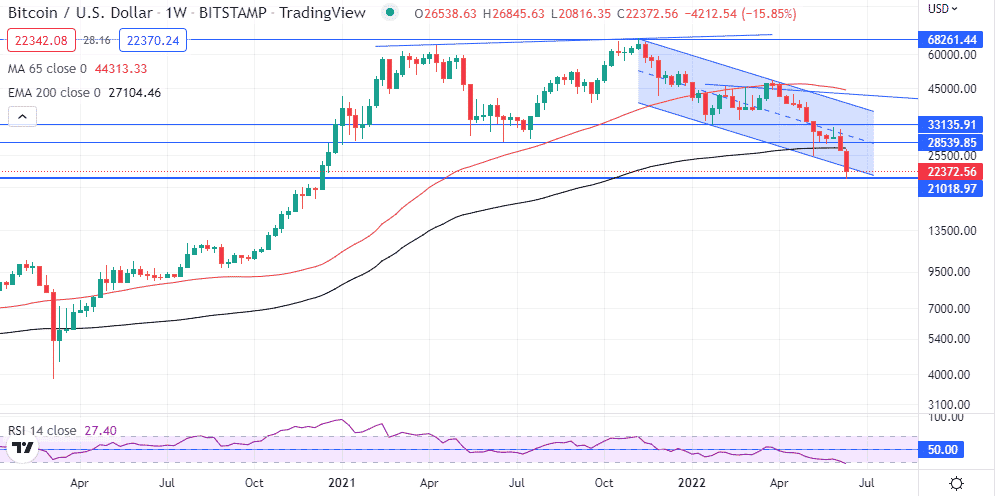

Bitcoin has officially crashed if a 67% plus pull back from record highs of $68,000 recorded last November is anything to go by. The flagship cryptocurrency is spearheading the move lower as the broader cryptocurrency sector remains under pressure as investors flee from riskier assets. More than $1 trillion in the market cap being wiped out in the cryptocurrency sector this year attest to the bubble burst.

Bitcoin’s plunge below the $30,000 level to 18-month lows of $20,782 shows no signs of slowing down with bears in control. Binance CEO forced to hold BTC withdrawals due to massive losses in the biggest cryptocurrency and futures. With the US dollar strengthening across the board and fear forcing investors to scamper for safety, the prospect of Bitcoin plunging below the $20,000 level is high.

Why Did Bitcoin and Cryptocurrency Crash Happen

Bitcoin and cryptocurrency crash has been long coming as investors have remained wary of the global economy for the better part of the year. However, after correcting from record highs recorded last November, the sell-off accelerated as inflationary pressures hit early in the year.

Soaring inflationary pressures forced investors to scamper for safety in safe havens. A move by the US Federal Reserve to hike interest rates triggered dollar strength, all but working against Bitcoin and cryptocurrencies.

However, the implosion of stablecoin terraUSD and Luna in recent months appears to have accelerated the sell-off in the market. The implosion spooked the market at one of the worst times as demand for risk was at all-time lows.

Bitcoin is one of the coins that have felt the full brunt of the overall cryptocurrency market crashing. The flagship cryptocurrency has struggled to find support above the $30,000 level, affirming increased sell-off in the market.

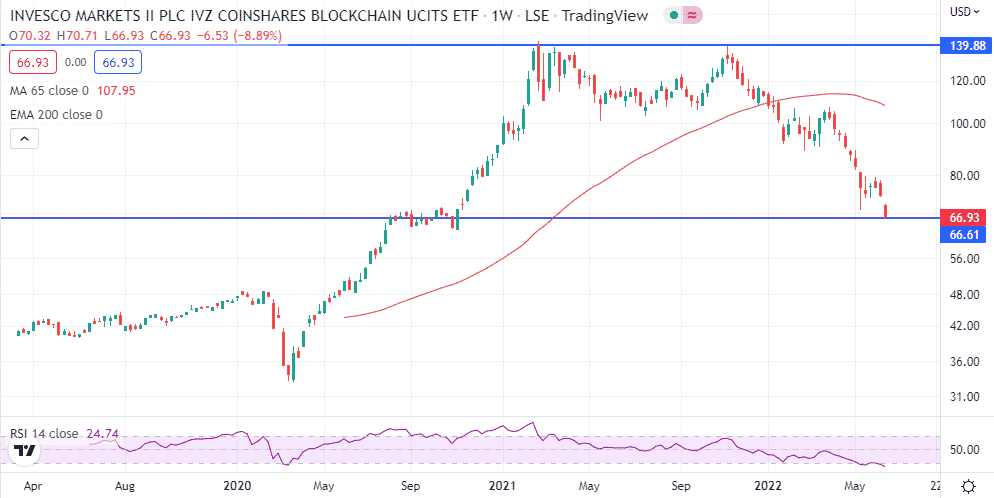

The CoinShares blockchain Global Equity Index, which tracks the performance of 49 firms with exposure to cryptocurrencies, is already down by more than 30% year to date and officially in bear territory.

Will Crypto and Bitcoin Recover

The uncertainty that has gripped the capital markets amid inflationary pressures and the central banks moving to hike interest rates paints a dull outlook for cryptocurrencies. So instead of investing in highly battered assets that are down by more than 50%, investors increasingly turn to cash or safe havens as uncertainty continues to grip riskier markets.

The prospect of Bitcoin and cryptocurrencies bouncing back from current lows fades by the day. The slide lower is not showing signs of slowing down as negative news round the clock continues to give short-sellers a reason to continue selling.

Reports that US Cryptocurrency Company Celsius network has frozen all cryptocurrency withdrawals citing extreme conditions attest to the negative outlook in the market. However, unless something drastic happens, cryptocurrencies could remain under pressure heading into year-end as investors shun riskier assets.

BTC Price Prediction

Bitcoin’s short-term outlook remains bearish after a recent slide to 18-month lows of $20,782. The sell-off comes at the backdrop of a crypto bubble burst depicted by a deep correction from record highs last year.

With the overall capital markets under pressure and uncertainty amid growing concern about the global economy, the prospect of Bitcoin bouncing back is dim. However, analysts at Digitalcoinprice.com believe the coin could bounce back to highs of $30,775 before year-end after a recent slide below the $30,000 psychological level.

ETH Price Prediction

Ethereum, as the second-largest cryptocurrency by market share, has also felt the brunt of the overall cryptocurrency market turning bearish. The crypto is down by more than 60% from all-time highs and at risk of plunging below the pivotal $1,000 a coin level after a slide to 18-month lows of $1,215 a coin.

While the short-term outlook remains, bearish Ethereum could bounce back to the $1,704 level, according to estimates at Digitalcoinprice.com. However, the coin could face an uphill task to rise above the level, which has emerged as a critical resistance level from which short-sellers have come into the fold and pushed the coin lower.

Unless the cryptocurrency sell-off dust settles, Ethereum looks set to trade below the $1,704 heading into year-end.

BNB Price Prediction

Ranked as the fifth-largest cryptocurrency by market share, BNB is down by more than 50% year to date and looking increasingly bearish after a slide to 16-month lows. With the coin trading near the $225 a coin level, the expectation is high that it could rise and average $296 before year-end.