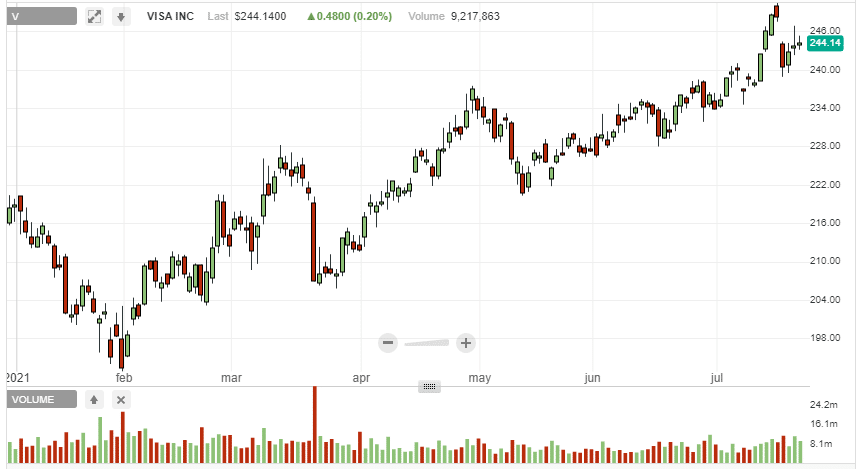

- Visa stock up 10% year to date

- Q3 Earnings and revenues to top estimates

- Improving consumer spending patterns

- Surging operating expenditures

Visa Inc. (NYSE: V) will report its third-quarter fiscal 2021 results after the close on July 27, 2021. The earnings report comes after an impressive run in the market, with the stock rallying 10% year to date. While it has pulled lower, slightly away from the 52-week highs, the Q3 report could sway investor’s sentiments and influence a spike back to 52-week highs.

In the first half of the year, Visa performed exceedingly well, characterized by growth in payment lines and the number of processed transactions. Improved operating efficiency all but affirms the company’s prospects in posting better than expected results.

Q3 expectations

The payment giant is expected to report revenues and earnings above consensus estimates. It is highly anticipated that increased digital payment adoption in the quarter positively impacted its top line.

Visa draws in revenues every time a customer uses its debit/credit card to make payments. Consequently, higher spending on Visa cards translates to increased revenues for the company in fees. Last year in the same quarter, the payment giant experienced a significant decrease in revenues as low spending on Visa cards came into play amid the Covid-19 pandemic.

Processed transactions and cross-border volumes are believed to have improved in the third quarter, which should lead to a spike in volumes translating to higher earnings.

Wall Street expects the payment processor to report $1.32 share earnings, representing a 24.53% year-over-year increase. In the second quarter, Visa delivered an EPS of $1.38 above consensus estimates of $1.26 a share.

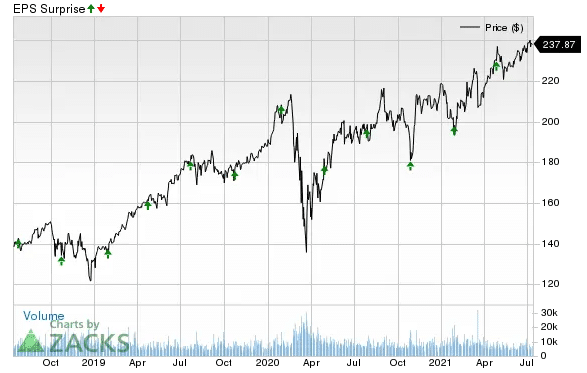

Visa boasts of an impressive track record, having surpassed earnings estimates in each of the last four quarters by an average of 7%. Sales are expected at $5.82 billion, suggesting a 20.32% year-over-year increase.

What to look out for

Visa is poised to report its fiscal Q3 results at the back of the opening of the global economy on the easing of Covid-19 fears. Spending patterns have improved significantly amid improved consumer sentiments.

While retail sales have been edging higher as people spend the amounts saved the past year amid the lockdowns, payment volume should have edged higher in the quarter as well. Consequently, Visa must have processed more transactions translating to increased fees.

Low travel spend was a big headwind in the second quarter and the better part of last year. Covid-19 vaccination campaigns have resulted in reopening travel destinations as more people once again hit the roads and the airwaves. A pick up in travel spend in the third quarter could be on the cards, which should positively impact revenues.

On the flip side, operating expenses are believed to have edged higher in the quarter. Visa is believed to have stepped up its investments for marketing and key initiatives as it looks to revitalize its growth opportunities with the reopening of the global economy.

Additionally, the focus will be on the payment processor cryptocurrency business. In recent days the company has confirmed that more than $1 billion worth of cryptocurrencies have been spent by consumers on goods and services through its crypto-linked cards in the first six months of the year.

The spike in crypto-linked payments comes on the backdrop of the company creating an ecosystem that makes cryptocurrencies more usable like any other currencies. With more than 93% of US consumers planning to use virtual currencies or other emerging payment technologies, Visa could be in for tremendous growth on this front.

Bottom line

Visa is poised to report its third-quarter results having performed in line with market averages. A pick-up in consumer spending patterns following the opening of the global economy should allow the company to post better than expected earnings and revenues. The outcome of the report could be the catalyst to fuel a breakout after a 10% spike year to date.