- US dollar strength softens ahead of retail sales data

- GBPUSD struggling to capitalize on dollar softens

- AUDUSD tanks as RBA chief warns of economic slowdown

- Gold tanks to crucial support level

- Bitcoin and Ethereum bounce back gathers pace

The US dollar remains in consolidation mode as the focus in the market shifts to next week’s Federal Reserve policy meeting and retail sales data later in the day. The FED meeting is crucial as it could provide clues on when the central bank intends to start tapering stimulus.

Dollar strength has also been weighed by Treasury yields edging lower in recent days following disappointing CPI data. Inflation data showing prices are not rising as fast as initially feared has triggered pessimism over whether the FED will taper, consequently sending yields lower.

GBPUSD under pressure

With the greenback in consolidation mode, the GBPUSD pair is struggling to edge higher treading water early Thursday. After initially pushing above the 1.3850 level, the pair has tumbled to 1.3820and remains susceptible to a drop to 1.3800, the next substantial support level.

GBPUSD holding above the 1.3800 could act as a catalyst to fuel a bounce back. On the flip side, a sell followed by a close below the 1.3800 level could trigger a sell-off to 1.3746, the next substantial support level.

The British pound has remained resilient against the dollar in recent days owing to inflation data coming higher than expected all but supporting the case for rate hikes and stimulus tapering by the Bank of England. Inflation increasing to 3.2% in August from 2% in July and above 2.9% expected is increasingly fuelling talks for stimulus tapering.

However, pound strength continues to be weighed heavily by unending Brexit concerns following reports the UK had postponed post Brexit checks on imports to England, Scotland, and Wales citing global supply chain disruptions.

AUDUSD bears eye support

Meanwhile, the Australian dollar is under pressure against the dollar, with the AUDUSD pair at risk of sliding below the 0.7300 level. After being rejected near the 0.7380 level, the pair has dropped and trading near the 0.7300 level.

The Australian dollar sentiments have taken a hit on the Reserve Bank of Australia, reiterating that the pandemic continues to take a toll on small and medium-sized enterprises. Looking ahead, the focus is on the release of US retail sales for August, which could paint a clear picture of inflation, likely to influence greenback strength against AUD.

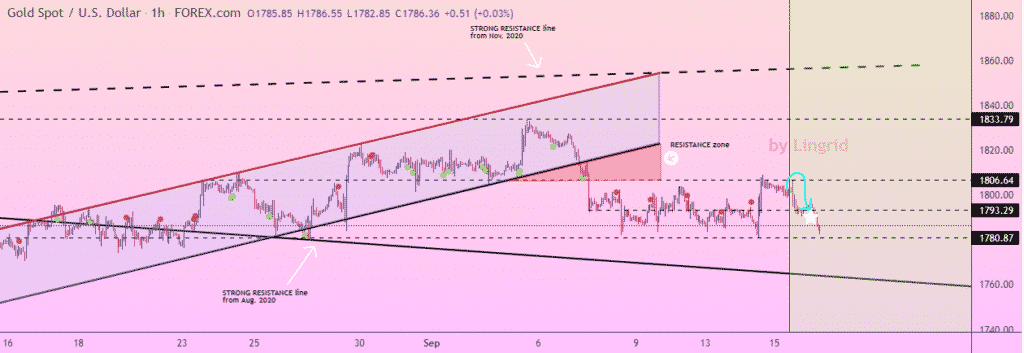

Gold tanks

In the commodity markets, gold remains under pressure after rejection above the $1800 level. XAUUSD has since dropped near a critical support level at $1780. A break below the $1780 level could result in a shift of bias to bears

A break below the $1780 level could set the stage for bears to fuel a drop to the $1750 level, extending towards the $1729-28 level.

After two consecutive days of gains, open interest in the precious metal dropped by 3.2K contracts on Wednesday. While the further downside is not favored, the precious metal could remain range-bound ahead of the US’s release of key retail sales data.

US benchmarks bounce back

US stocks gained the most in more than three weeks in the equity market, helping push major US indices higher on Wednesday. The rally in the equity market came amid easing concerns about slow economic growth.

The S&P 500 added 0.8%, ending a six-day losing streak. However, it remains 1.3% down from its all-time highs. The Dow also turned bullish, gaining 0.7% as the NASDAQ climbed 0.8%. Amid the bounce back, there is still concern that the overall market is still ripe for a pullback after a match to record highs for the better part of the year.

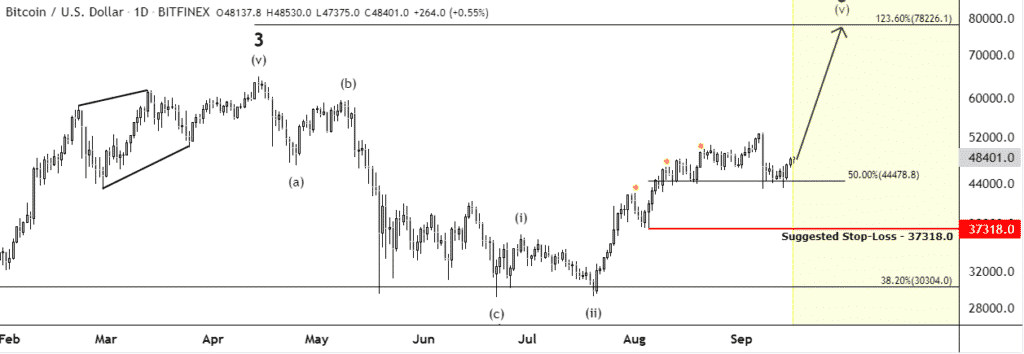

Bitcoin and Ethereum in bounce back mode

Bitcoin and Ethereum remain on the front foot for a second day running after a recent steep correction in the cryptocurrency market. BTCUSD has since bounced back above the $48,000 level as bull’s eye the $50,000 psychological level.

ETH has also recovered after a recent sell-off to about $3,100 level. The second-largest cryptocurrency by market cap has regained the $3,600 handle as bulls remain under control.