- The US dollar eases lower from a 16-month high.

- USDJPY spikes on disappointing GDP data.

- NZDUSD up on solid Chinese data.

- US oil drops on supply and demand concerns.

- Bitcoin and Ethereum bounce back.

The US dollar eased slightly on Monday morning but remained elevated near 16-month highs. The pullback comes following last week’s blockbuster move supported by red hot inflation data that fuelled calls for the Federal Reserve to hike interest rates.

After touching 16-month highs above 95.22, the dollar index, which measures dollar strength, has pulled slightly below 95.00. However, it remains well above levels not seen in 2021, affirming dollar strength across the board.

The focus is on the release of US retail sales on Tuesday, which could provide clues about the health of the US economy amid the runaway inflation.

USDJPY bounce back

Amid the dollar softness, the USDJPY did pull back early Monday morning below the 114.00 level. However, the pair started recouping the losses in response to disappointing Japan Q3 GDP data.

Following the pullback, the 113.73 has emerged as the short-term support level above which the USDJPY pair remains well supported for further upside action. A rally followed by a close above the 114.10 level could pave the way for a rally to three-year highs of 114.51 level.

The renewed upward momentum on USDJPY comes on the backdrop of Japan’s Q3 data showing a drop at an annualized rate of 3%. The GDP data also showed a 0.8% quarterly drop worse than the economist median estimate of a 0.2% contraction.

Data also showed that private consumption, which accounts for more than half of the economy, dropped 1.1 % versus a 0.5% expected to drop. The drop has once again aroused concerns about Japan’s economic health, fuelling yen weakness. Consequently, the bullish momentum on the USDJPY looks set to persist.

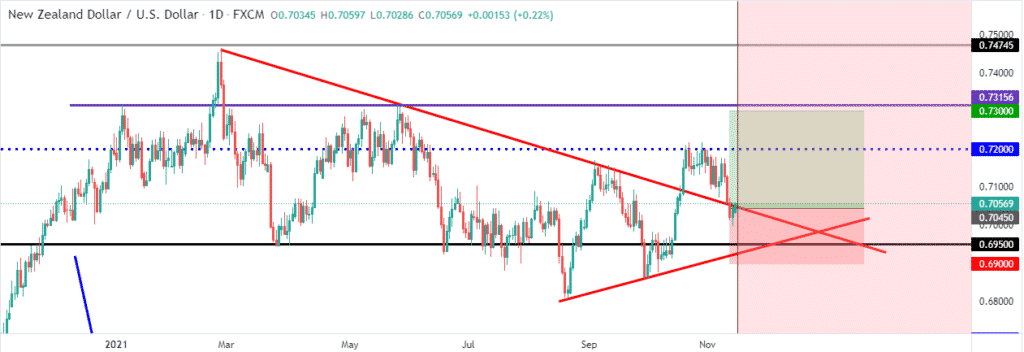

NZDUSD above 0.7000

Meanwhile, the NZDUSD is on the front foot at the start of the week after two consecutive weekly falls. The pair appears to have found support above the 0.7028 level; the pair is trading around the 0.7050 level, well-supported by upbeat Chinese economic data.

The latest data out of China shows that retail sales and industrial output rose 4.9% and 3.5% year-over-year in October, respectively. In addition, the pair remains well supported by softness in the dollar, which has pulled slightly from a 16-month high.

Amid the lack of big economic releases on Monday, focus shifts to US retail sales on Tuesday and a speech by the Reserve Bank of Australia Governor on Tuesday. Charter around the Reserve Bank of New Zealand interest rate decision next week will also be crucial.

Oil prices drop

In the commodity markets, a slide in oil prices continued on Monday, with US oil prices remaining slightly below the $80 a barrel level. Brent crude, on the other hand, is trying to hold on to gains above the $81.72 a barrel level.

The pullback in oil prices comes amid expectations of rising supply in the oil market amid lower demand. Lower demand forecast amid higher energy costs also curtails a surge in prices after recent gains.

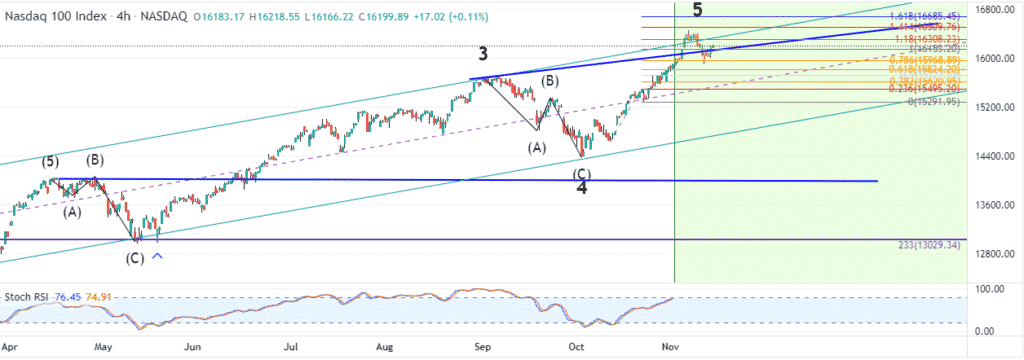

US equity indices near record highs

In the equity markets, major US indices finished near record highs on Friday as investors continued to shrug off inflation fears and a rise in government debt yields. The Dow Jones rose 179 points on Friday, as The S&P 500 rose 33.58 points to $4,682. Tech heavy Nasdaq rose 156 points on Friday to 15,860.

For the week, the Dow was down 0.6%, the S&P 500 lost 0.3%, and the NASDAQ fell 0.7%. The gains on Friday came as investors remained optimistic that corporate earnings would remain healthy amid the supply chain headwinds.

Bitcoin and Ethereum bounce back

In the cryptocurrency market, Bitcoin and Ethereum are once again in a recovery mode, trying to bounce back after a recent pullback from all-time highs. BTCUSD has retaken the $65,560 level after a recent pullback to the $62,056 level.

Ethereum has also bounced back to the $4,600 level after a pullback from $4,890 to lows of $4,560 level. The upward momentum in the two cryptocurrencies remains intact despite the recent pullbacks.