- US dollar softness persists, sending majors higher.

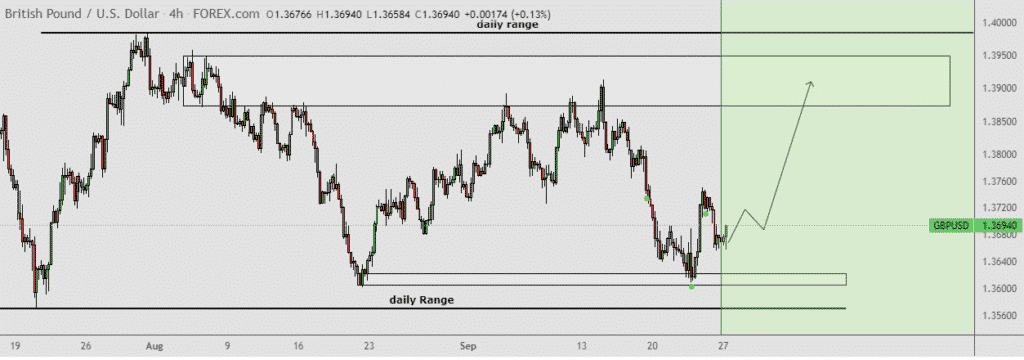

- GBPUSD trying to bounce back.

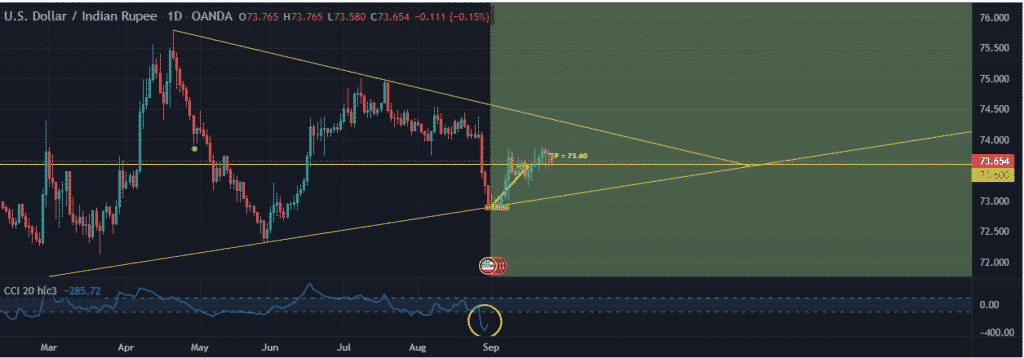

- USDINR sell-off persists as Rupee strengthens.

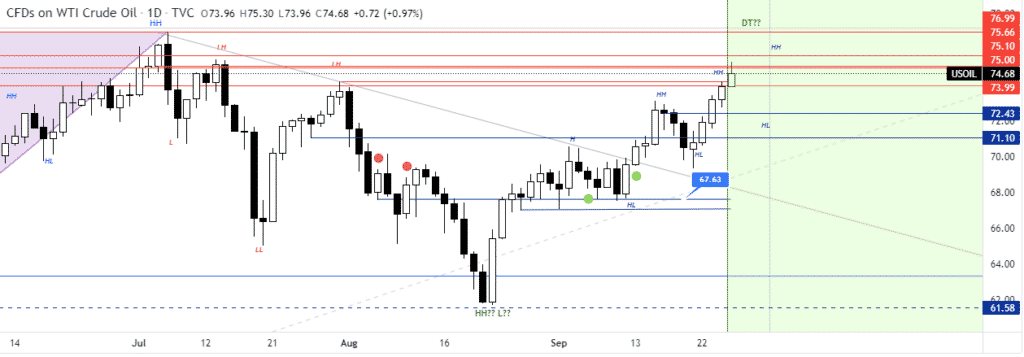

- Oil prices edge higher on strong demand.

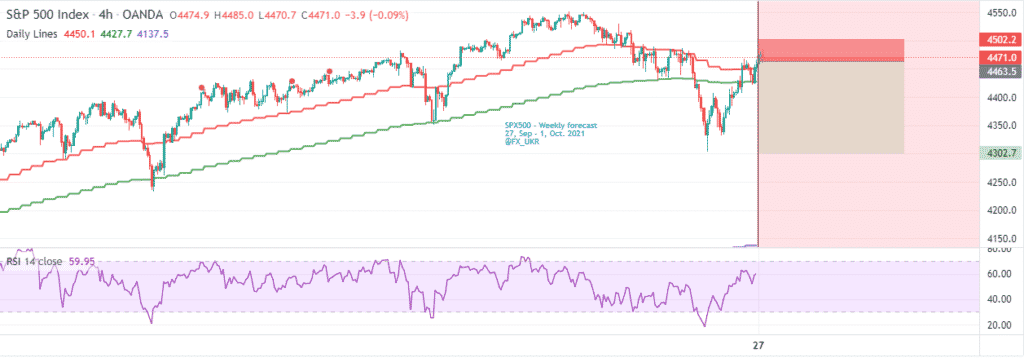

- US equity bounce back continues after sell-off.

