While Facebook and Twitter are both categorized as social media technology stocks, they have a vastly different business model. Tech giants primarily earn their revenues from advertising, but that is where the similarity stops.

Facebook has resorted to inorganic growth as it saw reduced traction on its main platform. It introduced messenger and bought Instagram (2012) and Whatsapp (2014). This led to a sharp increase in cumulative users across Facebook’s platforms.

Financials

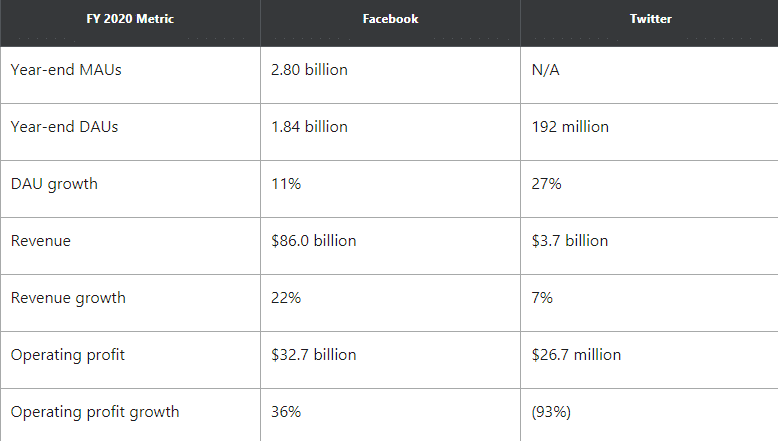

As can be seen below, Facebook’s daily active users are almost ten times that of Twitter, which also reflects in the revenue and profit numbers. Facebook has already achieved massive scale via growth and acquisitions. This puts it in an advantageous position. As you can see, revenue growth for Facebook for FY20 was 22% vs Twitter’s 7%.

Although, you can see that in terms of user growth, Twitter is ahead with 27% growth vs. Facebook’s 11%. It is worth noting, though. that this growth is off a low base, so in terms of the absolute number of users, Facebook is still ahead.

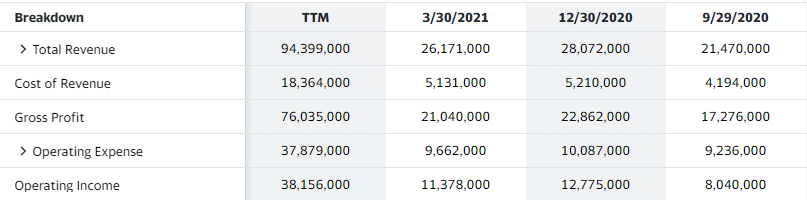

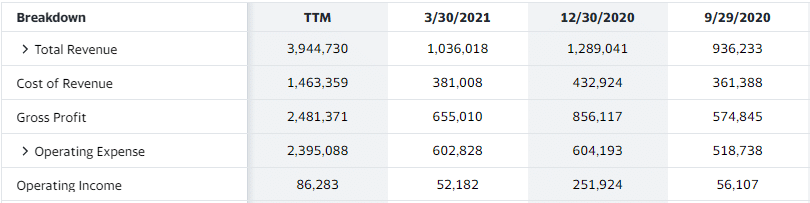

In terms of QoQ, both companies saw their revenues and profits fall in the March quarter. This was because the US, thanks to its massive vaccination program, has seen a swift reopening across states. The Covid-19 pandemic had led to a massive surge in usage as people were forced to sit at homes. However, this surge is now reversing as people move to offices.

As can be seen below, the December quarter operating income was 50% higher for Facebook vs. the September quarter. This number was a whopping 230% higher for Twitter! However, the fall was equally steep.

Facebook Quarterly Numbers

Twitter Quarterly Numbers

Facebook’s large free cash flow also gives it leeway to invest in new stocks and make acquisitions. It also undertakes stock buybacks from time to time which supports the stock. On the other hand, Twitter is not in such a comfortable situation and hence might struggle to grow inorganically.

Regulations and politics

The entire tech industry is currently under fire for various reasons. Many of the tech companies are monopolies and hence are drawing the ire of the regulator. This has become increasingly evident under the Biden administration. The Democrats, too, have been pushing for more oversight as they control both the houses at Capitol Hill.

Social media companies are facing even higher scrutiny as their role in influencing elections is becoming more and more critical. Twitter was early on this as it started flagging several of Donald Trump’s tweets as manipulatives and finally suspended his account. This might have won Twitter some support in the Democratic Party.

Facebook, on the other hand, has been playing catch up as it was slow to ban or restrict conspiracy theories on the platform and other such questionable activities. Presently it is also under scanner for not preventing the spread of fake news around the Covid-19 pandemic.

CEOs of both the companies, Mark Zuckerberg of Facebook and Jack Dorsey of Twitter, have been called to Senate hearings in the past. This regulatory overhang is likely to weigh on the stock, especially for Facebook.

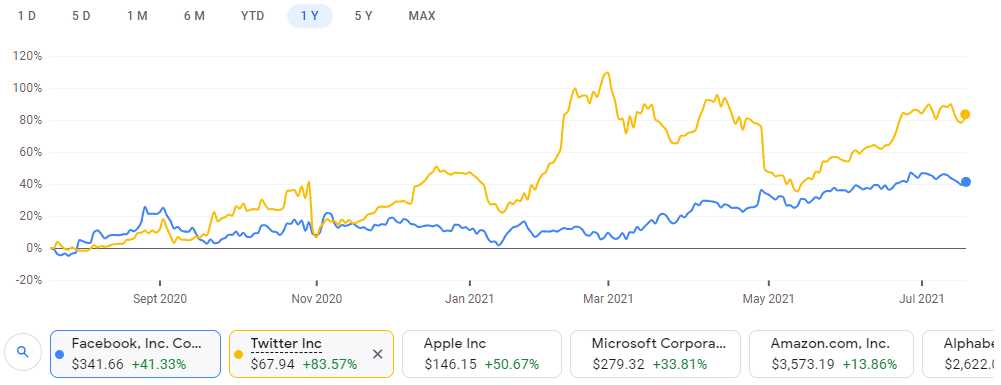

Stock performance

Over the past year, Twitter has outperformed Facebook stock by more than 40%. This might seem surprising given Facebook’s financial position, but if you notice that most of this outperformance came after Twitter’s December quarter results.

However, going forward, Facebook should be a safer bet. With interest rates expected to rise, investor sentiment will be favorable towards larger and safer companies, where Facebook has a clear advantage.