- American Airlines stock up 20% plus ahead of earnings.

- Wall Street projects higher revenues but net loss.

- Focus is being on capacity levels on domestic and international fleets.

American Airlines Group Inc. (NASDAQ: AAL) will report its third-quarter earnings before the market opens on October 22, 2021. While the report is expected to show significant improvements, especially on the revenue front, the road to profitability looks to be slow as the air travel industry is yet to recover fully.

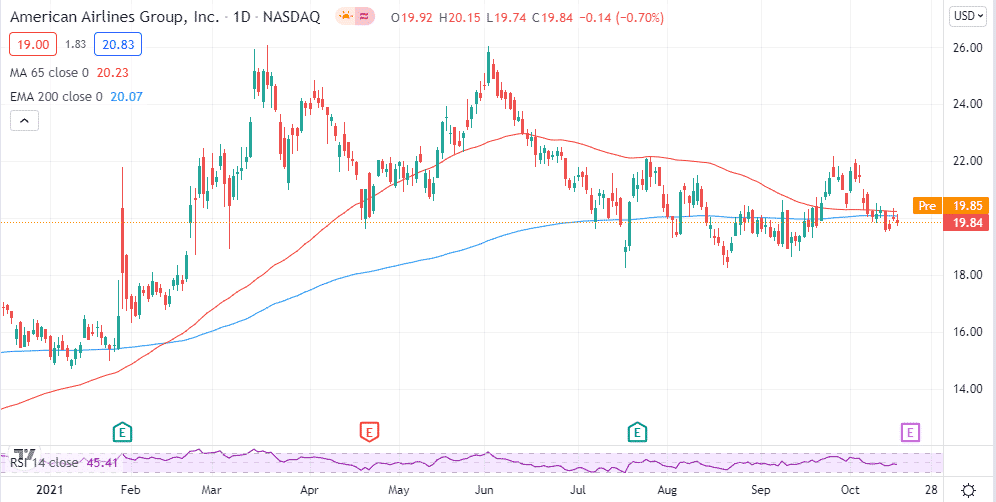

While the airline has been hit hard over the past year owing to COVID-19 restrictions, there is optimism that things are starting to look up. The stock is already up by about 24% year to date as investors remain confident that the crucial class revenue stream will rebound swiftly.

A move by the US government to allow all fully vaccinated passengers to board airplanes starting November 8 all but affirms the improving outlook in the air travel business. A rebound of American Airlines’ international service will be key for the airline to bounce back to profitability.

However, the ever-growing risk of a surge in oil prices threatens to derail the airline prospects of bouncing back to profitability. Oil prices have rallied to seven-year highs, all but triggering runaway inflation which could significantly hurt the air travel business.

Q3 earnings expectations

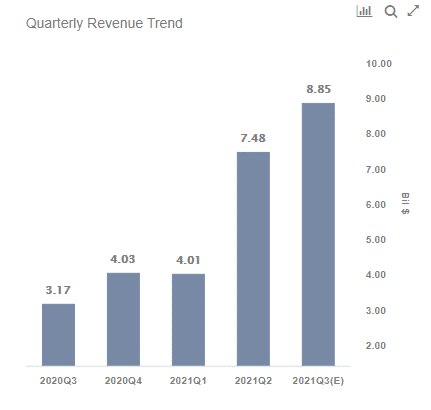

Wall Street expects American Airlines to post a significant improvement in revenue, keeping up with the trajectory that started in the second quarter. Analysts expect revenue to land at $8.9 billion, which would be the best performance since the first quarter of 2020 while representing a 180% year-over-year increase.

Such a feat would mostly be as a result of the rising passenger numbers. However, cargo revenue is believed to have taken a hit. The company delivered an 87% increase in revenue from the first quarter to $7.5 billion in the second quarter.

Amid the significant revenue increase, the airline is still expected to report negative earnings but an improvement from the second quarter, where it posted a net loss of $1.4 billion. Wall Street projects a net loss of $890 million in Q3.

Loss per share in Q3 is expected at $1.07 up 79% from the same quarter last year and an improvement from a loss of $1.69 a share delivered in the second quarter.

What to look out for

When American Airlines delivered the second-quarter results, management reiterated the strides in reshaping the network and simplifying the fleet. Additionally, it took additional efforts to make the cost structure more efficient. Consequently, it will be interesting to know the kind of impact the strides have had on the company’s performance.

While the airline did indicate it expects third-quarter capacity to be down by about 15% to 20% in Q3 compared to the third quarter of 2019, it would be a significant improvement from the third quarter of 2020.

The airline had also indicated that it expects its third-quarter revenue to be down by about 20% compared to the third quarter of 2019. This will be a significant improvement compared to the same levels last year at the height of the pandemic.

Additionally, the airline had indicated plans to operate more than 150 new routes in the summer, including new destinations in Miami, Austin, Texas Orlando, Florida. Plans to fly more than 90% of domestic seat capacity and 805 of international seat capacity should have a significant impact on the revenue base.

Bottom line

American Airlines has started recovering from the shocks of COVID-19 as air travel once again shows signs of improvement amid the aggressive vaccination campaigns. The airline is expected to post better results attributed to the increased capacity of its planes.

Additionally, a cost-cutting measure implemented in the previous quarter should significantly impact the quarterly results. A better than expected Q3 report could be the catalyst to cause the stock to move higher after the 20% plus rally year to date. The stock is currently trading at a discount going by the trailing price to earnings multiple of 2.