- US dollar retreats from one-month highs against the majors.

- USDCAD drops on greenback softness and CAD strength

- GBPJPY bounced back, experiencing some resistance.

- Gold remains under pressure after rejection near $1770.

- US equities post the biggest loss since May.

- Bitcoin and Ethereum tank to two-month lows.

The US dollar is under pressure after retreating from one-month highs. The pullback comes as traders turn their attention to the upcoming Federal Reserve meeting, waiting to see if it will provide signals on tapering. The dollar index, which measures greenback strength against the majors, has pulled from highs of 93.41 to 93.12.

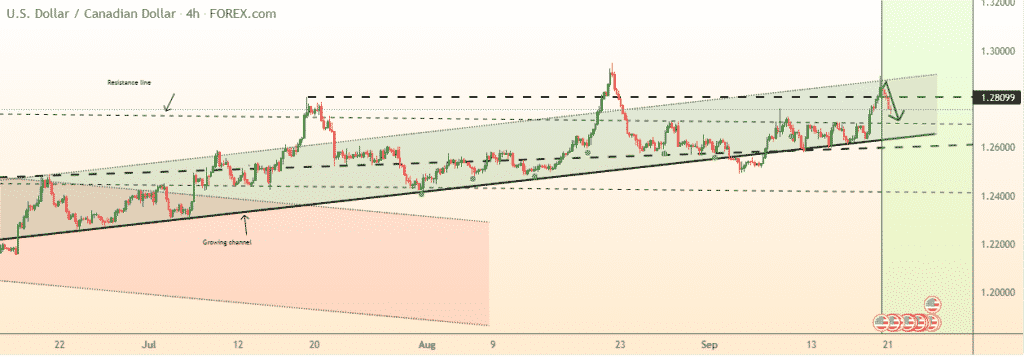

USDCAD retreats from 1.2900

With the dollar under pressure, USDCAD has pulled back from one-month highs above the 1.2900 level as the Canadian dollar continues to strengthen across the board. The pair has since pulled to about 1.2763, from where bears are likely to fuel a drop to about 1.2710, the next substantial support level.

USDCAD breaking below the 1.2700 level could trigger increased sell-off to about 1.2608, the next substantial support level. On the flip side, the pair remains well supported for a bounce-back on bulls defending the 1.2700 support level.

Renewed Canadian dollar strength against the greenback comes on Justin Trudeau winning the just concluded election and securing a third term. Opposition Conservative party leader Erin O’ Toole has already conceded defeat.

Additionally, the Canadian dollar remains well supported by oil prices bouncing back after dropping below the $70 a barrel level. Broad-based dollar retreat from one-month highs ahead of the FOMC report also continues to offer support to USDCAD pullback from one-month highs.

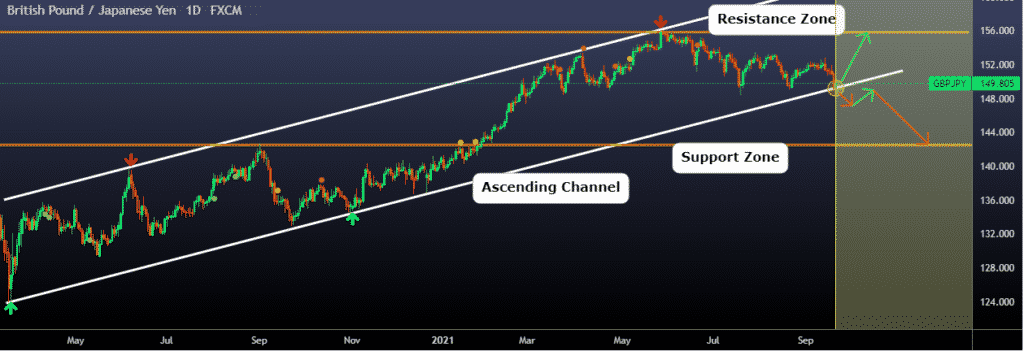

GBPJPY bounce back stalling

Meanwhile, GBPJPY is trying to bounce back after tanking to one-month lows on pound weakness. The pound came under immense pressure as traders scampered for safety on safe-havens such as the yen on fears of the Chinese property giant Evergrande default risk.

After finding support above the 149.11 level, GBPJPY has bounced back. However, the bulls find going above the 149.60 level tough. The pound remains under pressure amid growing concerns over UK energy shock, with a number of companies needing a bailout.

Brexit standoff between the UK and Northern Ireland over trade is another headwind that continues to take a toll on the pound. On the other hand, the yen continues to attract bids as a safe haven amid the Evergrande debacle.

