- Risk sentiment appears to be fading away in the Forex market as major currency pairs hold firm near key support levels.

- The US dollar is holding firm at three-month highs despite treasury yields edging lower after a recent spike to 14-month highs.

- Commodity currencies are under pressure on oil prices, edging lower amid demand worries on Europe lockdowns.

Risk sentiment stabilized at the start of the European trading session on Thursday after major pairs came under pressure on Wednesday on dollar and yen strength. US futures were little changed, with treasuries stabilizing after a recent pullback from 14 month-highs

The pause might be short-lived as weaker currencies against the USD look increasingly vulnerable as the greenback holds up near three-month highs even on yields pulling lower. EUR/USD AUD/USD and NZD/USD struggle to bounce back as the dollar continues to strengthen on a surge in risk sentiment.

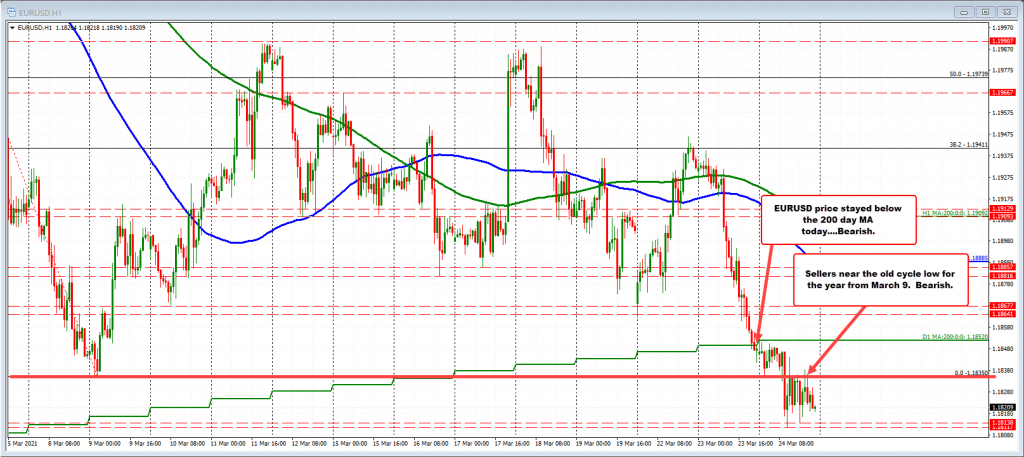

EUR/USD-GBP/USD sell-off

The euro is on course for a third consecutive day of losses against the dollar. The widening of the US and the European COVID-19 response is weighing on euro strength. The extension of lockdown measures in Germany threatens to slow down economic recovery in Europe’s biggest economy, conversely pilling pressure on the common currency.

Weak economic data led by disappointing German Manufacturing Purchasing Managers Index and the European Manufacturing and Service PMIs also continue to take a toll on euro strength. The EUR/USD pair is seen hovering near the 1.1800 support level, a breach of which could accelerate a sell-off to the 1.16 handle.

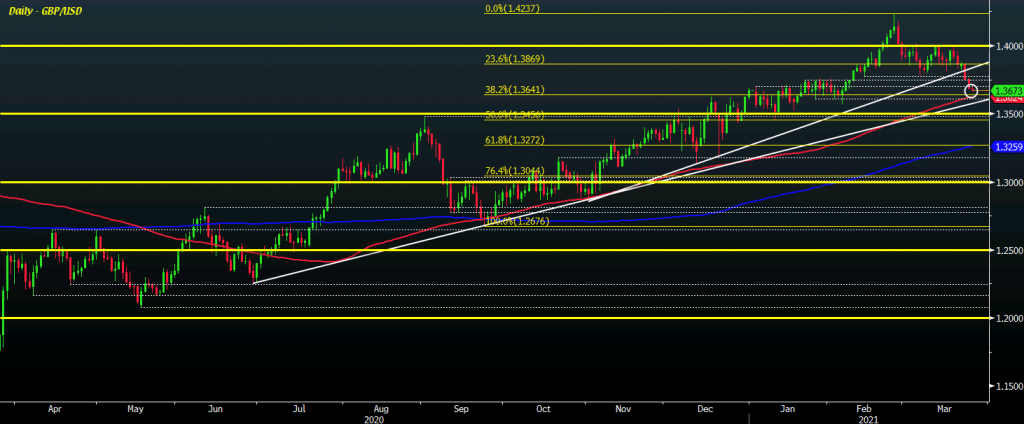

On the other hand, the British pound shows some resilience against the dollar after dropping to one-month lows. The GBP/USD pair bounced back during the European session, waiting to see if the upward momentum has what it takes to push through the 1.37 handle.

The sterling has been hit in recent days amid escalating tension with the European Commission over the AstraZeneca vaccine supply. The EU has threatened to ban the vaccine’s exports to the kingdom, given its higher vaccination rates.

The fear of a significant decline in vaccine supplies threatens to derail the UK’s plan to exit the current lockdown. The UK and the EU reiterating they are committed to working together might have averted a further slide. A positive tone in the equity markets might pull traders from placing bullish trades on the dollar, which has triggered euro and pound weakness.

Market participants await a speech by the Bank of England Governor that could sway sentiments on the pound later in the day.

Commodity currencies weakness

Commodity currencies led by the New Zealand dollar remained under pressure. The New Zealand dollar is down to five months low against the dollar. The sell-off comes amid growing concerns about the country’s economy despite its success story in the fight against COVID-19.

The Kiwi has since plunged to the 0.69 handle amid dollar strength. In April, a reduction in government bond issuance and the lack of LSAP triggered a sell-off in bond yields, conversely weighing heavily on NZD, resulting in the sell-off against the dollar.

With no major economic data in the way and interest rates stabilizing, the NZD/USD pair could stabilize in the 0.69 level.

The Aussie has also not been spared, tanking to two-month lows against the dollar on modest equity and commodity weakness. However, the sell-off appears relatively large compared to the wobbles in the commodities market.

Oil demand woes

Oil is one of the commodities that have come under pressure amid growing concerns of the third wave of coronavirus infections. Oil prices were down by as much as 2% as lockdowns in some key markets revived worries about demand for oil products.

US oil is struggling to find support above the $60 a barrel level after the recent sell-off. On the other hand, Brent crude held firm at the $63 a barrel level after a 6% jump overnight.

Lastly, Gold was up on Thursday morning, receiving support on steadying treasury yields that had weighed on it in recent weeks. The precious metal has found support above $1,730 an ounce level in recent days.