- Gold price is on a 4-month high after moving past the psychological level of $1,900.

- The US dollar’s downtrend, which has lasted since the beginning of April, has fuelled the rally.

- The decline in Treasury yields has further supported gold prices.

Weakening US dollar

The gold price has an inverse correlation with the value of the US dollar. The greenback started the year on an uptrend. The rallying was fuelled by optimism on economic recovery from the coronavirus pandemic. After hitting a low of $89.17 on 6th January, the dollar index surged to $93.48 on 31st March.

In the year’s second quarter, the greenback has been in a downtrend, falling to its current 89.72. The dovish tone held by the Federal Reserve has been a key driver of the US dollar’s plunge. Despite the strong economic data and heightened inflation jitters, the central bank has maintained that the recovery is still incomplete and uneven.

Recently, various Fed officials have downplayed the ongoing inflationary pressures. St. Louis’ Fed President James Bullard, Atlanta’s Fed President Raphael Bostic, and Governor Lael Brainard are the latest officials to assert that the expected inflation will be transitory. For instance, Brainard noted,

“A very important part of inflation dynamics is longer-term inflation expectations and those have been extremely well-anchored… If we did see inflation that moves persistently and materially above our goals in a manner that also threatened to have some impact on those long-term inflation expectations, we have the tools and the experience to gently guide inflation back to target.”

The officials’ remarks have lowered the bets on the Fed hiking interest rates, at least in the short term. In theory, tightening the monetary policy would be a bullish catalyst for the US dollar. In turn, it would trigger a decline in gold prices.

This week, the released US economic data have further exerted pressure on the US dollar. On Tuesday, data by the Conference Board showed that consumer confidence had dropped to 117.2 in May compared to the forecasted 119.2. This is the first time in the current year that the figure has come in lower-than-expected.

At the same time, the country’s new home sales were lower than expected in April at 863,000. Economists had expected a reading of 970,000, which would have been higher than the prior month’s 917,000.

Declining US bond yields

Gold price is also being boosted by the plunge in Treasury yields. From a broad perspective, the yields offer support to the US dollar. As such, a decline in the bond yields usually triggers a drop in the value of the greenback, which in turn offers support to the gold price.

At the time of writing, the benchmark 10-year US bond yields were down by 0.01% at 1.56. Over the past one week, it has been on a downtrend; having declined from 1.69 on 19th May. The longer 30-year yields are also down by 0.20% at 2.25.

Gold price technical outlook

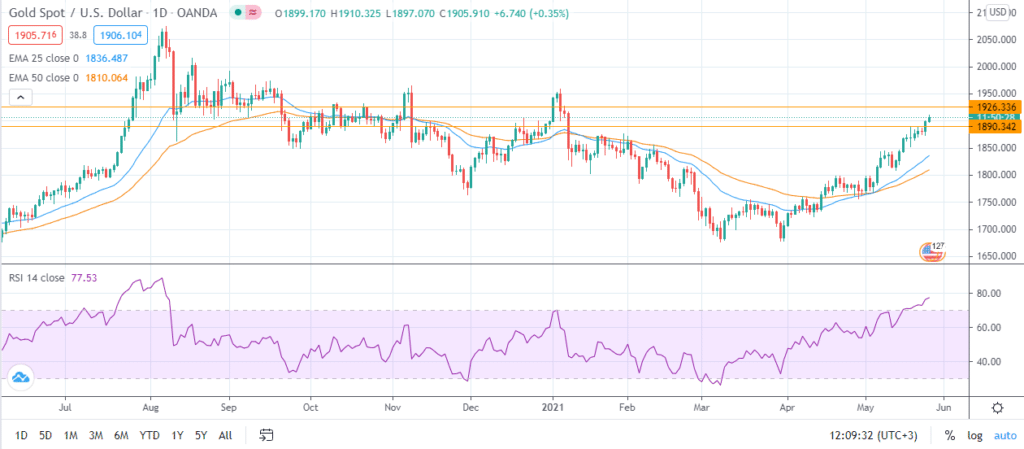

Gold’s price is trading above 1,900 for the first time since January. After hitting a two-month high on 6th January at 1,958.52, the precious metal began a downtrend that had it reach its nine-month low of 1,676.42 in early March. In the second quarter, the gold price has been in an uptrend.

At the time of writing, it was up by 0.49% at 1,908.32. At that level, it has erased the losses recorded year-to-date. Notably, over the past 10 trading sessions, it has only recorded one day of losses.

On a daily chart, it is trading above the 25 and 50-day Exponential Moving Averages. With an RSI of 77, it is in the overbought territory.

I expect the gold price to pull back to the psychological level of 1,900 before moving back up towards its next target at 1,926.33. It is also possible for the pullback to reach 1,890 before reviving its uptrend. However, a move below that support level will invalidate this thesis.