- US dollar softens following disappointing CPI

- EURSUSD under pressure near 1.1800

- EURGBP edging lower on British pound strength

- Oil prices edge higher on supply concerns in the US

- US equity benchmarks tank amid ongoing correction

- BTCUSD and ETHUSD bounce back following correction

The US dollar remained under pressure on Wednesday after softer-than-expected US inflation data cast doubt about tapering of stimulus by the US Federal Reserve. Data released on Tuesday showed that the core consumer price index grew 4% against an expected 4.3% year-over-year and 0.1% month-over-month in August.

The softer print all but eased recent concerns of imminent acceleration in prices that warrant immediate tapering. However, tapering before year-end looks likely, which explains why the dollar continues to hold firm against the majors despite yields edging lower on Tuesday.

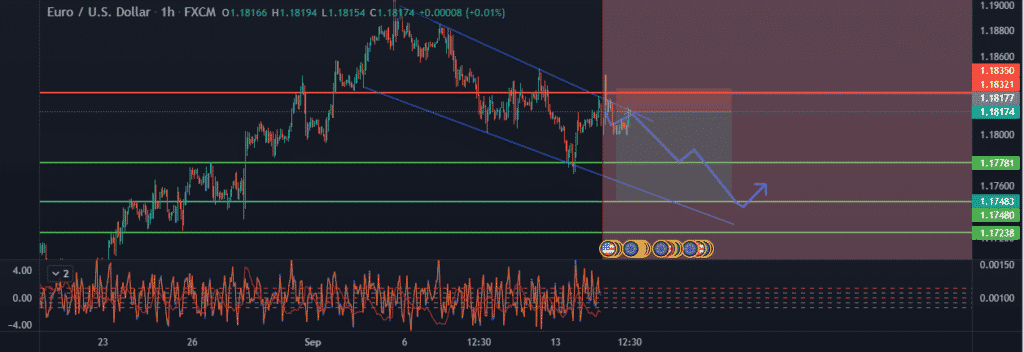

EURUSD under pressure

With the dollar holding firm, EURUSD has come under pressure after initially powering to highs of 1.18451. A pullback means the pair is trading near the 1.1800 level from where bulls are trying to fuel another leg high.

EURUSD remains well supported for further price gains above the 1.1800 level. On the flipside, a sell-off followed by a close below the psychological level could result in the pair tanking to lows of 1.1750 levels.

Amid the dollar strength, the European Central Bank governing Council members Francois Villeroy de Galhau and Executive Board Member Isabel Schnabel have rejected fears of high inflation. The remarks are already fuelling talks of the need for tapering and rate actions to curtail runaway inflation, expected to benefit the euro.

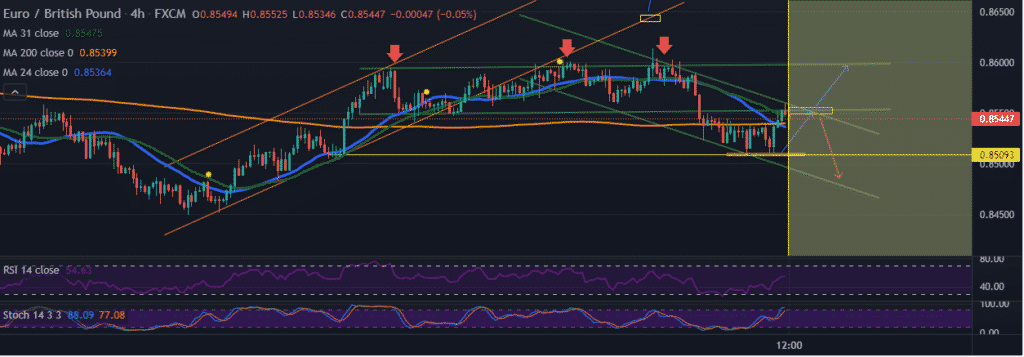

EURGBP tanks

Meanwhile, EURGBP remains under pressure, with the euro struggling against the British pound despite upbeat remarks from the European Central Bank policymakers. A drop to the 0.8533 level means it remains susceptible to further losses.

