Ethereum price is hovering near its all-time high as demand for the coin and other cryptocurrencies jumped. ETH crossed the $4,000 milestone on Tuesday for the first time since July this year. This means that the currency has jumped by more than 130% from its lowest level in July. The rally brought its total market capitalization to more than $461 billion.

Ethereum in a strong bull run

Ethereum is a blockchain project that has become pivotal to the decentralized industry. The network, which was built by a team led by Vitalik Buterin, is currently used by most developers to build applications. Its role is important in industries like decentralized finance (DeFi), non-fungible tokens (NFT), and other decentralized applications.

As a first-generation platform, Ethereum has many challenges. For one, its speed is significantly low, with an average transaction per second (TPS) of less than 20. Similarly, it often has interoperability and scalability problems.

Most importantly, Ethereum uses the proof-of-work consensus mechanism that is known for being less efficient. Still, the team behind it is hard at work to transition to a proof-of-stake consensus by the first quarter of 2022.

As a result, recent focus has been on the so-called Ethereum-killers. These are blockchain projects built to create a faster and more diverse alternative to Ethereum. Indeed, recently, many of these Ethereum-killers like Solana, Avalanche, Hedera Hashgraph, and Polkadot have seen their token prices soar. For example, while Ethereum’s TPS is less than 20, Solana has a TPS of more than 2,000.

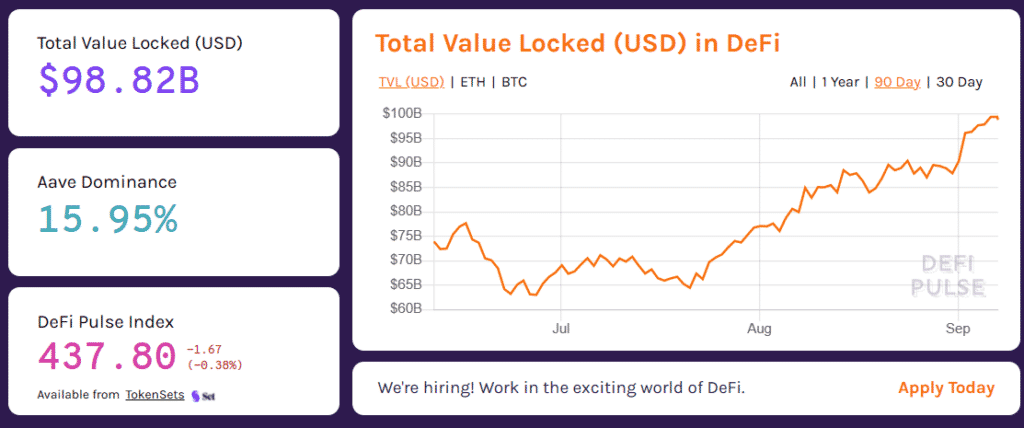

Still, Ethereum has a bigger market share than these tokens. For example, the total value locked (TVL) in the biggest Ethereum DeFi platforms rose to more than $99 billion. This is a substantial increase since these platforms were inexistent a few years ago. Aave has a TVL of more than $18 billion, while Maker, InstaDapp, and Curve Finance have TVLs of more than $12 billion.

At the same time, Ethereum is the foundation platform for most NFT platforms like OpenSea. This is a growing industry that is expected to process billions of dollars of transactions every year.

