- US dollar firms near 16-month highs amid safe-haven demand.

- USDJPY suffers the biggest sell-off in 20 months.

- EURUSD is under pressure amid Omicron concerns.

- Oil prices bounce back amid production cuts.

- Bitcoin and Ethereum bounce back.

The US dollar was trading higher on Monday morning as investors continued to scamper for safety in the discovery of a coronavirus variant that is potentially resistant to vaccines. The Dollar index bounced back to the 96.18 handle after initially tanking to lows of 95.86.

Amid the dollar strength, investors are also banking on other safe havens led by the Japanese yen and Swiss franc as the greenback looks highly overstretched at 16-month highs. The gains on the dollar could be restricted as traders continue to take profits after the recent surge higher.

USDJPY sell-off

As the race to safety heats up, the USDJPY fell the most in more than 20 months to two-week lows of 112.98. The sell-off came as investors flocked the Japanese yen, seen as one of the most reliable safe-haven assets in times of uncertainty, similar to the one triggered by the Omicron Covid-19 variant.

While the pair has bounced back above the 113.03 level, it remains susceptible to further losses as the yen continues to strengthen against the dollar. Following the deep pullback, the 112.73 is the immediate support level above which the pair could bounce back.

A sell-off followed by a close below the 112.73 level could trigger renewed sell-off to the 112.01 level, the next substantial support level.

The renewed sell-off on the USDJPY also comes on the backdrop of US treasury yields edging lower in response to the COVID-19 concerns. The US 10-year yield tanking to lows of 1.47% appears to have triggered weakness on the dollar against the yen, consequently the pull back on the USDJPY.

EURUSD struggles

Amid the sell-off, the USDJPY, the EURUSD remains under pressure after a recent bounce back to the 1.1330 level. The pair has edged lower and is struggling for direction near the 1.1284 level. The pair remains under pressure amid a push by most European powers to impose lockdown restrictions to combat the spread of the Omicron variant.

Following the recent pullback, the pair is staring at support at the 1.1270 level. A break below the 1.1270 support level could trigger renewed sell-off on the pair back to 16-month lows. A rally on the EURUSD looks unlikely, following reports from the European Center of Disease Prevention and Control indicating that the Omicron variant could significantly reduce vaccine effectiveness and boost the risk of reinfections.

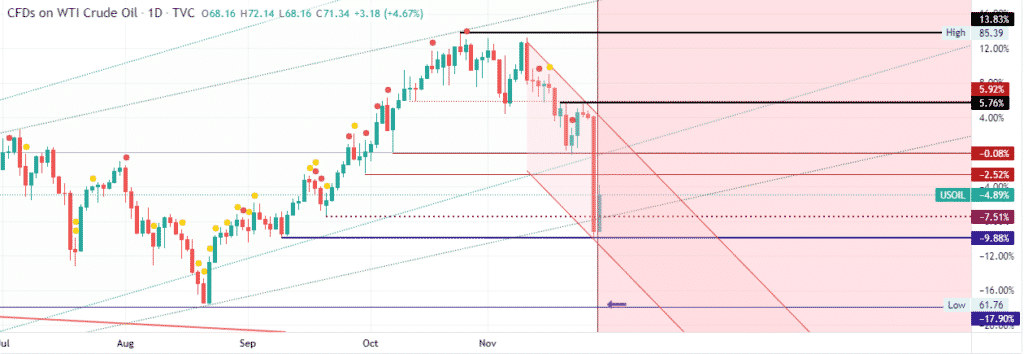

Oil prices bounce back

Oil prices were in recovery mode on Monday after sell-off to three-month lows last week in the commodity markets. US West Texas oil rallied 5.1% to $71.62 a barrel as Brent crude rallied 4.3% to $75.8. Amid the bounce back, prices remain below the $80 a barrel level.

Oil prices have been rattled in recent days amid growing concerns that the new COVID-19 variant could affect demand levels worldwide. This is especially the case as most countries resort to lockdown measures to stem the spread.

Reports that OPEC members are contemplating reducing supply into the market appear to have offered some reprieve curtailing further losses.

US stock futures recover

In the equity market, some calmness is slowly creeping in after a major sell-off last week. Stocks came under pressure amid concerns that the Omicron Coronavirus variant will derail economic recoveries and proposed tightening plans by the central bank.

Early Monday morning, the S&P 500 futures gained 0.78% as the Nasdaq Futures gained 0.9%. The bounce-back came after the overall stock market suffered its ugliest Black Friday sell-off.

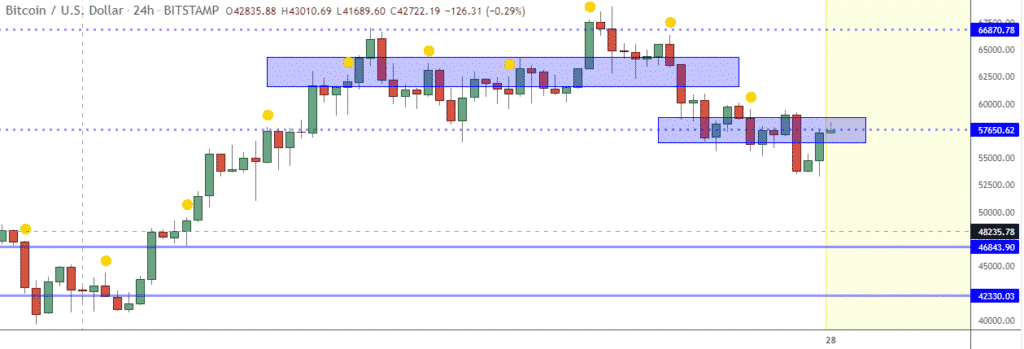

Crypto bounce back

In the cryptocurrency market, Bitcoin and Ethereum were also in a recovery mode holding on to gains accrued over the weekend. BTCUSD was trading above $57,500 on Monday morning after coming under pressure on Friday and tanking to lows of $53,700.

Ethereum was also in recovery mode powering through the $4,300 after tanking to lows of $3,900 on Friday.