- US dollar strength persists on rising yields.

- USDCAD shrugs off rising oil prices to rally.

- AUDJPY retreats on AUD weakness.

- Gold under pressure below $1750.

- US equities struggling for direction.

- Bitcoin and Ethereum sell-off resumes.

A strengthened dollar is a central theme in the forex market on US Treasury yields powering to three-month highs. The benchmark 10-year US yield topping 1.5% is the catalyst attracting Japanese investors to US bonds, consequently sending the dollar higher against the majors.

The dollar also continues to attract bids following a more hawkish FED last week that affirmed the case for asset tapering before year-end. Concerns that China Evergrande could default on its $305 billion debt has also sparked fear in the market, fuelling demand for safe-haven, thus sending the dollar high.

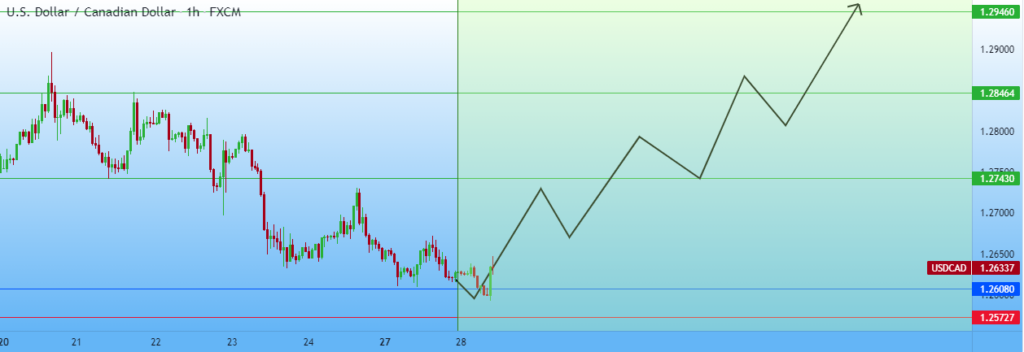

USDCAD bounce back

A strengthened dollar is why the Canadian dollar remains under pressure despite oil prices rallying to three-year highs. The USDCAD pair has since bottomed out of two-week lows and started edging higher amid the greenback strength.

After retaking the 1.2600 handle, the next stop could be the 1.2660, the next substantial resistance level.

On the flip side, any pullback will experience strong support at the 1.2600 level from where the current higher leg started. Stronger prices for crude oil could limit further upside action on USDCAD as it is Canada’s biggest export.

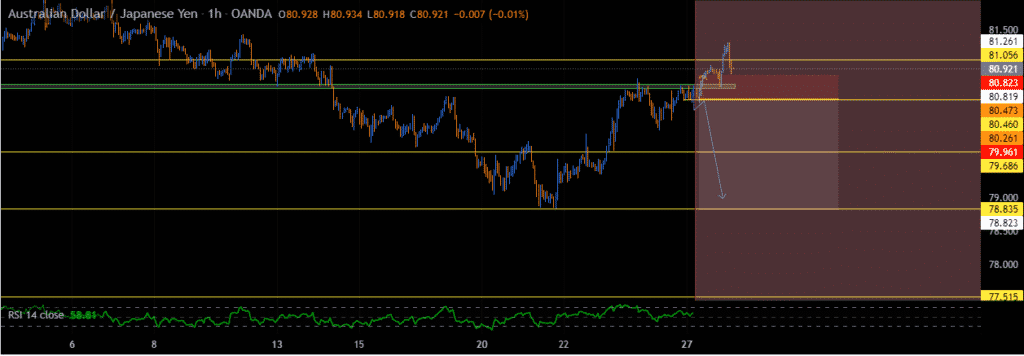

AUDJPY rally stalls

Meanwhile, AUDJPY buyers experienced multiple resistance levels, with the pair retreating from two-week highs. A drop from 81.30 came as the Australian dollar came under immense pressure as the greenback continued to strengthen across the board.

A drop followed by a close below the 81.00 psychological levels could trigger an increased sell-off to the 78.85 level. On the flip side, bulls need to bypass the 81.99 level to break the bearish sloping line that continues to curtail upside action.

