BlackRock Inc. analyst Russ Koesterich says Gold is proving to be a less effective hedge against moves in other assets and inflation, according to Bloomberg. The portfolio manager warns that gold faces headwinds should the recovery pick up pace.

Koesterich says that Gold’s relationship with risky assets was even stronger when compared with tech stocks

The BlackRock’s portfolio manager considers Gold’s ability to hedge against inflation as somewhat exaggerated and less reliable as a reasonable store of value in the long term.

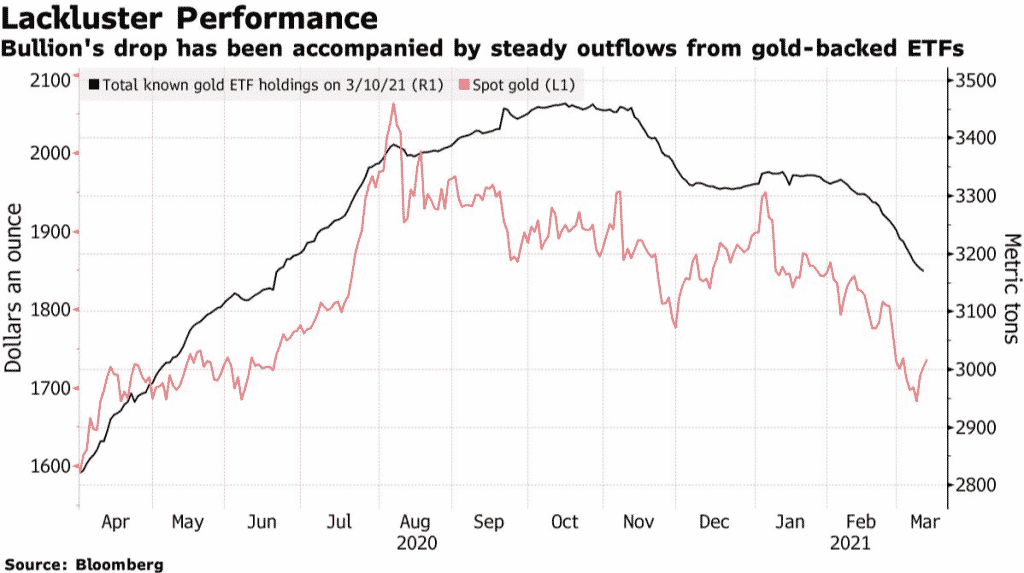

Bullion has lost ground in 2021 as recovery from the pandemic gains traction and Treasury yields surge, despite coming back this week.

Koesterich says gold should be thought of as a dollar hedge since it has demonstrated a strong, inverse relationship with the U.S currency

The portfolio manager expects the upcoming U.S stimulus and vaccine distribution to lead to rate hikes that will be a headwind for gold.

Gold’s decline has been accompanied by a steady drawdown in holdings in gold-backed exchange-traded funds, while banks have chopped price targets after it hit a record in 2020.

Gold is currently declining. XAUUSD is down 0.44%