Intel, NVidia, and Advanced Micro Devices (AMD) are perhaps the three most prominent names in the world of computer chips. While the three belong to the semiconductors sector, both have significantly different kinds of customers, with the chips also having varying utilities. This is what drives divergence in their stock performance.

Nvidia – leading the growth race

Nvidia perhaps is going through one of its strongest growth phases. Setting aside the automotive biz, which is in general suffering from chip shortages, all other segments such as gaming, data centers, and OEMs have posted strong growth in the 1st quarter of FY 2022.

Nvidia’s Q1 revenue has seen a staggering 84% jump YoY and stands at $5.7 billion. Its earnings per share are at $3.7, nearly double what the EPS was a year ago. Further, the company management has provided strong guidance, with Q2 revenue expected to rise to $6.3 billion, which is a 63% jump YoY.

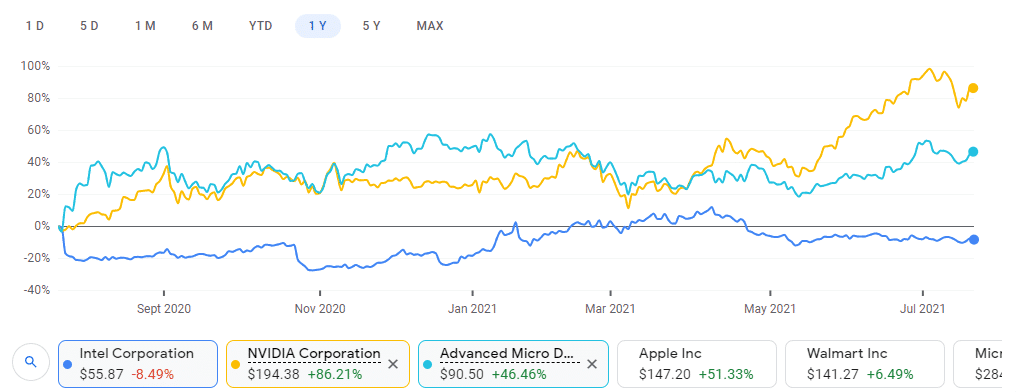

This growth is expected to sustain for the next couple of years as the major revenue sources for Nvidia data center and gaming are expected to see strong demand. Given the above-mentioned factors, Nvidia’s outperformance over the other two names is justified as the stock has posted 86% returns in 1 year, much ahead of Intel and AMD.

AMD – lagging stock performance amid revenue growth

AMD is expected to post a 50% revenue growth this year as it gains market share in the CPU server segment. In Q1 alone, it has recorded a 93% revenue growth YoY to post $3.4 billion sales, much higher than market expectations.

AMD’s tie-up with TSMC is providing it a competitive edge as the latter is developing 5nm and 6nm nodes which will be more efficient. This, coupled with a jump in demand for graphic cards, is expected to drive revenue growth for AMD, although it continues to lag NVidia in that particular segment.

AMD’s stock has posted an impressive 46% return over 1 year, although it significantly lags Nvidia’s gains. This gap can be expected to narrow as AMD’s growth is catching up with that of Nvidia’s.

Intel – structural issues plaguing the company

Intel is perhaps the most well-known processor company. Yet, over the past few years, the company has lost its competitive edge. Some of its customers have started making their own chips, while others have switched to its competitors.

Intel’s Q1 revenues stood at $18.6 billion, flat YoY. Gross margin, in fact, dropped by a whopping 6.7%. This meant that net income was also done by 6% vs Q1 last year. These numbers were not one-off as revenues are, in fact, expected to fall this year. This amply explains the stock’s underperformance. The stock is down by 8.5% over the past year when even the benchmark index has rallied significantly.

So, overall, among the three companies, Nvidia is in the pole position. Its revenues are up across nearly all segments, and the growth is expected to sustain for a long period. AMD, too, has seen strong growth and can be expected to see a good fiscal year thanks to strong demand for graphic cards. Intel, on the other hand, is the clear loser as it cedes market share to the other two players. Its current financial state also leaves little room for improvement.

Among Nvidia and AMD, there is a potential for AMD to catch up in terms of stock performance, given it has lagged Nvidia by 40%. Even from a valuation perspective, AMD looks like a better investment, as it trades at 36 times price to earnings ratios vs NVidia’s 90 times.