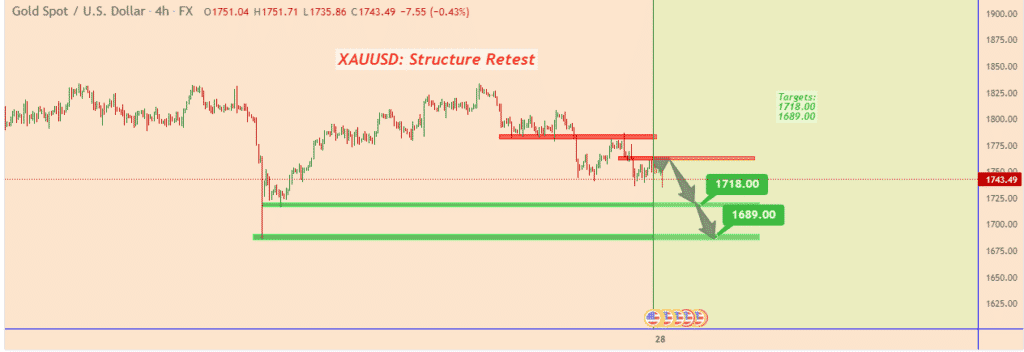

Gold below $1750

In the commodity market, rising US treasury yields is the reason XAUUSD is struggling to hold on to gains above the $1750 handle. The precious metal has since tanked, touching one and a half month lows as of writing.

A sell-off followed by a close below the $1736 handle could reignite renewed bearish pressure that could result in the metal plunging to the $1700 level.

On the flipside, XAUUSD finding support above the $1736 support level should fuel a bounce back to the $1750 mark that is emerging as a critical resistance level. Gold has come under pressure on dollar strength. A recovery in risk sentiment in the market has also had a negative impact on the precious metal that traders often rush to in times of uncertainty.

However, the rising US Treasury yield seems to be fuelling a slump in gold prices. As traders rush to US bonds to take advantage of the rising yields, the metal looks set to remain under pressure with the greenback strengthening across the board.

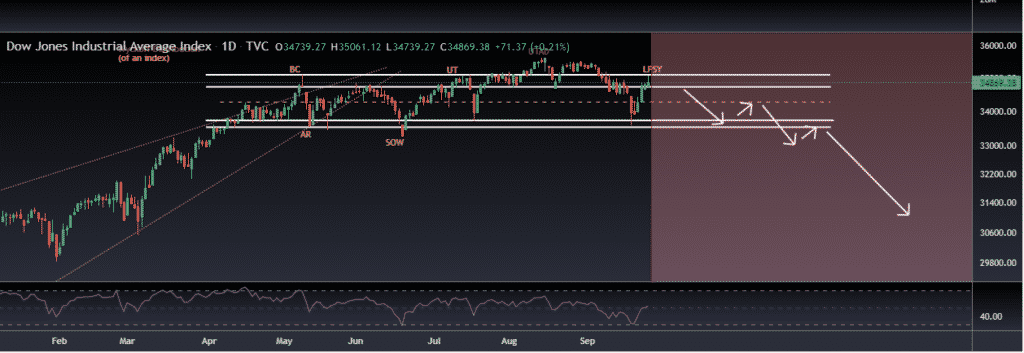

US indices struggling for direction

Major indices are struggling for direction amid mixed sentiment in the broader equity market in the equity markets. The Dow Jones Industrial Average was the only one to finish on the green, rising 0.41% on Monday as the S&P 500 fell 0.1% and NASDAQ fell 0.45%.

The mixed sentiment comes as investors shift their attention to value overgrowth. Tech shares were the biggest casualty hurt by rising Treasury yields that touched three-month highs. Investors are increasingly favoring lower cap stocks instead of mega techs as they are well-positioned to benefit from economic revival.

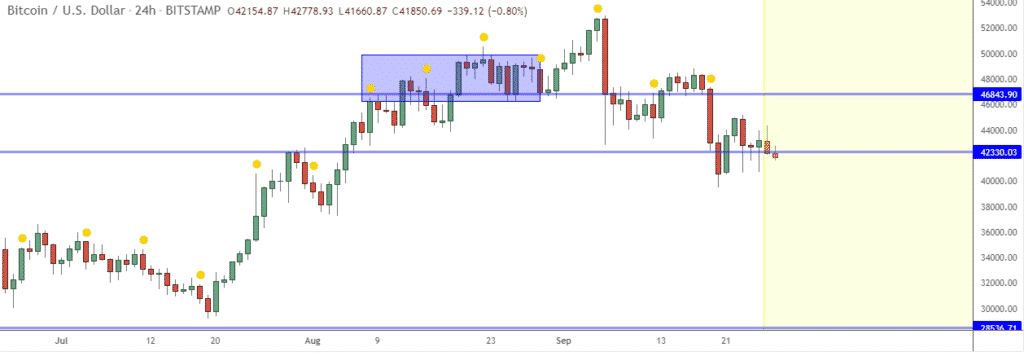

Bitcoin and Ethereum sell-off kicks in

Cryptocurrencies have also not been spared as the dollar continues to strengthen across the board. Bitcoin and Ethereum are some of the biggest casualties breaking through the key support level. BTCUSD has since tanked below the $43,000 support level and now looks set to be headed to the $40,000 psychological level.

Ethereum also remains under pressure after bears fuelled a break through the $3,000 support level. A drop to the $2,800 level means ETHUSD remains susceptible to further losses.