- US dollar firms near 14 months high.

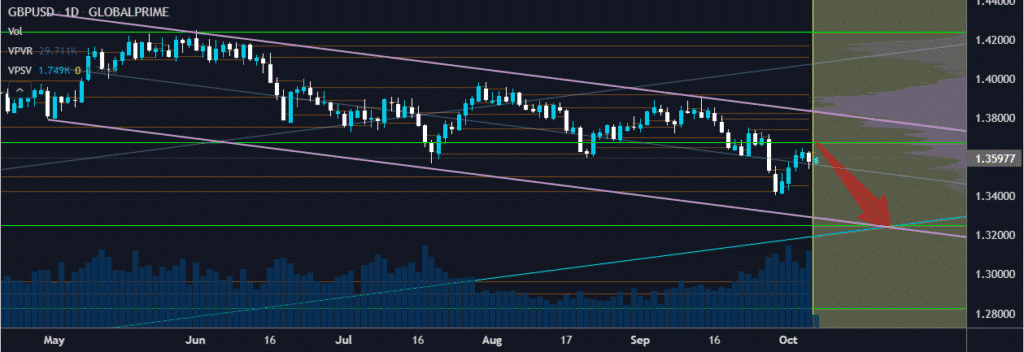

- GBPUSD is on the defensive as bounce-back stalls.

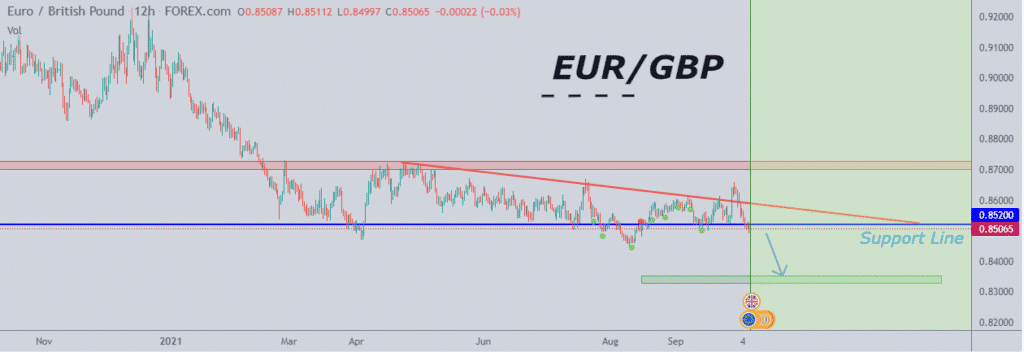

- EURGBP edges lower amid euro weakness.

- Oil prices amid demand concerns in the US.

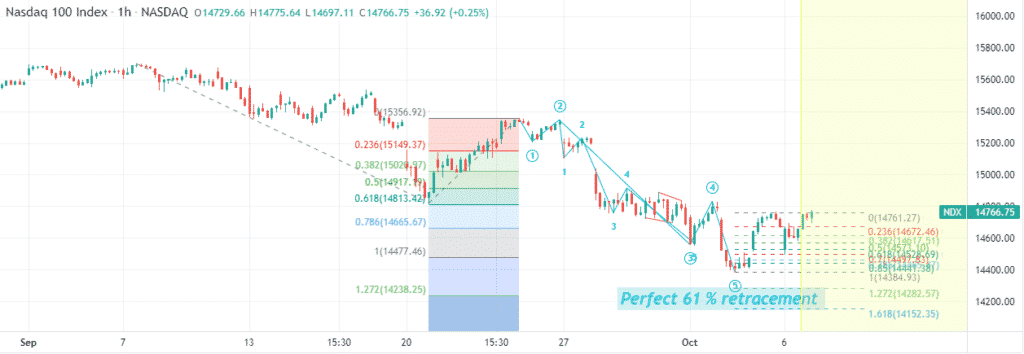

- US benchmark indices edge lower amid inflation concerns.

- Bitcoin rallies to five-month highs.

The US dollar was slightly lower on Thursday but near a 14-month high, as surging energy prices continued to fuel concerns about inflation. With inflation rallying, the prospects of higher interest rates are becoming increasingly clear, all but working in favor of a stronger dollar.

