- The US dollar firms near one-year highs.

- USDJPY bulls are closing in on 112.00.

- AUDNZD rallies as NZD weakens on the RBNZ hike.

- Oil prices rally amid supply concerns.

- US equity recovery gathers steam amid dip-buying.

- The Bitcoin and Ethereum rally gathers steam.

The US dollar edged higher on Wednesday morning, helped by Treasury yields bouncing back to three-month highs. The greenback continues to attract bids as investors turn to safe-haven amid growing concerns about the global growth outlook.

The greenback has also been on the front foot awaiting the Federal Reserve to begin asset tapering. Focus shifts to the Non-Farm Payroll report on Friday, expected to provide clues on tapering timing. With the dollar index above the 94.00 level, the greenback continues to pile pressure on the majors.

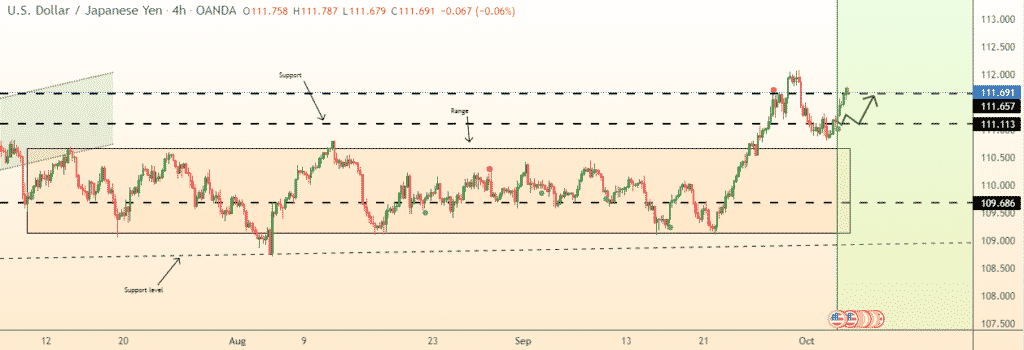

USDJPY bulls eye 112.00

USDJPY is one of the pairs that have felt the full impact of rising yields and dollar strength. The pair has since bounced back to one-week highs above the 111.50 level. The rally comes on the US benchmark 10-year Treasury yield rising 5 basis points to 1.53%.

With bulls in control, USDJPY looks set to make a run for the 112. 00 level as the yen remains under pressure against the buck. Yen weakness comes on the backdrop of Bank of Japan Governor Haruhiko Kuroda reiterating that demand is yet to recover rapidly as it has been the case in the US.

Impressive economic releases also continue to offer support to dollar strength against the yen. The US ISM Manufacturing Purchasing index increased to 61.9 in September from 61.7 in August. The trade deficit also expanded to a record high in August, affirming the resilience of the US economy.

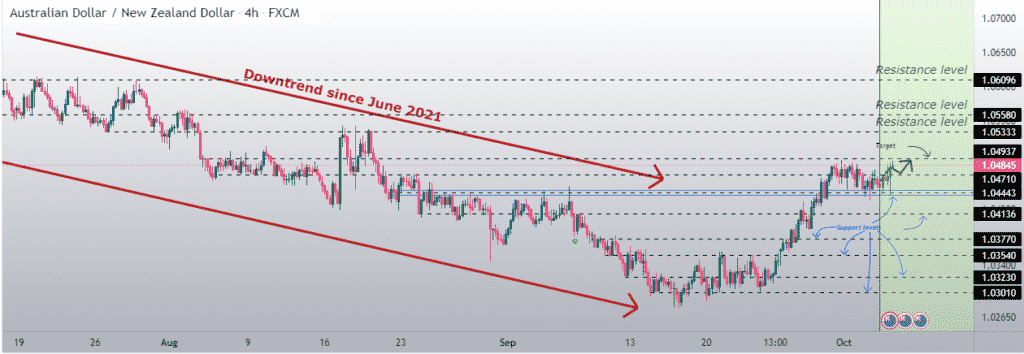

NZD weakens after RBNZ hike

Meanwhile, the New Zealand dollar came under pressure despite the Reserve Bank of New Zealand hiking interest rates. At its October monetary policy meeting, the central bank members decided to raise the Official Cash rate from 0.25% to 0.50%, as widely expected.

