1.3800 levels. The major tailwind that could trigger a retreat from current highs is the growing concern of Scotland breaking away from the UK.

Brazil real rally

The Brazilian real is another currency gaining ground against the dollar. The real has risen to four months’ highs in the wake of the country’s central bank hawkish tone. The central bank also hiked interest rates leading to further strengthening in the real against the dollar.

Global banks publishing revised outlook about the Brazilian economy continues to fuel strength in the real. The banks expect the country’s rate to rise more quickly and aggressively. In the past week alone, the real has gained more than 1.5% against the dollar.

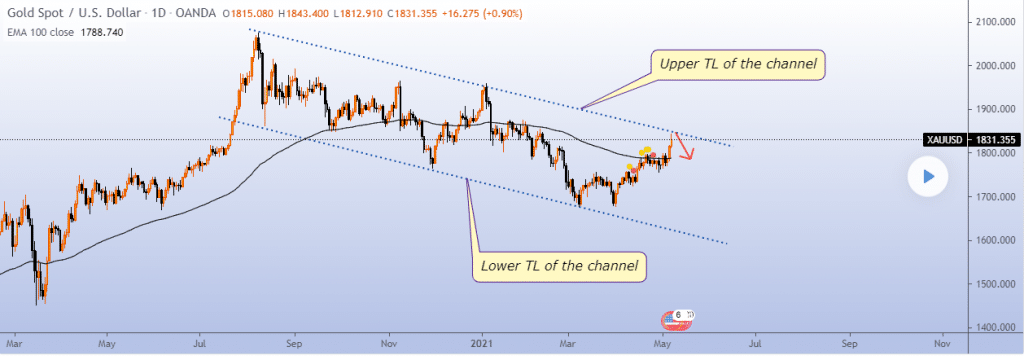

Gold rally

In the commodity markets, gold has powered three-month highs in the wake of the greenback plunging to two months low on weak employment data. The precious metal has since retaken the $1800 an ounce level after coming under immense pressure in recent months.

However, a rebound in US Treasury yield early Monday morning is helping cap further price gains in the bullion. The $1840 has since emerged as the immediate resistance level limiting further upside action. A rally followed by a close above the $1840 level should pave the way for gold to make a run for the $1852 level, a crucial resistance level. Overall, gold prices look increasingly bullish, supported by weakness in the greenback.

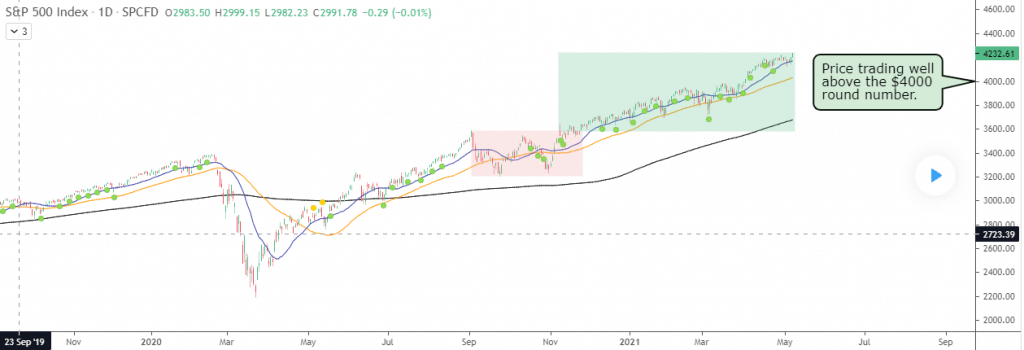

Major indices buy tone

The buy tone remains intact in the equity markets, with major indices in the US powering back to all-time highs the past week. The rallies on the S&P 500 and the Dow Jones Industrial Average were mostly fuelled by weakness in the US dollar following a big miss on the Non-Farm Payroll Report.

