- The US dollar strengthens amid safe-haven demand.

- USDJPY finds support above 114.00.

- EURUSD plunges below 1.1300 amid COVID fears.

- Gold is under pressure as the dollar strengthens.

- Bitcoin and Ethereum sell-off persists.

The US dollar is showing no signs of slowing down as it continues to strengthen across the board. The dollar index, which measures the greenback strength against the majors, remains elevated at 16-month highs, having powered through the 96.00 handle.

Dollar strength received a boost Monday morning as traders rushed to safe-haven in response to escalating the COVID-19 situation in Europe. Federal Reserve Vice Chairman Richard Clarida and Governor Christopher Waller reiterating that higher inflation rates and economic recovery warrant faster asset tapering also continue to fuel dollar strength.

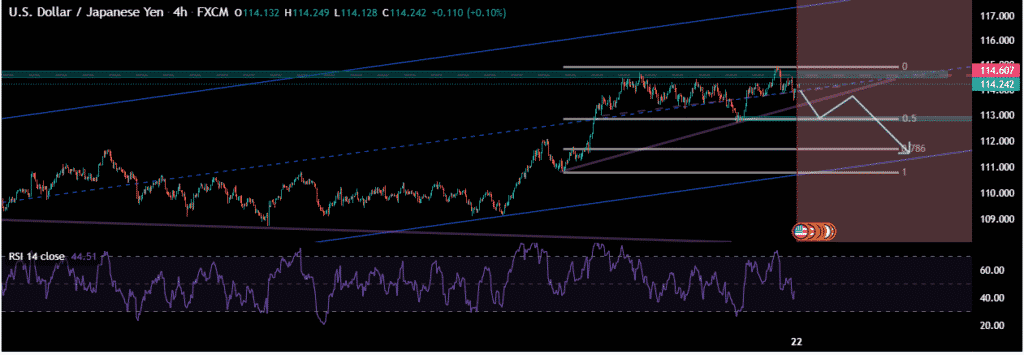

USDJPY upward momentum

The USDJPY has since powered and found support above the 114.00 level amid the dollar strength across the board. The rally on the pair remains supported by a spike in treasury yields as calls for rate hikes in the US gather momentum.

After the recent spike, 113.79 has emerged as a key support level above which USDJPY remains well supported for further gains. In addition, bulls are staring at resistance near the 114.30 level above which the pair could power to four-year highs of 115.00. The EURUSD is holding steady near the 1.1270 level amid concerns over the oversold conditions.

EURUSD sell-off

Meanwhile, the EURUSD pair is being hammered, having failed to find support above the 1.1300 level after the recent bounce back. The pair has since plunged to a 16-month low of 1.1270 and remains under immense bearish pressure.

The pair remains susceptible to a further slide to the 1.1150 level, seen as the next substantial support level. On the flip side, it needs to bounce back and find support above the 1.1300 level to avert a further slide to multi-year lows.

The renewed sell-off on the EURUSD pair comes on Austria’s heels, reiterating it could be forced into a full lockdown amid surging COVID-19 infections. Germany is also believed to be considering lockdowns to avert the spread of the virus.

Gold under pressure

In the commodity markets, Gold is yet again under pressure for the third consecutive day. XAUUSD has slid below the $1850 level as the sell-off continues to gather pace. While the pair did bounce back after initially touching two-week lows of $1838, it remains susceptible to plunge back to the key support level.

The renewed sell-off on XAUUSD comes on the backdrop of the dollar powering high and strengthening to 16-month highs. The dollar strength continues to offset gold price gains after the recent rally to highs of $1873.

However, the sell-off on the XAUUSD could be limited as traders flock to the precious metal as a safe haven amid ongoing uncertainty. The escalating COVID-19 situation in Europe is already fuelling demand for safe-havens, all but strengthening gold sentiments.

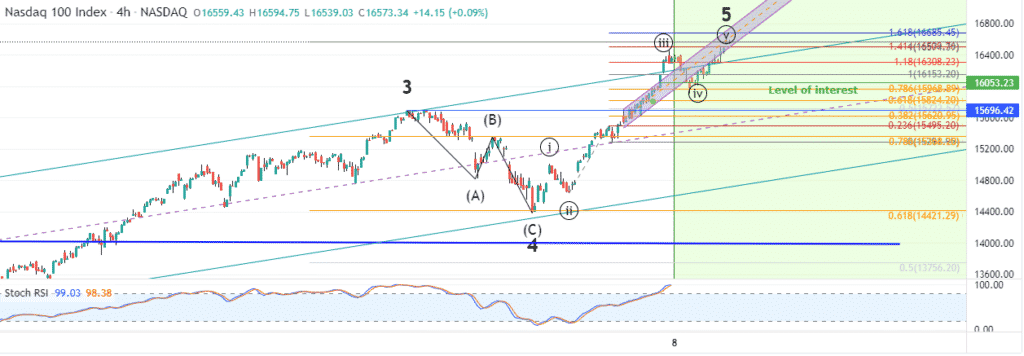

US indices mixed

Major US indices finished mixed on Friday in the equity markets as concerns over rising COVID-19 cases triggered caution in the market. For the week, the Dow Jones Industrial Average fell the most, shedding 1.4% as the S&P 500 gained 0.3%. The c was up 1.2% for the week.

The gains registered in the equity benchmarks were due to technology stocks bouncing back and shrugging off the COVID-19 concerns. The fears have triggered a strong interest in stay-at-home trades, benefiting a good chunk of technology stocks. Travel-oriented stocks remain the most affected, edging lower amid travel restrictions concerns.

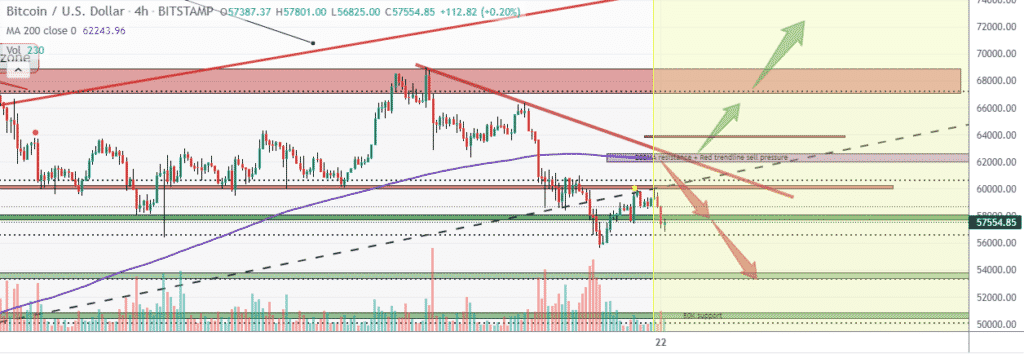

Bitcoin-Ethereum pull back

In the cryptocurrency market, Bitcoin and Ethereum remain under pressure as a sell-off from record highs persists. BTCUSD has struggled to bounce back above the $60,000 level with bears in control. The pair looks set to plunge to the $56,500 level, a critical support level.

Ethereum is also under pressure after retreating from highs of $4,900. ETHUSD is staring at support near the $3900 level after the recent slide to $4,168.