- Facebook stock up 35% ahead of the earnings report

- Q2 earnings and revenue expected to top estimates

- Focus on active users is crucial to advertising revenue growth

Facebook Inc. (NASDAQ: FB) is slated to report its second-quarter financial results on July 28, 2021. Expectations are high that the company will deliver top-line growth at the back of strong demand for online advertising. However, red flags have started to emerge, signaling things could become tough as the year progresses.

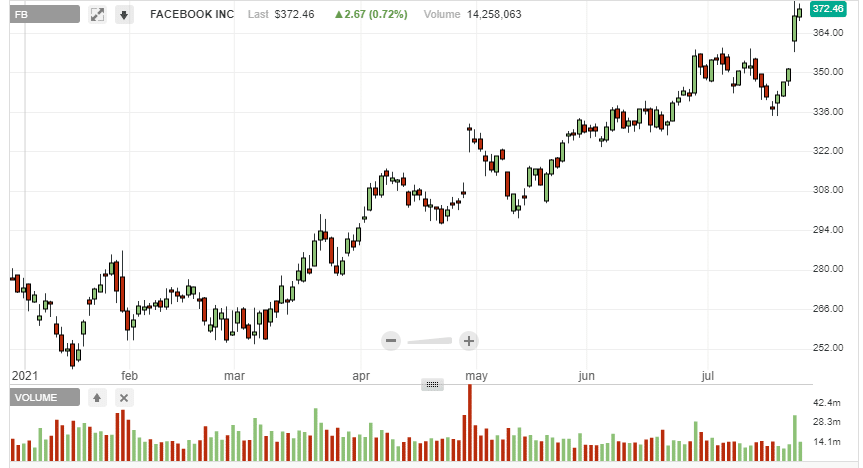

The social networking giant heads into the earning session at the back of an impressive run in the stock market. The stock is up by about 35% year to date, outperforming the overall market.

Additionally, the stock is flirting with record highs. Consequently, the Q2 report is one of the catalysts likely to sway investor’s sentiments.

While the company did not issue specific guidance for the latest quarter, CFO Dave Wehner reiterated expectations of stable or modest revenue growth relative to the growth in Q1.

Q2 expectations

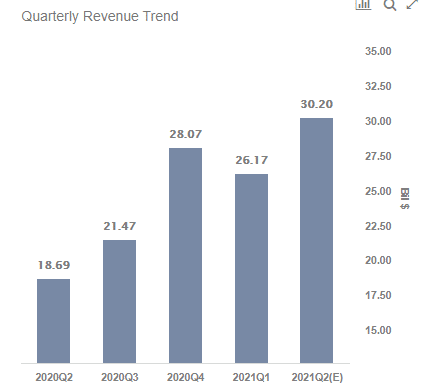

Wall Street expects Facebook to report revenues of $27.8 billion compared to $18.7 billion reported in the same quarter last year. In the first quarter, revenues jumped 48% year over year to $26.2 billion. The increase was mostly driven by a 30% growth in average price per ad.

In addition, the social networking giant profited from a 12% increase in ads delivered.

Analysts expect net income to jump to $8.73 billion or $3.02 a share, signaling a 68% year-over-year increase from $1.80 a share delivered last year in the same quarter.

In Q1, earnings jumped 93% to $3.30 a share, easily beating analysts’ projections of $2.37 a share. Earnings growth came at the back of an 8% jump in daily active users and a 10% jump in monthly active users.

What to look out for?

Ahead of the Q2 report, Facebook boasts an impressive track record, having topped expectations in the last four quarters. Advertising has always been the company’s domain from where it generates most of its revenues and earnings.

The focus will be on whether the company was able to capitalize on the opening of the global economy believed to have triggered increased demand for online advertising. Higher prices on the advertising front should be a key driver of total sales.

The number of active users on the flagship app will also elicit strong interest as daily active users grew by 8% in the first quarter. The more the number of active users, the increased chances of Facebook selling more ads.

Daily active users are a closely watched metric as investors use it to assess whether people remain engaged on the platform or Facebook is facing stiff competition from other platforms.

In the second quarter, regulatory pressure continued to build up, waiting to see the kind of impact they had on the bottom line. Apple unveiling new operating software that gives users the ability to stop apps like Facebook and other online advertisers from tracking their web activity could have hurt the top-line growth.

Q3 outlook will also be closely watched as Facebook navigates from the weak comparatives over the past year. Management has already warned that it expects revenue growth rates to decelerate heading into year-end, waiting to see the guidance that the company delivers.

Bottom line

Facebook is poised to report its Q2 report having hit an all-time high in the market. The stock has been moving high amid expectations that the company is one of the biggest beneficiaries of the opening of the global economy.

Consequently, a solid Q2 report could strengthen investor’s sentiments resulting in the stock edging higher. A miss could trigger a sell-off from current highs.