- Bitcoin and Ethereum find support above key levels.

The US dollar was on the back foot Monday morning, struggling for direction near one-month highs. The receding fears of the Evergrande Group defaulting on its $305 billion of debt after the People,s Bank of China injected $15.46 billion into the financial system appears to have brought some calmness into the market, fuelling the risk-on mood.

GBPUSD in consolidation

The dollar softness is one of the factors fuelling recovery among riskier currencies hard hit by the Evergrande debacle. The British pound is one of the majors trying to take advantage of the dollar weakness, with the GBPUSD pair trying to bounce back from one-month lows near the 1.3650 support level.

Amid the bounce back, the British pound remains under pressure, with the country’s Brexit concerns and rising virus-led death toll and manpower shortage.

While growing risk appetite is helping restrict GBPUSD downside pressure, escalating Brexit worries could take a toll on the pound, fuelling another leg lower.

USDINR edges lower

Meanwhile, the Indian Rupee continues to strengthen against the US dollar with the USD/INR dropping for the third consecutive day. The drop comes amid a broad risk-on mood that continues to weigh on the greenback’s safe-haven demand.

The pair has since dropped to the 73.65 level after rallying last week on dollar strength.

Easing COVID-19 fears in India is also helping offer some support on the Rupee against the dollar. The latest figures from the government suggest the lowest virus cases since March of 2020. The daily rise in cases also dropped to 26,041 last week from 28,326 the previous week.

The Indian Rupee has also benefited from the ongoing talk that the Indian shares in the equity markets have outperformed peers in the emerging markets sector. Progress in the country’s vaccination drive is helping fuel sentiment ahead of the busy festive season.

Oil prices rally persists

In the commodity markets, oil prices continue to edge higher for a fifth consecutive day. The rally comes amid signs that the market is tightening amid the global energy crunch. Brent crude was up by 1.20% Monday morning to $78.16 a barrel as WTI futures rose 1.27% to $74.92 a barrel.

The surge in oil prices comes on the EIA report showing bigger than expected draws in the US crude oil supply in the previous week. With stockpiles at three-year lows, there is growing confidence demand is picking up.

Oil prices are up by more than 80% in 2021 as global demand continues to improve with the COVID-19 situation being brought under control. OPEC members slowly easing output restrictions has also helped in the tightening of the market, helping support a spike in prices.

US equities bounce back

US stocks bounced back, finishing last week on a high at the back of heightened volatility. The Dow was up 0.6%, the S&P 500 up 0.5%, and NASDAQ down 0.1% for the week.

The gains came after the indexes wobbled between gains and losses throughout the week after a hawkish Federal Reserve policy report. The market also came under pressure amid concerns about the escalating Evergrande situation in China, a situation compounded by COVID-19 and US politics standoff.

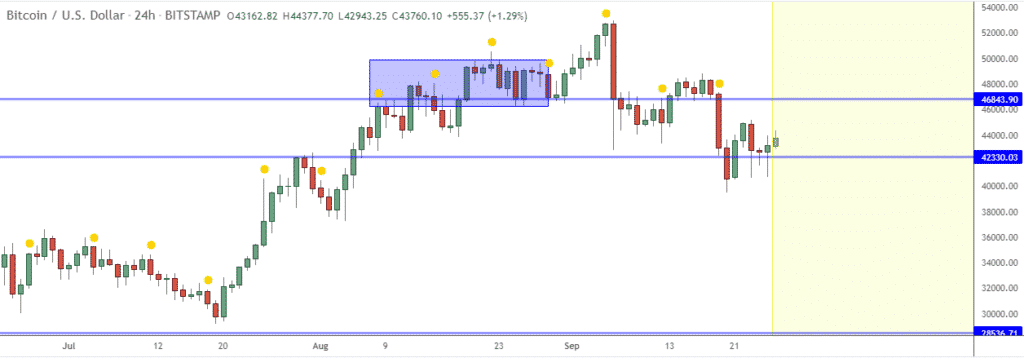

Bitcoin & Ethereum recovery continues

In the cryptocurrency market, Bitcoin and Ethereum were yet to gain on a recovery mode on Monday, powering through key support levels. BTCUSD bulls have succeeded in pushing the flagship crypto above the critical $43,000 level after plunging below the $40,000 level last week.

Bitcoin remains well supported for further price against above the $43,000 level. On the other hand, Ethereum has also regained its footing on bouncing above the $3,000 psychological level.