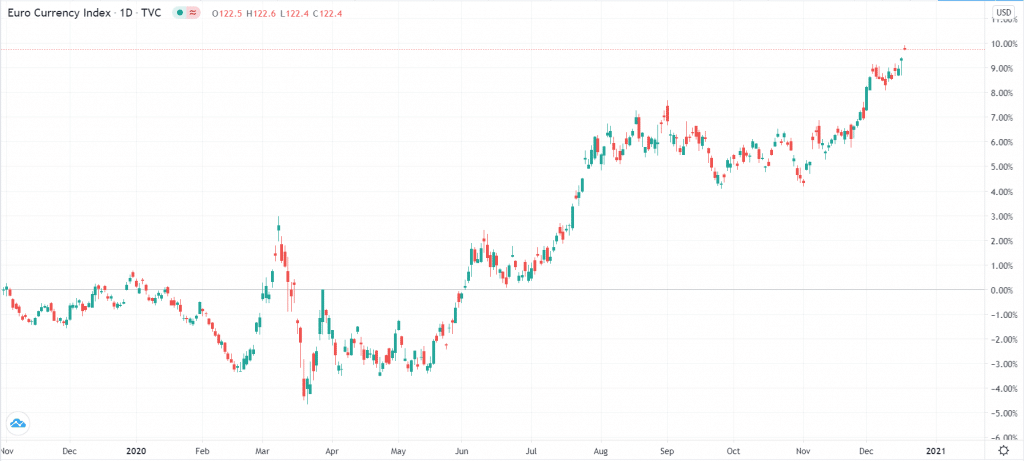

The euro had a strong year in 2020. The euro index, which measures the performance of the currency against a basket of global peers, rose by more than 9% during the year. This happened as the euro rose against key currencies like the dollar, pound, and the Japanese yen. In this article, we will look at the reasons why the euro rose and provide an outlook for 2021.

The euro index had a strong year in 2020

Why the euro soared in 2020

The euro bounced back in 2020 because of several reasons: dollar weakness, European Central Bank (ECB) policies, European stimulus, and the fact that the bloc handled the virus better than the United States.

Dollar weakness

The US dollar is the biggest constituent of the euro index. And 2020 was one of its worst years as its value dropped by more than 8%. This decline was mostly because of risk-off sentiment as traders shifted their holdings to other currencies. That happened as the hopes of a COVID-19 vaccine rose, and as the Joe Biden victory reduced the possibility of more trade wars in the coming years.

ECB policies

In 2020, the ECB reacted swiftly to provide support to the European economy. As the pandemic started, the bank decided to slash interest rates, pushing them deeper into the negative territory. The bank also decided to launch an aggressive quantitative easing program totaling about 1.85 trillion euros.

European fiscal stimulus

The euro rose after the European governments launched a 750 billion euros recovery fund in July. The funds will be deployed to countries through low-interest-rate debt and grants. In addition, the members agreed to a 1.8 trillion euro seven-year budget that will also go funding most countries. Therefore, investors believe that the region’s recovery will be relatively swifter than that of other regions.

European handling of the virus

Finally, the euro rose because of the fact that Europe handled the virus better than the United States. In total, the US recorded more than 16 million cases and more than 300k deaths. That was significantly higher than the combined cases and deaths in the European Union.

What will move the euro in 2021?

In 2021, the euro will move in reaction to several key movers, including the actions by the ECB, global risks, the upcoming Senate election in Georgia, COVID-vaccine roll-out, and even Brexit.

European Central Bank

As mentioned above, the ECB held a relatively dovish tone in 2020 as the bloc continued to battle the virus. In its final interest rate decision, the bank said that it would continue the asset purchases at least until the end of 2022.

It said that the rates would remain low until the rate of inflation rose above 2%. Indeed, like the Fed, it has hinted that it will let inflation move above 2%.

Therefore, in 2021, forex traders will be watching out for the key actions by the ECB. For example, if the COVID vaccine leads to a faster recovery in Europe, the bank could be forced to change its policies in a hawkish tone.