The British pound is holding firm against the common currency after the UK unemployment rate fell 4.6% in July, the lowest level since August of last year. The pound is also holding firm following stronger than expected UK consumer inflation figures. The headline CPI for August accelerated to 0.7% against 0.5%. The inflation rate also surpassed expectations jumping 3.2% from 2%, all but fuelling talks of tapering.

Oil Prices edge higher

In the commodity markets, oil prices continue to edge higher for the second consecutive day. The spike comes on a significant increase in crude oil stocks in the US, the world’s largest consumer of black gold.

China is set to start unloading strategic oil reserves on september 24th. Growing expectations that oil demand will improve as vaccine rollouts widen worldwide also continue to offer support for higher oil prices. Brent crude gained 0.7% to $74.14 a barrel while US West Texas Oil gained 0.8% to $70.99.

US crude stocks fell last week in the aftermath of Hurricane Ida, which triggered a shutdown in numerous refineries and offshore drilling. A drop of 5.4 million barrels last week against a 3.5 million barrels drop expected was supportive of higher prices.

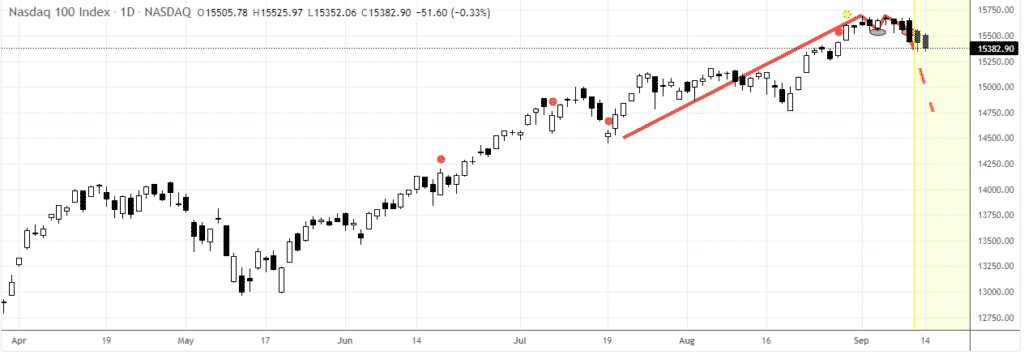

US equity correction

US stocks remained under pressure for a second consecutive day sending major benchmarks lower on Tuesday. The Dow Jones Industrial Average dropped 292.06 points as the S&P 500 fell 0.57% and the NASDAQ composite fell 0.5%.

The sell-off in the equity market came as investors digested the fresh inflation data that showed prices are not increasing faster as initially feared. However, investors remain wary that the underlying price pressures could still prove persistent.

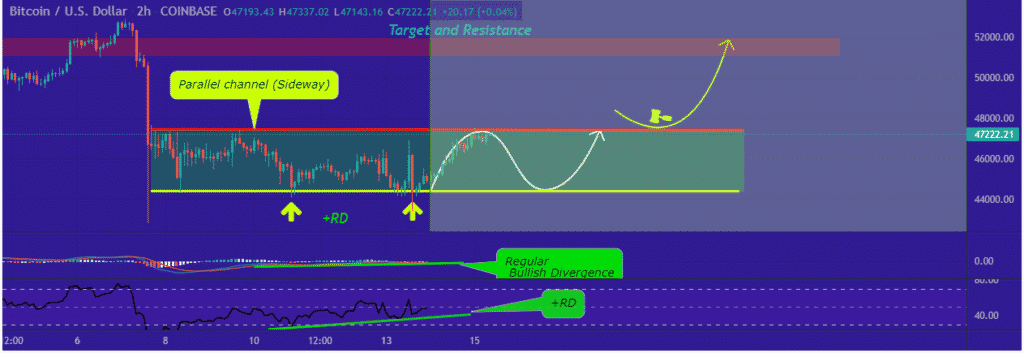

Bitcoin and Ethereum bounce back

In the cryptocurrency markets, Bitcoin and Ethereum are on a recovery mode following last week’s sell-off. After tanking below the $44,000 level, BTCUSD has bounced back, powering to highs of $47,157.

The bounce-back comes following a sell-off from four-month highs of $52,000 last week. ETHUSD is also in a recovery mode bouncing off lows of $3,100 to highs of $3,398.