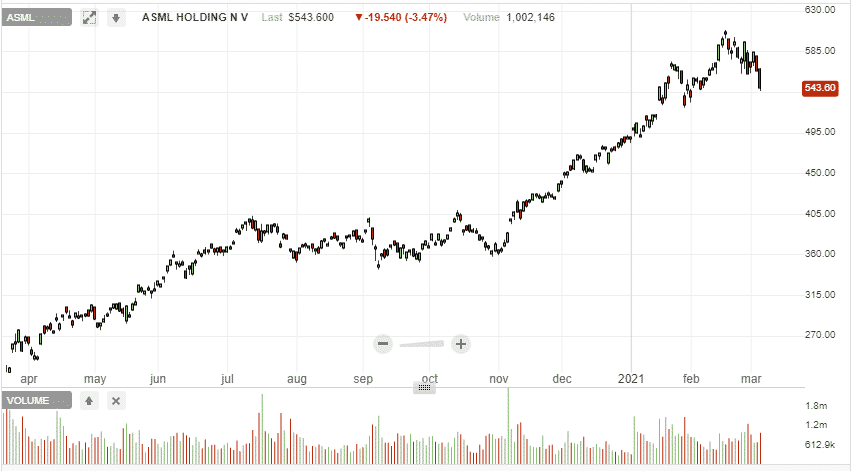

ASML Holding NV (NASDAQ: ASML) has been on a fine run, having more than doubled in value over the past 12 months. While the under-the-radar semiconductor stock has pulled lower after an impressive start to the new year, it could still have plenty of room to run, given the underlying fundamentals and strength of upward momentum.

Growth metrics

The stock is down by more than 5% from its record highs, which appears to be a minor correction. Going by the events of the past year, the pullback might as well act as a buying opportunity for investors who missed out on the initial leg higher.

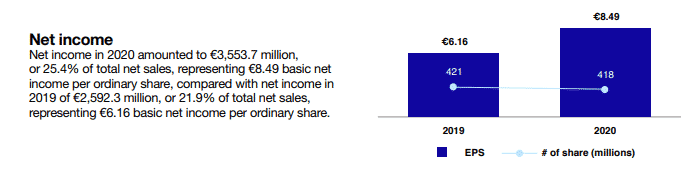

Going by the 2020 performance, it is clear that ASML Holding is an incredible growth stock with tremendous potential with some of the best growth features. The company boasts an impressive track record on earnings growth that strengthens investor confidence in the stock.

ASML Holdings’ historical earnings per share growth rate stands at about 25%, one of the industry’s highest. With its EPS expected to grow by 29% in 2021, now could be the perfect time to take advantage of the recent correction. In contrast, analysts call for a 24.9% average EPS growth for the industry.

A solid balance sheet is another factor that continues to affirm ASML Holding’s long-term prospects. The company boasts a cash flow growth of 35.6%, much higher than that of its peers and the industry average of 33%.

Revenue and earnings growth

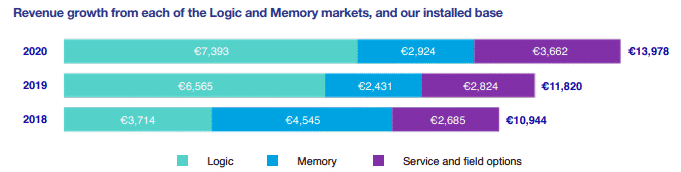

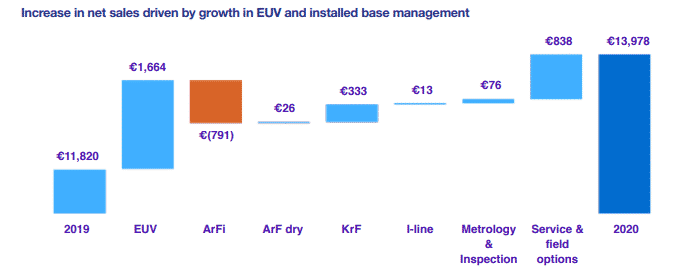

ASML Holding is coming off an impressive 2020 whereby it could shrug off the COVID-19 shocks to post a €2.2 billion growth in net sales that totaled €14 billion. Net sales growth received a boost from increased sales in the Logic market Memory market.