While the raise was expected to trigger NZD strength, that was not the case. NZDUSD edged lower as AUDNZD rallied to one-month highs as the NZD attracted renewed sell-off. After initially slipping to lows of 1.0440, AUDNZD has since bounced back, powering to one-month highs of 1.0486.

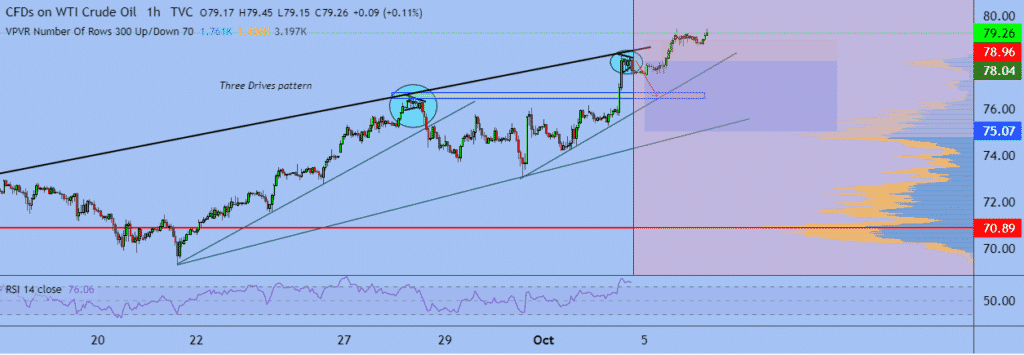

Oil prices at 7-year highs

In the commodity markets, oil prices are flirting with levels not seen since 2014 as supply concerns continue to push prices higher. Brent crude has already powered through the $80 a barrel level to $82.25 a barrel. US oil is also closing in on the elusive level after powering to $79.26 a barrel.

Higher oil prices are supported by OPEC’s decision to only boost output by 400,000 barrels each month until 2022. The increase is well below what the market expects as demand continues to increase with the opening of the global economy from the pandemic.

US indices bounce back

In the equity markets, major US indices bounced back on Tuesday to close on the green after coming under pressure on Monday. The S&P 500 and the NASDAQ 100 index gained 1.05% and 1.25%, respectively. The Dow Jones industrial average was also up 0.92%.

The rally comes as investors continue to eye opportunities after a recent correction from record highs. Buying the dip is turning out to be a central theme on technology stocks and other high-growth stocks that suffered in September. However, rising treasury yields continue to dent investor sentiments, given the prospects of a hike in interest rates.

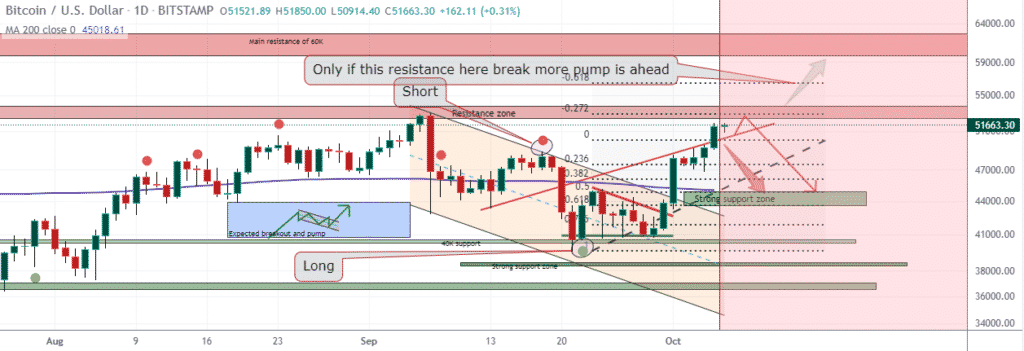

Bitcoin above $50,000

In the cryptocurrency market, Bitcoin continues to outperform Ethereum, powering to one-month highs above the $51,000 level. BTCUSD powered through the $50,000 level on its way to touching highs of $51,620.

Ethereum, on the other hand, has been on a fine run this week on finding support above the $3,000 level. ETHUSD has since powered to two-week highs of $3,490, with $3,500 emerging as a crucial resistance level.