- Amazon stock up 4% year to date ahead of the Q3 report.

- Q3 Earnings and revenue are expected to be above estimates?

- Focus on supply chain issues on the ability to fulfill customer needs.

- Cloud units are on the spot as corporations upgrade IT infrastructure.

Amazon.com, Inc. (NASDAQ: AMZN) is scheduled to report its third-quarter results after market close on October 28, 2021. While the expectation is high that the e-commerce giant will deliver better-than-expected results, supply chain bottlenecks might as well have affected its operations in the quarter. Additionally, investors will want to know what the company intends to do to fulfill customers’ needs heading into the busy holiday season.

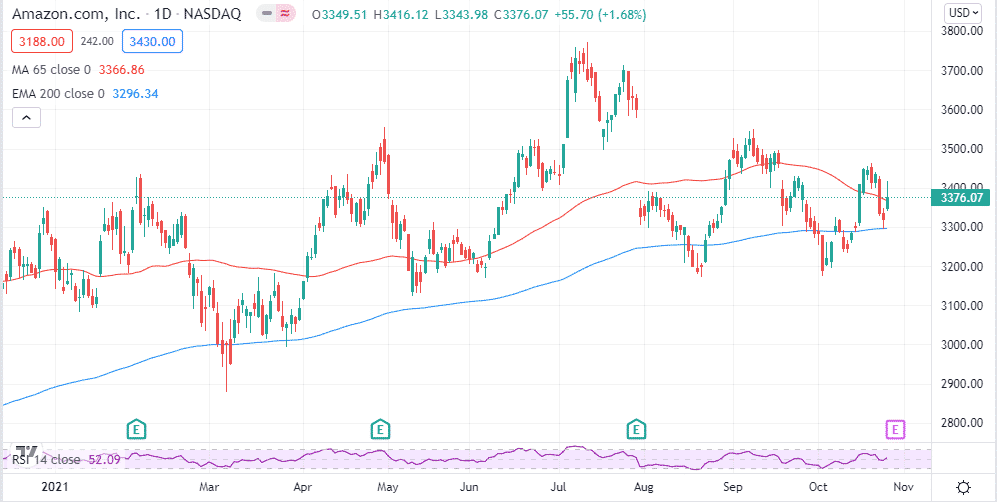

The tech giant stock has underperformed the overall market compared to the impressive run recorded at the height of the pandemic. The stock is up by just 4% compared to 20% plus gain for the S&P 500. In addition, the stock is down by about 10% from all-time highs. It’s been in consolidation in recent months.

Consequently, a solid earnings report is all that is needed if an investor’s sentiment is to edge higher and fuel a rally from recent lows. Amazon stocks sentiments have taken a hit on growing concerns over the impact of supply chain disruptions worldwide.

The opening of the global economies and the easing of COVID-19 restrictions is another factor that could have taken a toll on AMZN operations. The company was on a roll last year as consumers were forced to do shopping online. Fast forward, the openings have meant people can visit their favorite stores instead of depending on e-commerce platforms like Amazon.

Q3 earnings expectations

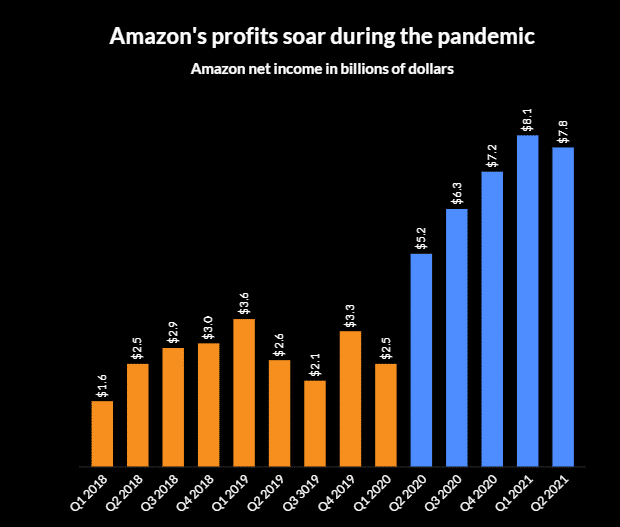

Wall Street expects Amazon to deliver revenue of $111.85 billion for Q3 representing a 16.3% year-over-year increase. In contrast, the company delivered net sales of $113.1 billion in Q2, representing a 27% year-over-year increase.

The decline in revenue sequentially affirms the potential impact of supply chain issues as well as slow growth amid the lifting of COVID-19 restrictions. Management on its own had also projected year-over-year growth of between 10% and 16% at the start of Q3. Amazon is likely to be hurt by tough comparisons heading into the year-end.

In addition, analysts expect the e-commerce giant to deliver an EPS of $8.92, a decline from earnings of $12.37 delivered the same quarter last year. It will also be a decline considering that the company delivered an EPS of $15.12 in the second quarter.

What to look out for when Amazon reports

At the height of the pandemic, Amazon stock surged by more than 90% as the company delivered record revenue and profits. While the momentum appears to have cooled off in recent months, investors will want to know what the company is doing to ensure the growth does not tank significantly. The market will want to know if the market share gains are here to stay.

Amazon has been one of the biggest beneficiaries as people were forced to work and learn from home amid the pandemic-induced restrictions. Its cloud solutions have attracted strong demand waiting to see if the momentum continued in the third quarter.

Amazon Web Services cloud-based solutions have also elicited strong demand as corporations sought to upgrade their IT infrastructure. Consequently, investors will want to see the run rate in the cloud division that is emerging as a key driver of bottom-line considering Amazon’s market-leading position in the sector.

Bottom line

Amazon finds itself in a precarious position, having benefited from the pandemic-driven growth last year. With the re-opening of the global economies, the pandemic has become a headwind that is driving costs higher. Supply chain issues have also posed significant headwinds. Additionally, the company finds itself in a tough comparison period compounded by slowing growth.

Therefore, the Q3 earnings report will be pivotal if Amazon’s sentiments in the market are to improve. An upbeat report could send the stock higher after a10% pullback from all-time highs. Similarly, disappointing results can only fuel further sell-off.