The Logic market posted a 13% increase in sales at €0.8 billion. The increase came on customers continuing to invest in future technology nodes. Likewise, demand for most advanced lithography systems remains healthy, with memory demand also showing signs of improvement.

Amid the stellar performance in 2020, the Dutch company still has some room to run, backed by a string of improving underlying fundamentals.

Lithography system growth

With ASML Holding controlling 80% market share for Lithography systems, it looks set to benefit a great deal from its market-leading status. The systems continue to elicit strong demand, given their ability to use light to print circuit patterns on silicon wafers.

ASML has carved a niche for itself on the development of EUV or extreme ultraviolet lithography machines that are the talk of the semiconductor industry. The systems are increasingly being used to develop the world’s smallest and most advanced chips.

Taiwan Semiconductor Manufacturing is one of the companies that has acquired the machines and used them to produce 5nm chips currently in Apple devices. Other companies using the machines to produce advanced chips include Samsung and Intel.

Semiconductor market growth

Developments in the broader semiconductor industry look set to be a key driver of ASML Holdings’ prospects going forward. Secular growth of new markets such as 5G networks cloud and AI service offers tremendous growth opportunities for which the Dutch company is well suited to take advantage of.

With the global semiconductor industry expected to grow by 7.7% in 2021 compared to a 5.4% growth in 2020, ASML Holdings could be in for a big paycheck. Taiwan Semiconductor Machines, which accounts for 31% of ASML Holdings revenue, is poised to increase Capex from €17 billion to €28 billion as it looks to keep up with the strong demand for chips for powering various devices and equipment.

Samsung and other chipmakers are also in the process of boosting their expenditure on the development of chips to cater to growing demand from the auto, data center, and cloud gaming industries.

As tech companies boost their spending, most of the amount should end in ASM Holdings, given that it is the key supplier of Lithography systems used in the development of advanced chips.

EUV systems boost

While EUV systems account for a small chuck of ASML Holdings shipments base, that could change sooner than later. The systems are becoming an integral part of the company’s top line, given that they cost much more than lithography systems.

While accounting for 8% of the total shipments, EUV systems bought in 43% of ASML holdings total revenue. Similarly, EUV revenues were up by 59% in 2020 compared to a 49% growth in 2019. Revenue growth on this front is expected to continue as TSMC, Samsung, and Intel increase their investments in the production of smaller but more powerful chips.

While AMSL did predict that its annual revenue will range between 15 billion euros and 24 billion euros by 2025, it might have to update the current underlying growth guidance. Rising Capex by some of the biggest semiconductor companies in a bid to meet the ever-growing shortage for advanced chips looks to accelerate the company’s run to record revenues.

Analyst’s expectations

Analysts are already projecting revenue growth of between 30% and 40% in 2021 at the back of increased Capex by some of the biggest foundries. Surging demand for 5G chips and rebounding memory markets, and demand for higher-end computing should continue to work in favor of ASML holdings. Going by the current underlying growth, ASML Holdings could easily surpass the 27 billion mark on revenues by 2025.

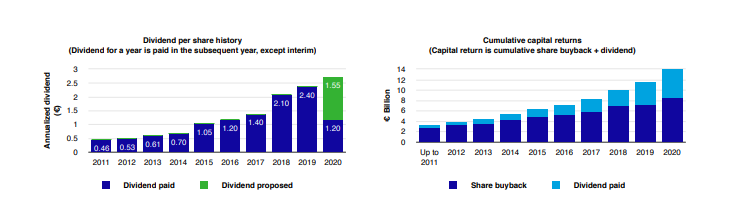

Similarly, the company’s earnings are also expected to increase significantly in keeping up with revenue growth. The sale of higher-margin EUV systems will mostly drive earnings growth. The buying back of more shares should also allow the company to bolster its EPS.

Bottom line

ASML Holdings is not cheap on trading at 40 times forward earnings, and it is a solid growth stock given the solid underlying fundamentals that affirm long-term prospects. Its dominance of the lithography systems market coupled with increasing Capex by some of the world’s biggest foundries should continue to support revenue and earnings growth going forward. Likewise, the company should continue to return optimum returns to investors through buybacks and dividends expected to strengthen its sentiments in the market.