- US dollar softness kicks in a spike to three-week highs

- USDCAD fending off dollar strength retreats from 1.2698

- NZDUSD trying to bounce back after sell-off to one-week lows

- Gold under pressure after sell-off to one-month lows

- US equity benchmark struggling for direction on economic growth concerns

- Bitcoin and Ethereum bounce back stalls

The US dollar was down Friday morning but still above three-week highs after strong US economic data on Thursday affirmed monetary policy expectations tightening by the US Federal Reserve. The dollar index, which measures the greenback strength, was up to highs of 92.82 with the elusive 93.00 handle insight.

The renewed dollar strength comes on US retail sales for August coming in better-than-expected after a 0.7% jump against a 0.8% expected drop. The impressive data has helped curb concerns over the health of the US economy, all but fuelling dollar strength.

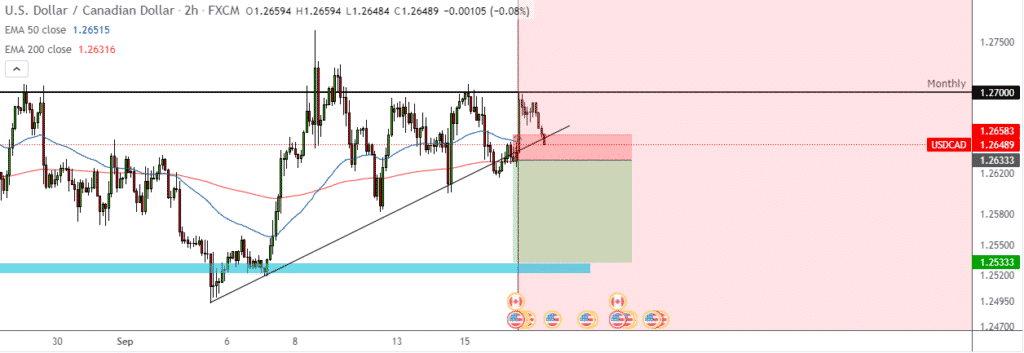

Canadian Dollar shrugs dollar strength

Amid the dollar strength across the board, the Canadian dollar continues to hold firm, averting further price gains on the USDCAD pair. After struggling to power through the 1.2700 level on Thursday, the pair has edged lower, finding support near the 1.2658 level.

The pair has attracted some selling pressure eroding a good chunk of the gains registered as the dollar raced to three-week highs. The upbeat economy released on Thursday has undermined USD safe-haven demand, all but putting pressure on USDCAD.

Additionally, a spike in crude prices to six-week highs in recent days also continues to offer support to the Canadian dollar against the greenback. Oil prices edging higher looks set to curtail any further dollar gains against the loonie.

NZDUSD bounce back

The New Zealand dollar is another major currency trying to fend off dollar strength heading into the weekend. The NZDUSD pair has since bottomed out from two-week lows of 0.7050.

Amid the bounce back, the pair faces strong resistance near the 0.7090 level if it is to bounce back and retake the 0.7100 handles.

The New Zealand dollar has come under immense pressure against the dollar amid the ongoing tapering talk in the US. Additionally, the US, UK, Australia security pact also appears to have teased China, raising fears in the market helping favor buck strength.

Solid economic releases have helped offer some strength to the NZD, helping avert a further slide on NZDUSD below the 0.7000 handle. NZ Q2 GDP data rose to 2.8% QoQ against an unexpected 1.3%. Year-over-year figures were even brighter rising to 17.4% against an expected 16.3%.

Gold under pressure

In the commodity markets, gold prices were heading to a second weekly loss after a dip on Thursday to one month lows, owing to dollar strength and rising yields. XAUUSD broke through the $1780 support level, plunging to lows of $1746.

A slight downtick in dollar strength on Friday has triggered a bounce back on the precious metal, which is expected to remain range-bound ahead of the pivotal Federal Reserve meeting next week. With the market expecting the FED to provide guidance on tapering, the precious metal could swing either way, depending on how the report comes out.

The risk-off mood on the US, the UK, and Australia joining forces on a new security pack to indirectly challenge China could offer support to XAUUSD on fuelling demand for safe-havens.

US Benchmarks struggling for direction

In the stock market, major equity benchmarks are struggling for direction after a recent pull back from all-time highs. The S&P 500 slipped 0.1% on Thursday as the Dow Jones Industrial Average gained 0.1%. Tech heavy NASDAQ fell 0.3%.

The mixed sentiments in the equity markets came at the back of significant losses in China and Hong Kong that continue to fuel jitters in the overall equity markets. Fears around economic growth slowdown and debt problems are increasingly weighing heavily on investors’ sentiments fuelling sell-offs.

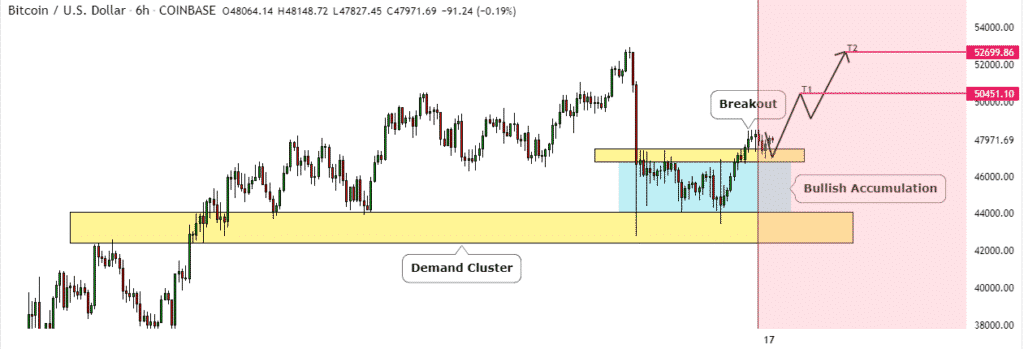

Bitcoin & Ethereum bounce back stalls

In the cryptocurrency market, Bitcoin and Ethereum bounce back has stalled, with the two cryptocurrencies coming under pressure heading into the weekend. The BTCUSD pair has since retreated from one-week highs above the $48,000 level. Any pullback could result in the pair tanking to the $47,000 level, the next substantial support level.

Ethereum also remains under pressure retreating from one-week highs of $3,600. Any pullback will face strong support near the $3,100 level.