For example, it could signal its willingness to hike interest rates earlier than expected. Also, it could even start tapering its asset purchases. Furthermore, some central banks like Riksbank and Norges Bank have already started warning that they will move earlier than expected. As such, if the bank turns hawkish, it will possibly be bullish for the euro.

Global risks

In 2021, the euro will also move because of potential risks in the market. Most traders believe that risks will reduce due to the COVID vaccine and Joe Biden as president. However, in reality, risks will continue being there.

For one, investors will start thinking about global debt, which exploded in 2020 as countries and companies boosted their borrowing. According to S&P Global, global debt soared by more than $20 trillion in 2020. That was the fastest increase ever.

While this borrowing was necessary, the challenge will come when it comes to paying back the money. That’s because rating agencies are expected to slash most countries and companies’ ratings, which could raise the potential for defaults.

At the same time, geopolitical risks will continue even during Biden’s presidency. For one, the US and China will continue being foes since Biden has said he will not immediately remove Trump’s tariffs. Similarly, Iran could make it difficult for Biden to renegotiate the nuclear deal.

Therefore, rising global risks will be negative for the euro and positive for the US dollar. That’s because, in times of high risks, investors tend to rush to the safety of the dollar.

Brexit

Another key item that will move the euro in 2020 will be Brexit. At the time of writing, the EU and the UK have not yet agreed on a deal even though time is quickly running out. The two sides will be deeply affected if the two sides fail to reach an agreement. That’s because of the volume of trade that the two sides transact with every day. Also, supply chains between the two are highly integrated. Therefore, in the case of a no-deal Brexit, the euro could see some weakness.

US Senate election

The upcoming US Senate election in Georgia will have an impact on the euro. If Democrats manage to win the two seats, it will mean that Joe Biden will control the two branches of government. That will make him be able to pass major spending deals, which will be positive for the euro – at the expense of the dollar.

However, if Republicans maintain the Senate, it means that there will be gridlock, which will be negative for the euro.

Final thoughts

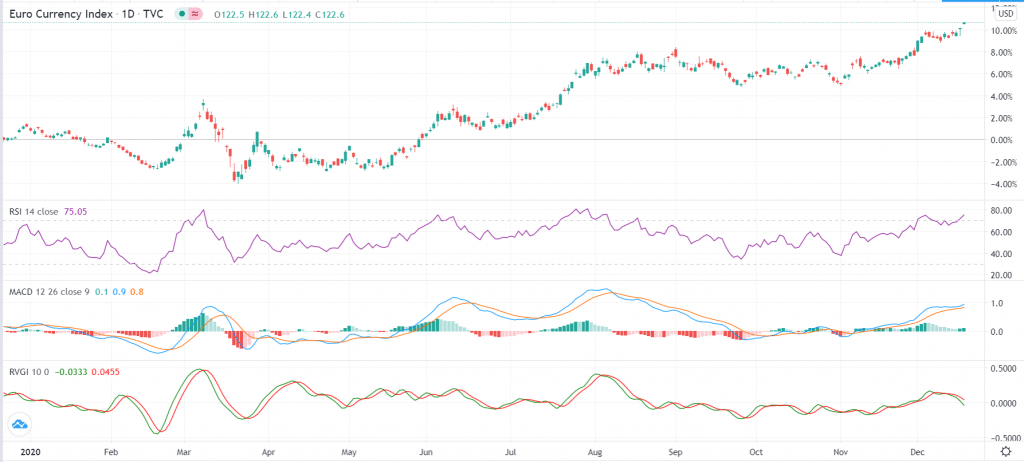

AS shown above, the euro has been in an overall strong rally in 2020. However, a look at the key oscillators like the Relative Strength Index (RSI), MACD, and the Relative Vigor Index (RVI) show that the index is getting overbought. This means that the currency will possibly pull back in the first quarter and then resume the upward trend.