- Asian investors cheer prospects of big US government spending after Democrats sweep Georgia runoff elections.

- Trump’s China crackdown unnerves investors in Hong Kong amid reports of Alibaba and Tencent ban.

- Moderna vaccine approval in Europe bolsters hope about defeating COVID-19, but rising infections pose a fresh risk to markets.

The financial sector the biggest driver of stock market gains across Asia

Asian stocks soared Thursday, following in the footsteps of US and Eurozone equities the day before. The financial sector has been the biggest driver of stock market gains across Asia. Investors hope for a quick economic recovery as a new vaccine to combat the coronavirus has been approved in Europe, and chances increase for big US government spending after Democrats swept Georgia runoff elections.

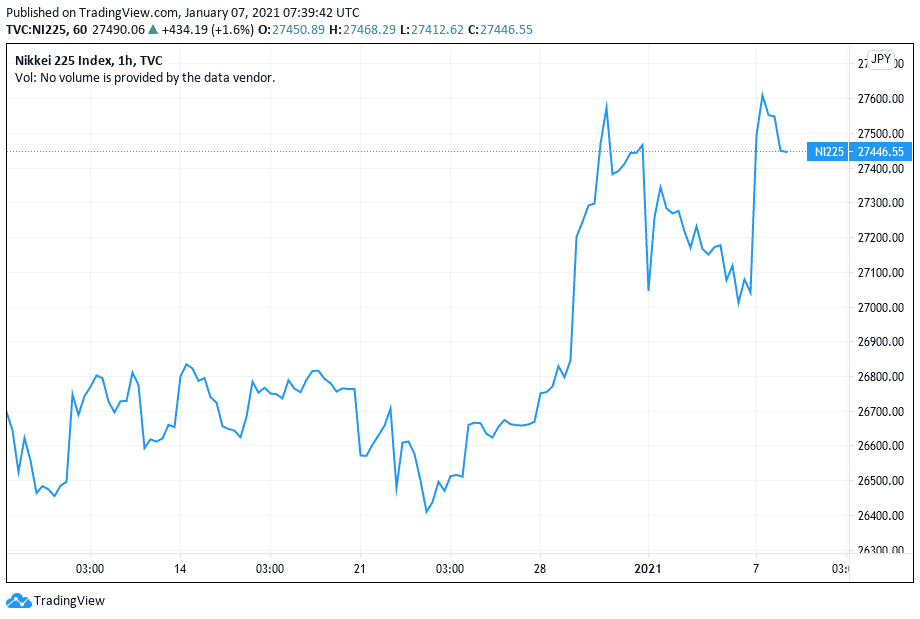

Japan’s Nikkei shines as Asian stocks surge

Japan’s Nikkei 225 index soared to a 30-year peak Thursday, with the rally mostly fueled by financial companies. The index closed with a 1.60% gain at 27,490.13.

Nikkei has come a long way. It fell to 16,000 lows in March 2020 as the coronavirus spread rapidly around the world. It began to regain ground after that and in June shot above the 23,000 level. In December, it crossed the 27,000 marks.

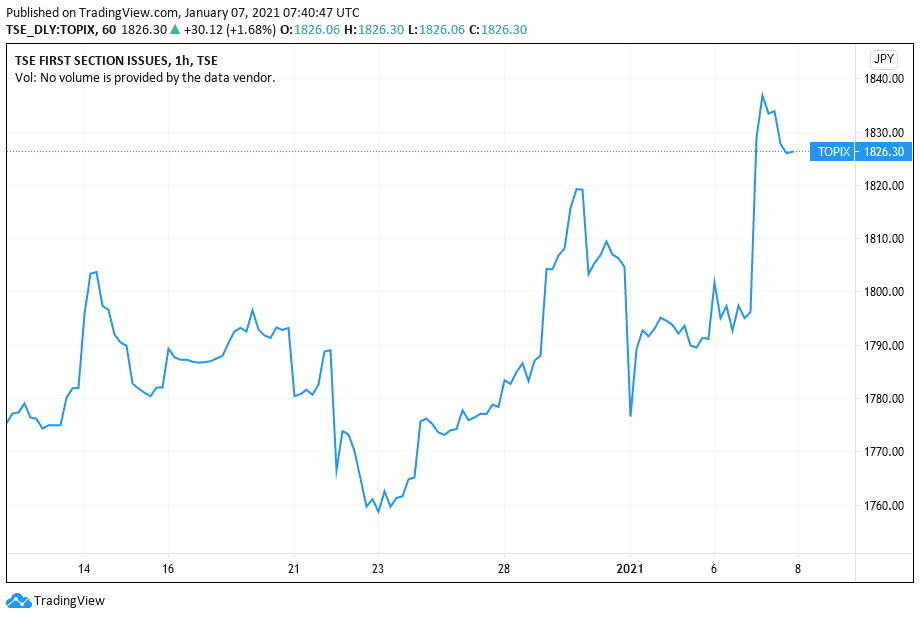

It was generally a great day for Japanese stocks. Japan’s broader benchmark Topix gained 1.68% to close at 1,826.30, its highest level since October 2018. The benchmark crashed to 12,000 lows in March and has tried to sustain its recovery since.