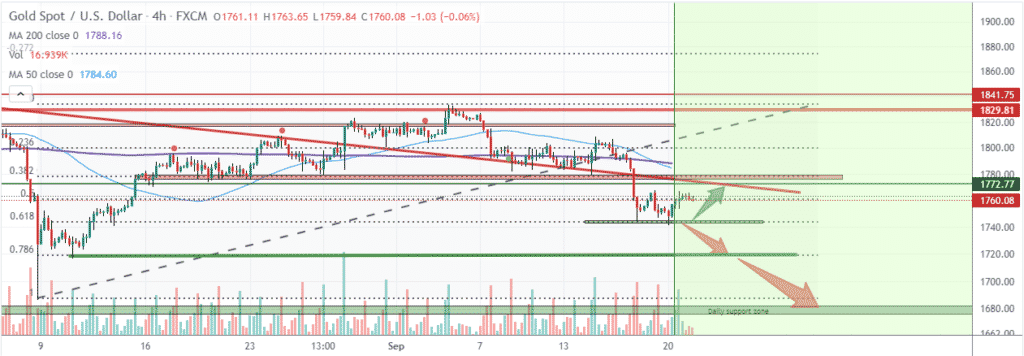

Gold under pressure below $1770

In the commodity markets, Gold remains under pressure and trying to hold on to modest gains above the $1762 an ounce level. The precious metal has come under immense pressure on the dollar, rallying to one-month highs.

XAUUSD has faced a strong resistance near the $1770 an ounce level. It remains susceptible to further losses amid improving risk sentiment as Hong Kong equities stabilize. The metal could plunge to the $1750 area, the next substantial support level.

In the meantime, XAUUSD could remain range-bound, awaiting the outcome of the FED meeting expected to influence dollar strength.

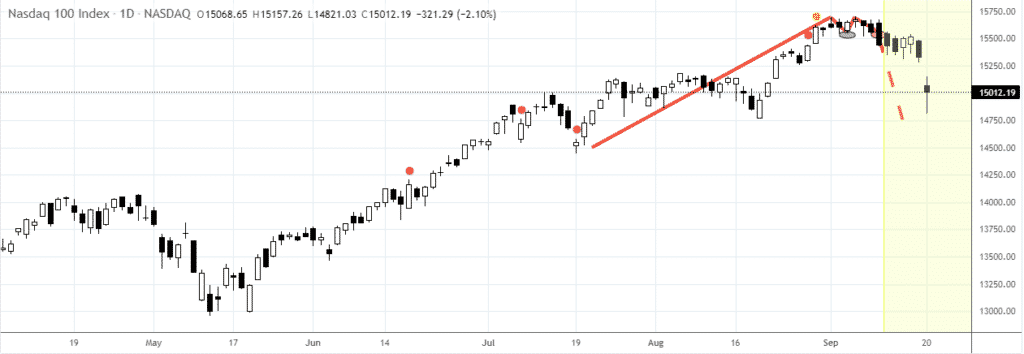

US equities biggest loss

Major US equity benchmarks suffered their biggest loss since May as investors digested several emerging risks for the market. The S&P 500 was down 1.7% on Monday as the Dow Jones Industrial Average slipped 1.8% and tech-heavy NASDAQ fell 2.2%.

The sell-off came as investors remained wary of developments in the Chinese property market owing to the Evergrande debacle. Additionally, investors remain on edge that the Federal Reserve could signal that it is ready to begin tapering amid surging inflation and improvements in the job market.

Bitcoin and Ethereum turn bearish

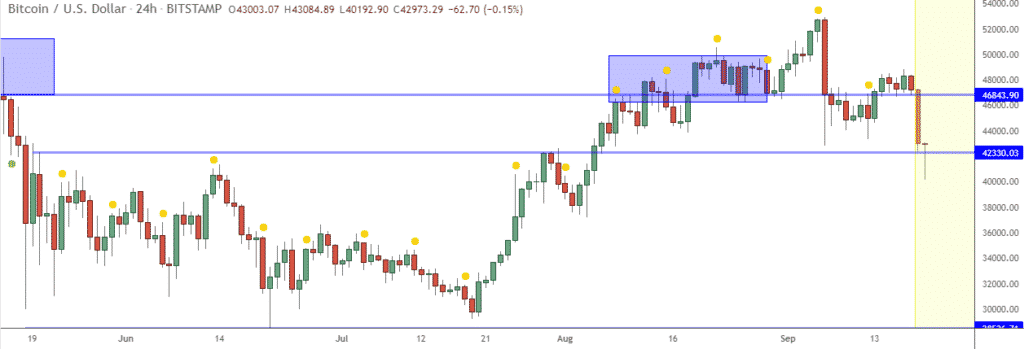

In the cryptocurrency market, Bitcoin and Ethereum are struggling to hold on to gains above key support levels. BTCUSD is under immense pressure after tanking below the $43,000 level.

While Bitcoin has bounced back after plunging to two months’ lows of $40,300, it remains susceptible to further losses below the $43,000 level. ETHUSD is also struggling to hold on to gains above $3,000 after initially tanking to lows of $2,800.