The bounce back in major indices could also be attributed to growing speculation that interest rates will remain low due to declining inflationary pressures. In recent weeks there has been growing fears that a robust US economic recovery could force the Federal Reserve to raise interest rates earlier than outlined. A weak NFP report has caused a quick reversal in such sentiments.

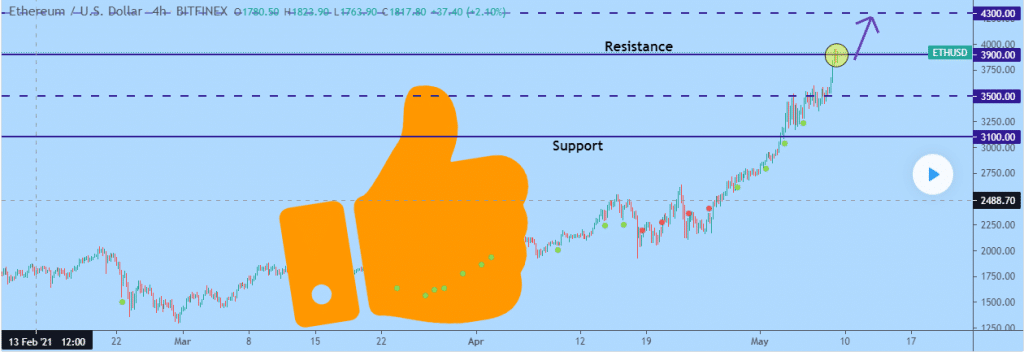

Bitcoin & Ethereum bounce back

In the cryptocurrency markets, Bitcoin and Ethereum have regained their upward momentum. Ethereum touched record highs of $4,000 as it continues to outperform Bitcoin and Dogecoin that have been the center of attention in recent weeks.

Upon breaching the $4,000 psychological level, Ethereum bulls may eye the $4,300 level the next substantial resistance level.

In recent weeks Ethereum has emerged as more than just number two, outshining Bitcoin in the process. As Bitcoin pulled back from record highs of $64,000, Ethereum continued to rally. Amid the outperformance, the two cryptocurrencies are top options for investors eyeing exposure in the cryptocurrency space.

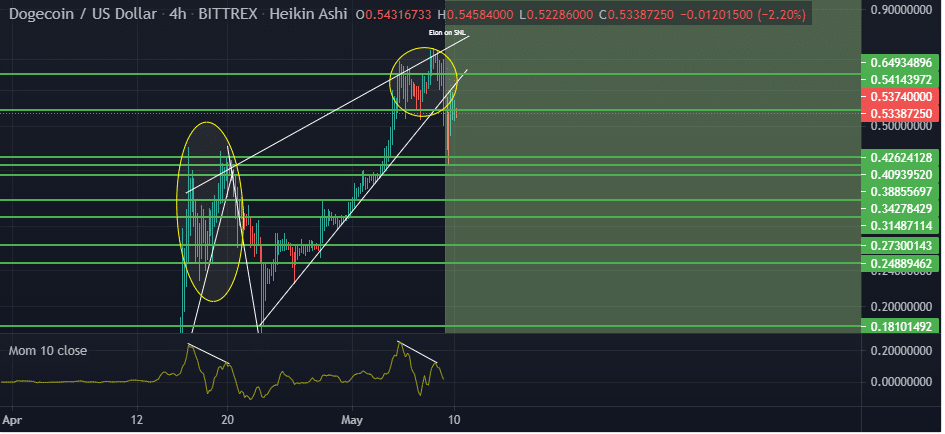

Dogecoin sell-off

Dogecoin’s impressive run came to a halt over the weekend, with the crypto imploding by more than 30%. The formation of a bearish divergence at all-time highs might as well signal that a deep correction might be in play.

DOGE is making the same correction pattern that it made the last time it corrected lower significantly. The recent sell-off has come at the backdrop of self-proclaimed ‘Dogefather’ Elon musk appearing on Saturday Nightlife and mentioning it in his opening monologue.