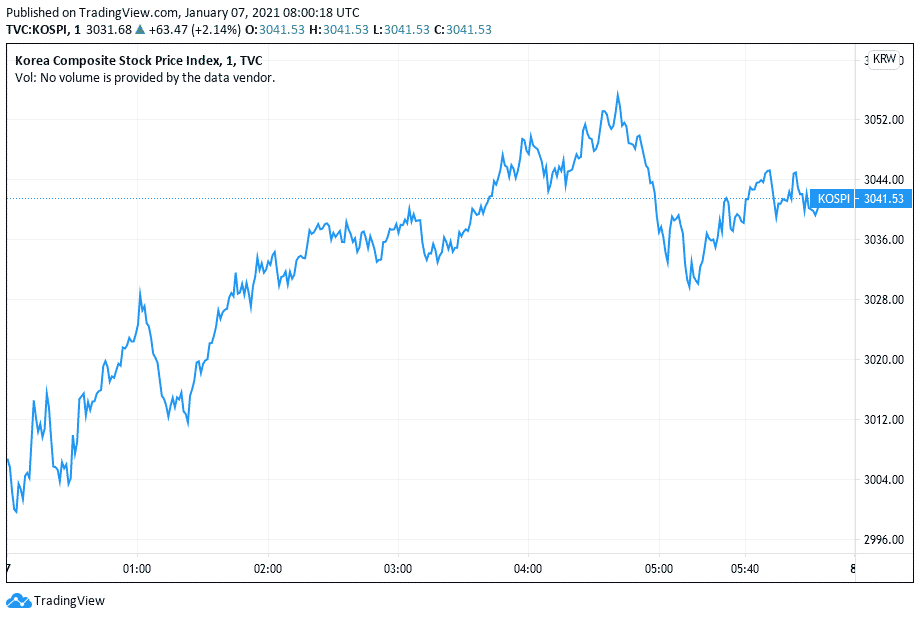

Foreign investors drive Korean stocks up as the won weakens against the dollar

In South Korea, the KOSPI stock benchmark rose 2.14% to close at 3,031.68. The Kospi is dominated by semiconductor companies that supply chips for a variety of electronics and machines. Foreign investors emerged as the net buyers in Korean stocks as the local currency won weakened against the US dollar.

Investors appeared cautious initially. The KOSPI opened at the 3,000 level but quickly dropped to 2,999 before making its way up again. It succeeded in hitting 3,030 but struggled to hold on to the gains and shortly after pulled down to the 3,010 level. At some point, the index crossed 3,055 but shed some of the gains as the closing bell neared.

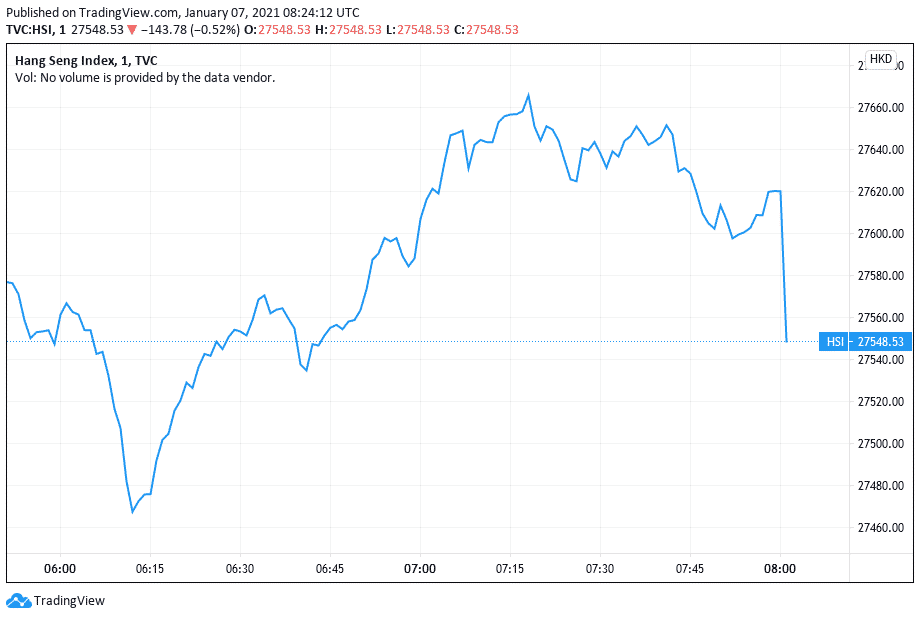

Trump’s Alibaba and Tencent ban threat roils Hong Kong shares

Hong Kong stocks had a bad day. But things look better for financial stocks. The Hang Seng index fell more than 4%, led by heavy selling in Alibaba and Tencent stocks.

It turns out that the Trump administration intends to ban Americans from investing in the Chinese tech giants. This comes as the administration has already forced the NYSE to delist the stocks of Chinese telecom companies China Mobile, China Telecom, and China Unicom. The administration is targeting companies with ties to the Chinese military in its intensifying China crackdown. The NYSE plans to suspend trading in the shares of the Chinese telecom companies Monday.

Meanwhile, financial stocks shone in Hong Kong. HSBC rose as much 5.5%, and Standard Chartered jumped 7.7%.

The Hang Seng index swung between a low of 27,457.47 and a high of 27,752.36 for the day. It was last seen at 27.548.53, representing a 0.52% pullback.

In Australia, the S&P ASX 200 gained 1.59% to 6,712.00. The index is dominated by mining and banking companies. In India, the S&P BSE Sensex rose 0.2% to 48,268.16 while the blue-chip NSE Nifty 50 index advanced 0.25% to 14,181.85.

Why investors are bidding up stocks

The rising Asian stocks show investors looking beyond the chaos that rocked the US Capitol as lawmakers convened to certify Joe Biden’s election. Investors anticipate a Democrats-controlled White House and Congress to expand government spending, positively impacting global economies. Investors also cheered Europe’s approval of Moderna’s COVID-19 vaccine. Containing the virus is crucial to sustaining economic recovery that has started in many places.

In the coming days, investors will be trading stocks with America’s ongoing China crackdown in mind, as well as the impact of the Democratic party’s Georgia electoral wins. The issue of a fresh wave of COVID-19 infections also lingers with countries moving to impose lockdowns again.