ETH demand rising

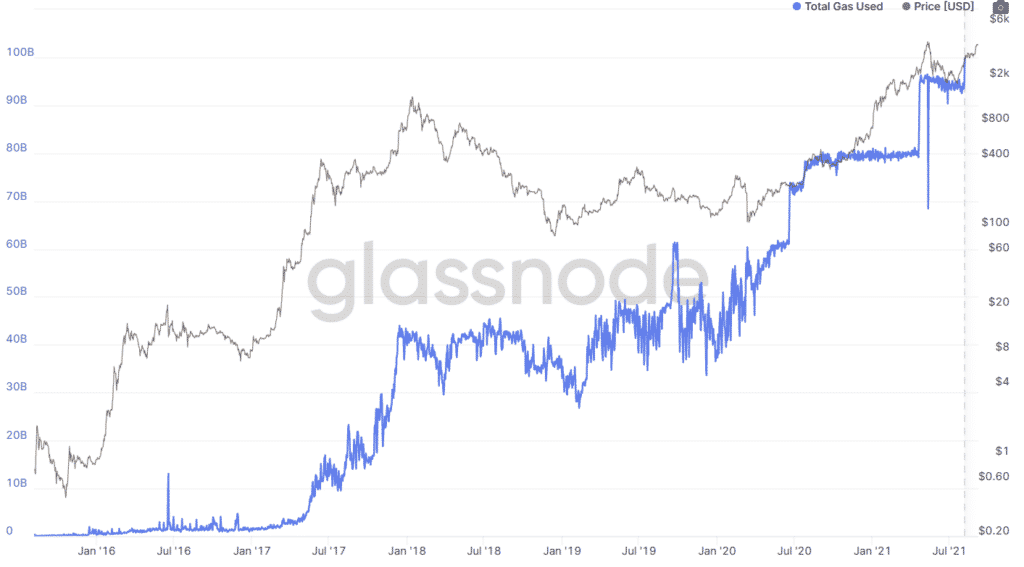

The Ethereum price is rising as demand for cryptocurrencies continues rising. On-chain data shows that the number of active Ethereum addresses has risen from the lowest level in July. Similarly, the number of accounts with non-zero balances has also been rising, which is a sign that investors are coming back to the industry. And, according to Glassnode, the total gas used has also been rising, which is a sign of rising demand.

Ethereum gas used

Still, a closer look at the cryptocurrencies market shows that other coins are also in a bullish trend. For one, Bitcoin has ended its consolidation phase and is currently approaching the $53,000 mark. Other altcoins have also risen, pushing the total market capitalization of all cryptocurrencies to more than $2.3 trillion.

Ethereum price forecast

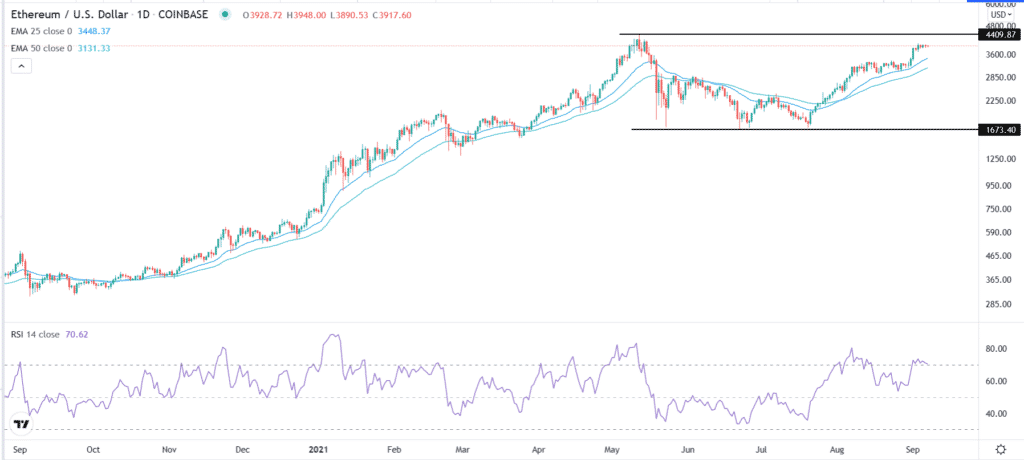

The ETH price formed a strong support at $1,673 in June and July. At the time, the coin was down by more than 60% from its all-time high. Since then, the Ethereum price has more than doubled. Along the way, it has moved above the key resistance levels at $2,000, $2,500, and $3,000.

The bullish trend is also being supported by the 25-day and 50-day exponential moving averages (EMA). Oscillators like the MACD and the Relative Strength Index (RSI) have been rising. Therefore, the coin’s path of least resistance is to the upside, with the next key level to watch being at $4,400.