- The US dollar firms at 16-month highs on the Omicron uncertainty.

- NZDUSD drops to 1-year lows.

- USDCAD is under pressure on dollar strength.

- Gold bounces back amid falling treasury yields.

- Bitcoin and Ethereum are under pressure after last week’s implosion.

The US dollar firmed at 16-month highs Monday morning as demand for safe havens remained high amid the Omicron variant uncertainty. Additionally, the greenback continues to attract bids following a solid November jobs report that shows the US unemployment rate fell by 0.4% to 4.2%, with the labor market printing 240k jobs against an expected 550K.

The dollar index, which measures the greenback strength, has since found support above 96.00 after powering to highs of 96.28. The unemployment rate declining amid soaring inflation has all but fuelled chatter that the Federal Reserve could hike interest rates, all but fuelling dollar strength.

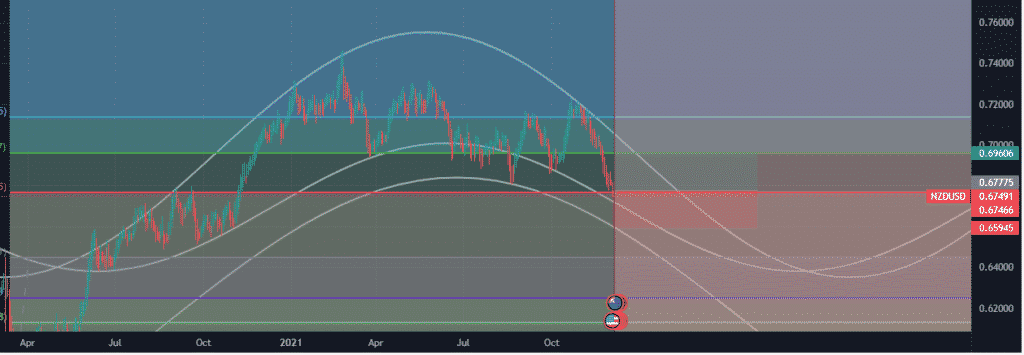

NZDUSD sell-off

Amid the dollar strength across the board, the NZDUSD pair has plunged to below the 0.6800 level. The kiwi pair was the biggest disappointment last week, dialing the most even as the NFP print missed expectations.

A drop to the 0.6754 level leaves NZDUSD susceptible to further losses, with the following support level at the 0.6610 level. A drop followed by a close below the 0.67201 could trigger renewed sell-off to the 0.6610 level.

On the flip side, a bounce-back followed by a close above the 0.6786 should pave the way for a bounce back to the 0.6861 level, the next substantial resistance level to the upside. The Kiwi pair looks set to remain under pressure amid the escalating Omicron variant concerns. Traders are increasingly shunning riskier currencies, such as NZD, and flocking safe-haven assets amid fears that the variant could trigger a slowdown in economic activity on initiating new restriction measures.

USDCAD above 1.2800

Meanwhile, USDCAD continues to edge higher, as the Canadian Dollar remains under pressure amid a tank in oil prices. After the recent pullback, the pair has powered and found support above the 1.2800 level on oil prices, struggling to rise above the $70 a barrel level.

The USDCAD pair remains well supported for further upside action, the 1.2816 having emerged as a pivotal support level. In contrast, the 1.2843 is the immediate short-term resistance level standing in the way of the pair powering back to two-month highs of 1.2853.

Looking ahead, the USDCAD will trade in tandem with oil prices. A surge in prices of black gold could trigger renewed selling pressure from current highs. However, an uptick in risk sentiments in the market owing to Omicron uncertainty could trigger dollar strength, seeing USDCAD edging higher.

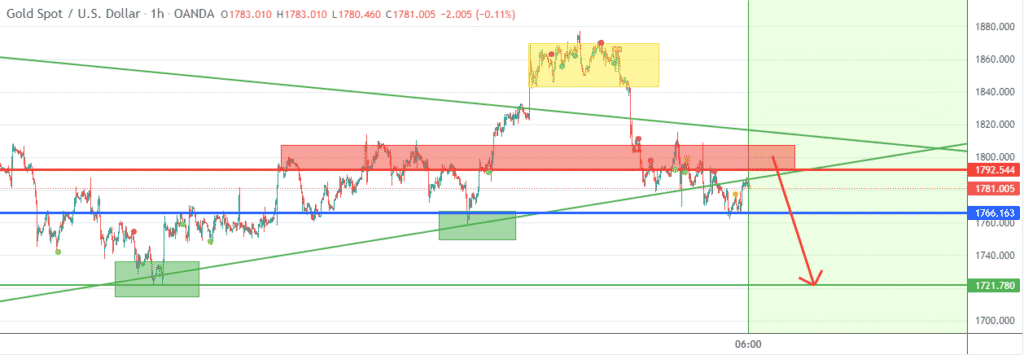

Gold bounce back

In the commodity market, gold prices steadied at the start of the week, powering through the $1780 an ounce level. XAUUSD remains well supported for further upside action, with $1780 emerging as the short-term support level. A break below the $1780 level could trigger a slide back to lows of $1761.

The rally in the precious metal comes on traders shrugging off dollar strength to steer XAUUSD higher. Rising inflation and a decline in treasury yields continue to offer support to XAUUSD bulls, as gold is often considered a hedge against high inflation.

US indices under pressure

In the equity markets, US stock futures remained under pressure on Monday, as stocks edged lower on Friday, concluding a losing week. The NASDAQ was down 1.9% on Friday. In the meantime, the Dow Jones Industrial Average slipped 0.2%, and S&P 500 tanked 0.8%

The sell-off came after the NFP report showed the US economy added 210,000 jobs against an expected 550,000. The unemployment rate dropping to 4.2% affirmed a solid report all but fuelling rate hike talks. Talk of rising interest rates amid Omicron uncertainty fuels fear in the equity markets.

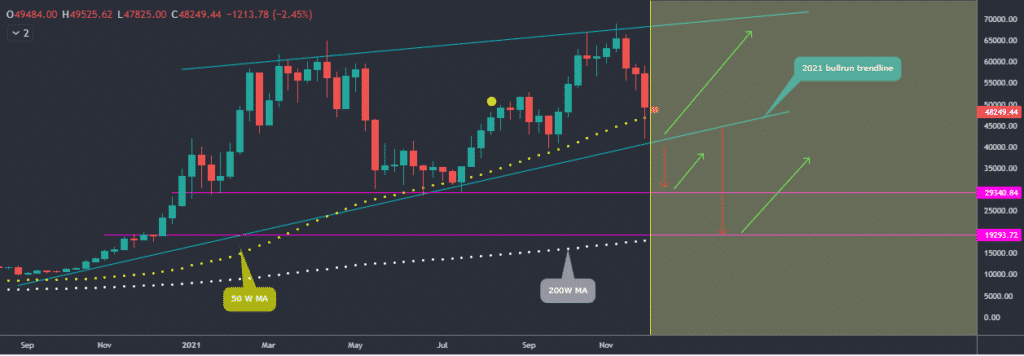

Cryptocurrencies Implosion

In the cryptocurrency market, it is a blood bath after Friday’s implosion. BTCUSD is struggling to power through the $50,000 level after tanking to lows of $41,940 and bouncing back to $49,202.

ETHUSD is also struggling to hold on to gains above the $4,000 level despite trading at highs of $4,124. The pair touched lows of $3,465 amid renewed sell-off following recent bounce back.