The Ark Innovation Fund (ARKK) is under intense pressure as most of its constituent companies struggle. The fund is down by more than 33% from the year-to-date high and is hovering at an important support level.

Growth stocks struggle

Cathie Wood has moved from relative obscurity to become one of the most prominent women in corporate America. In 2020, she appeared in lists of the most powerful women in Wall Street by Barrons and Institutional Investors.

Wood is known for her strong belief in technology companies and her ambitious targets for Tesla and Bitcoin prices. She believes that Tesla shares will surge to $3,000 while Bitcoin will soon soar to more than $300,000. At the same time, her fund has grown in size, with total assets under management rising to more than $52 billion.

Still, some analysts criticize Wood and her exchange-traded funds. They mostly cite her fees. For example, most of her funds have an expense ratio of 0.75%. While this might seem small, most funds in the US have a ratio of less than 0.05%.

The Ark Innovation Fund is Wood’s flagship ETF and is made of prominent stocks like Tesla and Square. Unfortunately, it has been a difficult time for being a growth investor.

The Vanguard Growth Fund (VUG) has declined by almost 4% in the past few days. At the same time, most of the well-known companies are in a correction. Such is the performance because investors expect these firm’s growth to wane and for the Fed to hike rates. As a result, there has been a rotation from growth to value stocks.

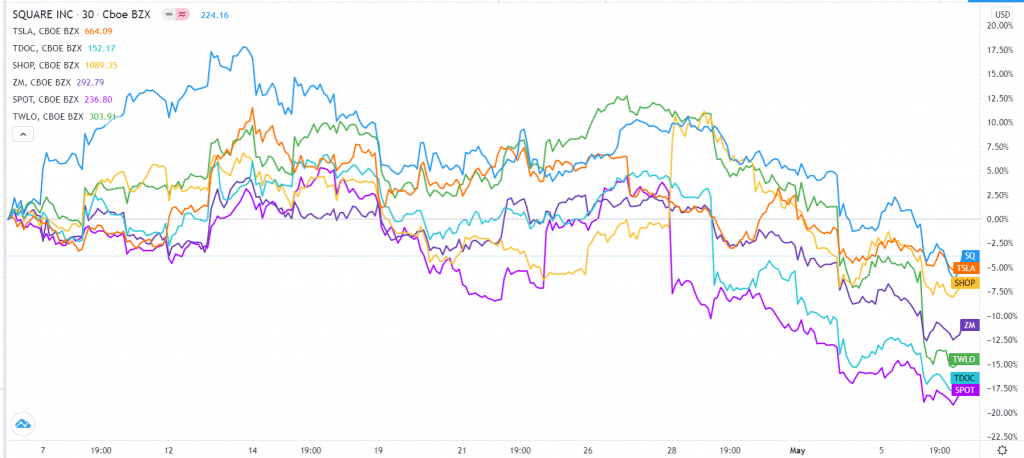

The biggest companies in the ARKK ETF are Tesla, Teladoc, Roku, Square, Shopify, Zoom, and Spotify. As shown below, all these firms have declined in the past 30 days.

Select ARKK ETF stocks 30-day performance

Square and Roku to the rescue?

Square is the fourth-biggest constituent of the ARKK ETF. It is a well-known company in the payment processing industry. It helps merchants accept payments in both their e-commerce and physical stores. The company also owns Cash App, one of the biggest peer-to-peer payments companies in the country. It is also a big player in the crypto industry.

On Thursday, Square stock price jumped by more than 2% in extended hours after the firm reported strong earnings. The company made a gross profit of $934 million, a year-on-year increase of 79%. The firm also added millions of new customers. For example, its Cash Card added more than 10 million people. It also expects to invest $1.1 billion to grow the business.

Roku stock also surged in extended hours after the company reported strong numbers. The company’s revenue rose to $574 million while its net income rose to $76 million. It added more than 2.4 million customers. The Roku stock price surged by more than 9% in extended hours.

While Square and Roku shares rose before and after earnings, Teladoc stock declined by more than 2%. This happened as Walmart expanded its healthcare investments by acquiring MeMD. The company, which was started in 2010, offers telehealth services to millions of customers. Investors are worried that the firm will take market share from Teladoc.

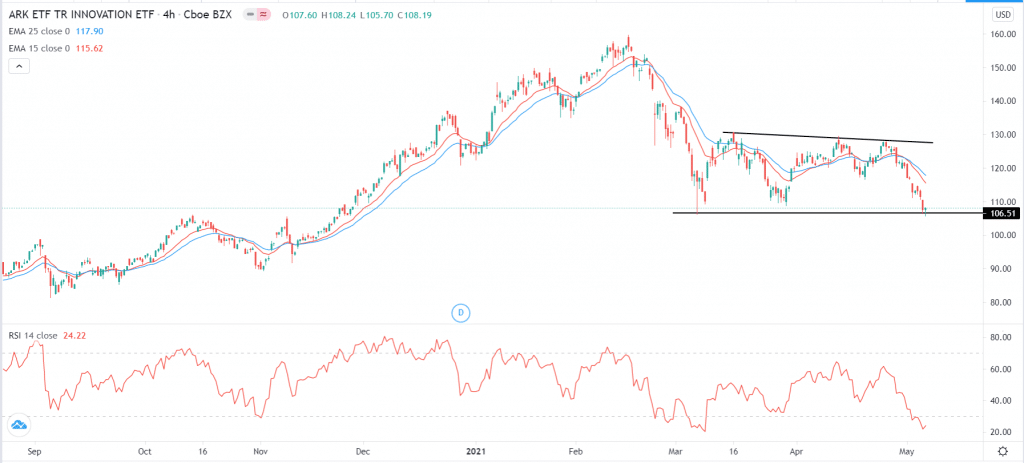

ARKK technical outlook

The ARKK fund declined to $106, which was the lowest level since May 5. The 25-day and 15-day moving averages have made a bearish crossover while the Relative Strength Index (RSI) has dropped to the oversold level of 24.

Therefore, there are two possible scenarios. The fund could resume the upward trend as bulls target the upper side of the channel at $128. On the other hand, it could continue falling as bears attempt to move below $100.