The Nvidia stock price jumped by 9.18% on Tuesday as the overall market rebounded. The shares are trading at $264.95, which is about 27% above the lowest level this week. It is the biggest semiconductor company with a total market cap of $666 billion.

Nvidia earnings review

Nvidia and other semiconductor stocks have been under intense pressure in the past few months as investors worry about growth. The closely watched iShares Semiconductor ETF (SOXX) that tracks the biggest names in the industry has declined by over 12% from its highest point this year.

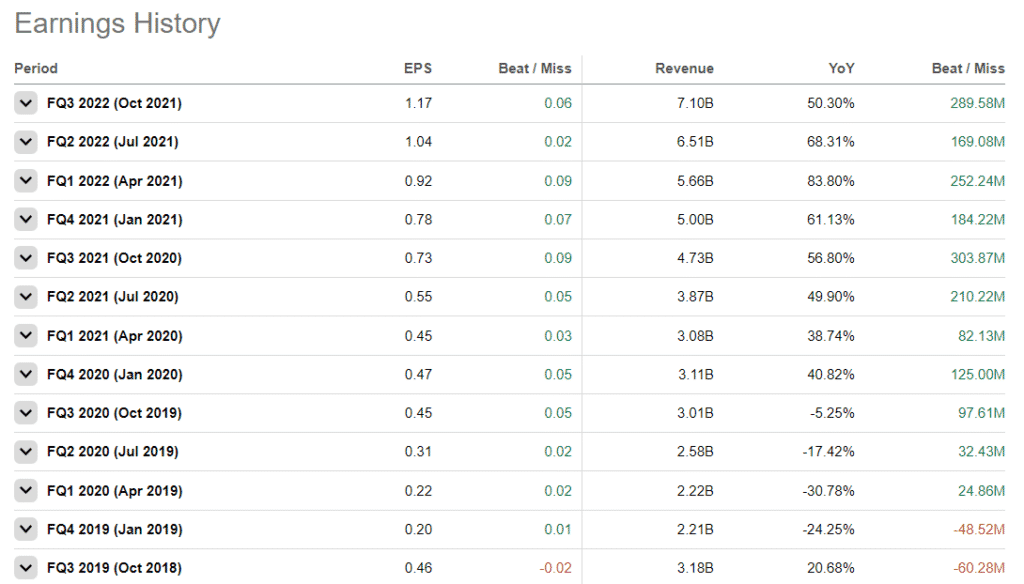

Nvidia will get a chance to justify its hefty valuation premium on Wednesday when it publishes its quarterly earnings. Analysts expect the company’s results to show that its revenue jumped to $7.43 billion in the fourth quarter because of the holiday season. Nvidia made $7.14 billion in Q3 and $5 billion in the same quarter in 2021.

While the cost of doing business is rising, analysts expect that Nvidia’s earnings per share (EPS) rose to $1.22 in the quarter. Still, as shown below, there is a likelihood that the company’s earnings will be better than estimates. The last time that Nvidia missed the projections was in 2018.

Areas to watch in NVDA earnings

Investors will be looking at several things in this release. First, they will be looking at the firm’s subscription product known as GeForce Now. In the past few years, this product has seen spectacular growth as more people embrace gaming. In the past quarter, the service had over 14 million members.

By segment, analysts will focus mostly on the gaming sector, which is pivotal for Nvidia’s growth. In the past quarter, the gaming section had revenue growth of 42% to $3.2 billion. Now, with more people going back to work and school, analysts will be watching the gaming trends.

Second, in addition to gaming, the market will focus on its pro visualization division, whose revenue rose by 11% to $577 million. The visualization arm is important because Nvidia wants to be a leading player in the Omniverse industry. One of its products in this segment is Omniverse Replicator which uses big data to train robots.

Finally, the Nvidia stock price will react to the company’s data center business. The segment’s revenue rose by 24% in the third quarter. Its revenue was $2.9 billion.

Is Nvidia a good investment?

Nvidia’s stock price has done well for the last several years. The shares have jumped by over 900% in the past 5 years as it has outperformed the S&P 500.

However, this performance has left the company highly overvalued, considering that it has a forward PE multiple of 55. The S&P 500 has a forward PE ratio of less than 20, meaning that Nvidia is trading at a premium.

Therefore, the stock will keep rising if Nvidia only can prove that it can sustain its growth in the coming years. As such, while NVDA is a good company, it is a high-risk investment at these valuations.

Nvidia stock price forecast

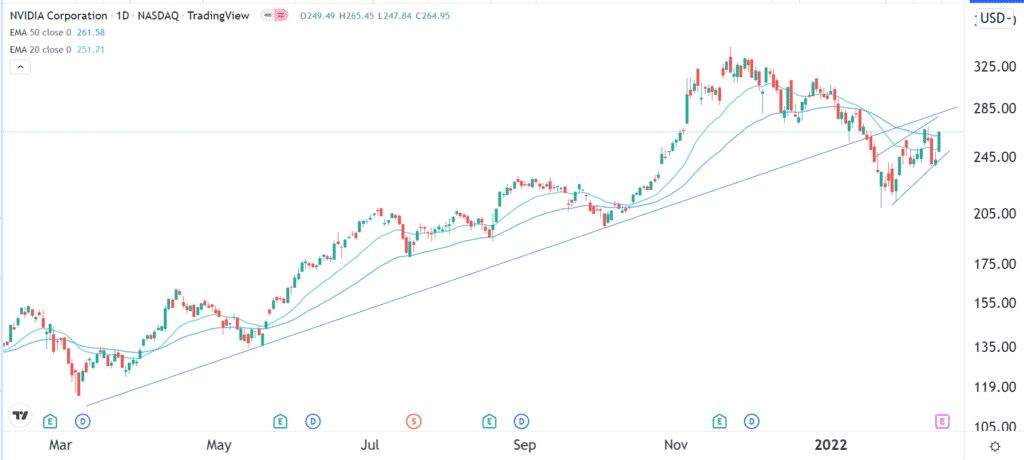

The Nvidia stock price has been in a bearish trend in the past few weeks as it has moved to a correction phase. The market is below the ascending trendline that is shown in blue. At the same time, the stock is trading along with the 25-day and 50-day Moving Averages (MA).

It has also formed what looks like a bearish flag pattern. Therefore, there is a likelihood that the NVDA stock price will decline sharply after earnings.

This article represents the views of the author. Growth stocks are highly speculative assets, and the author will not be held liable for any losses.