Additionally, the greenback remains well supported above one-year highs by waning investors’ appetite on riskier assets which is increasingly fuelling demand for safe havens. The dollar index, which measures the greenback strength against the majors, is already at one-year highs, having found support above 94.50 levels.

GBPUSD rally stalls

Renewed dollar strength might as well explain why GBPUSD bounced back from ten-month lows and has stalled. The pair has struggled to find support above the 1.3600, with bears coming back into the fold and fuelling another leg lower.

The pullback is staring at strong support near the 1.3540 level, below which a drop to the 1.3500 level should be expected. On the flip side, a rally followed by a close above the 1.3600 should affirm the bounce-back play.

Upbeat economic data continues to fuel dollar strength likely to continue piling pressure on the pound. The latest data shows that US private companies added 568,000 jobs in September above marketed expectations of 438,000.

On the other hand, the pound continues to weaken even on Prime Minister Boris Johnson, providing assurance that the energy industry will recover. The IHS Markit/ CIPS UK construction Purchasing Manager index declining to 52.6 in September against 54.0 expected also continues to raise serious concerns about the UK economy.

Pound resilience against euro

Meanwhile, the British pound continues to hold firm against the euro, which has come under immense pressure in recent days. The EURGBP pair has since slid to one and half month lows and flirted with key support at 0.8500 level.

Downbeat Factory orders and reflation fears are the latest headwinds that continue to weigh heavily on the euro against the pound. The euro also remains on the defensive on the European Central Bank, failing to provide a clear outline on when it could start tapering.

Oil prices pullback

In the commodity markets, oil prices retreated from seven-year highs as a buildup in US stockpiles again fuelled demand concerns. Oil futures were down by almost 2% to $777 barrel as traders reacted to US crude inventories expanding by 2.35 million barrels last week.

Prior to the pullback, oil prices had been in fine form, rallying to seven-year highs above the $80 a barrel level. The spike has come at the backdrop of an energy crunch in Europe to Asia that has continued to fuel chatter about greater demand.

OPEC reiterating that it would restore the modest amount of supply to the market also worked in favor of higher prices amid the surging demand.

US indices sell-off persists

In the equity markets, major benchmark indices remained on the defensive as a strong showing in the private jobs sector fuelled bets of the Federal Reserve moving with speed to reign in monetary stimulus. A surge in oil prices to multiyear highs also fuelled inflationary pressure triggering suggestions on the FED moving to hike interest rates.

Amid the inflationary pressures and interest rate hike concerns, the Dow Jones Industrial Average fell 0.86% in continuation of the sell-off wave that began in September. The S&P 500 was also down 0.69% as tech-heavy NASDAQ fell 0.34%. Focus shifts to the jobless claims on Thursday and the much-awaited Non-Farm Payroll report on Friday. The outcome of the two reports could sway investors’ sentiments on equity.

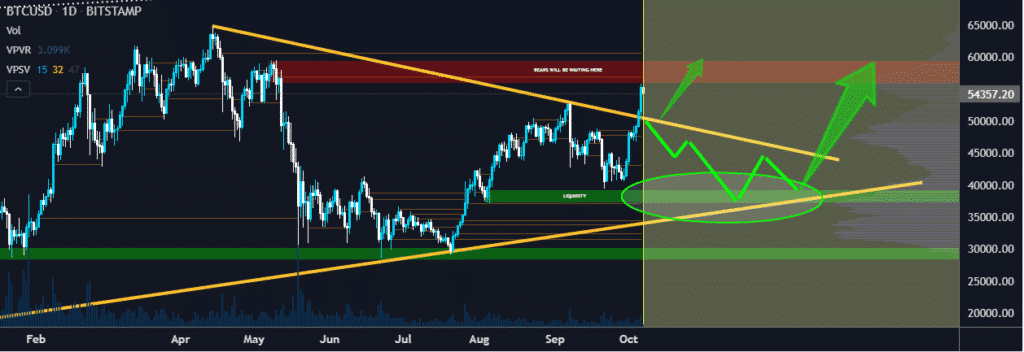

Bitcoin rally gathers steam

In the cryptocurrency market, Bitcoin continues to edge higher after finding support above the $50,000 level. The flagship crypto has since powered to five-month highs above $54,000 as bulls remain in control. After the recent rally, the next stop could be all-time highs of $64,000.

Ethereum is also showing signs of edging higher after powering through the $3,500 level.