- US dollar on the defensive despite rising Treasury yields.

- AUDUSD under pressure above 0.7300 despite dollar softness

- NZDUSD trying to hold on to gains above 0.7000 level

- Gold recovers to $1750 after sell-off to one-month lows

- US equities rally amid confidence about economic growth

- Bitcoin and Ethereum under pressure

The US dollar was on the defensive on Friday morning after plunging to near one-week lows on Thursday. Improved risk sentiment in the market wiped out recent gains on the greenback as concerns about the China Evergrande Group eased.

The sell-off in the greenback saw the dollar index plunge to lows of 93.02 despite US Treasury yields rising to their highest level since June. The spike in treasury yields comes on hawkish remarks from the Federal Reserve and the Bank of England.

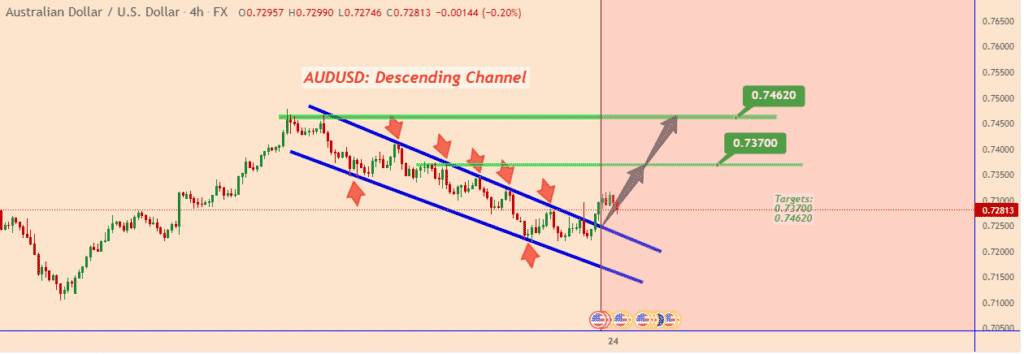

AUDUSD recovery stalls

With the US dollar on the defensive amid improving risk appetite, AUDUSD bottomed out from one-month lows powering to one-week highs above 0.7300.

However, AUDUSD remains under pressure and struggling to hold on to gains above the critical 0.7300 level. After the pullback, 0.7280 has emerged as short-term support to the upward momentum. A sell-off followed by a close below the support level could result in the pair plunging to the 0.7210 level.

The Australian Dollar has registered some gains against the greenback in the wake of Evergrande Group resolving one of its Coupon payments on Shenzhen traded bonds. However, the China National Development and Reform Commission have weighed the AUD strength, hinting at the rising raw material process and power limits.

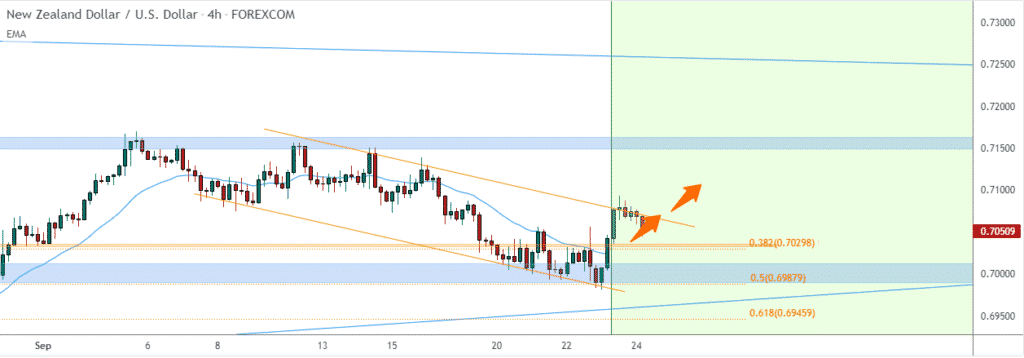

NZDUSD above 0.7000

Meanwhile, the NZDUSD is also on the defensive after bouncing above the 0.7000 psychological levels. Downbeat New Zealand economic data has continued to weigh heavily on the NZD against the majors, consequently taking a breather after the biggest jump since August.

After tanking to one-month lows of 0.69771, NZDUSD has bounced back and appears to have found support above the 0.7050 level. The bounce-back has come at the backdrop of dollar weakness amid improving risk sentiment in the market.

The pair could come under pressure as it becomes clear the New Zealand economy is not doing well. Immediate data shows that the Trade Balance dropped more than -$397 million to -$2144 million months over a month. Data also shows that exports dropped below $5.77 billion to $4.35 billion as imports rose.

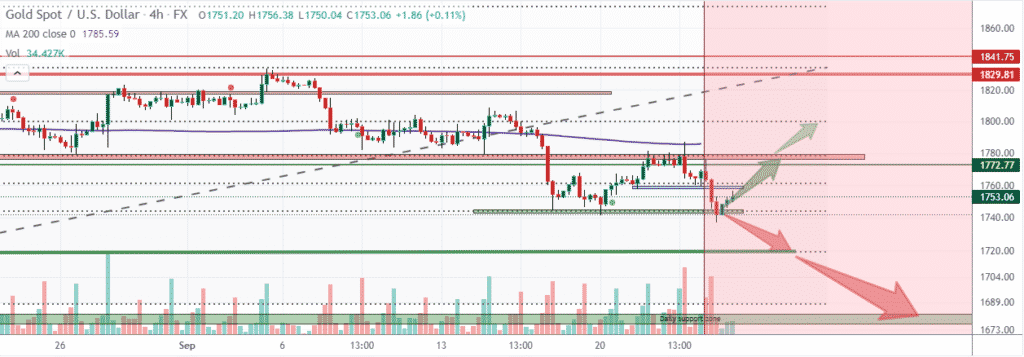

Gold recovery under pressure

In the commodity markets, gold prices bounced back after briefly plunging on Thursday to one and half month lows. A sell-off to lows of $1736 came at the backdrop of US treasury yields powering to three-month highs, piling pressure on the precious metal.

While XAUUSD has retaken the $1750 handle, it remains under pressure amid rising yields. A sell-off below the $1750 level could trigger renewed sell-offs that could see the metal sliding back to the $1730 territory.

Gold sell-off comes on the backdrop of the US dollar retreating from one-month highs even though the Federal Reserve hunting tapering could occur soon. While the greenback moves inversely to gold, it could pile pressure on the metal on bouncing back after the recent pullback.

US equity recovery persists

In the equity markets, the upward momentum is increasingly building up with the Dow Jones Industrial Average breaking out of its September Slump. Investor’s sentiments have improved amid growing confidence that the economy can withstand the withdrawal of stimulus as part of tapering by the Federal Reserve.

The Dow was up 1.5% on Thursday, posting its biggest gain since July. The S&P 500 also finished on the green, rallying 1.2% as tech-heavy NASDAQ gained 1%. The upward momentum in the US equity market comes amid easing concerns about the potential fallout of China’s e Evergrande Group.

Bitcoin & Ethereum bounce back stalls

In the crypto market, the upward momentum on Bitcoin and Ethereum is once again under immense pressure. BTCUSD is struggling to power through the $45,000 level after rejection. The immediate pullback will have to contend with support near the $43,300 level below which Bitcoin could turn bearish.

On the other hand, Ethereum bulls are under immense pressure on ETHUSD pulling near the $3,000 psychological level. A breach of the support level could accelerate sell-off to the $2,800 level.