- Zoom stock down 28% ahead of Q3 report.

- Q3 earnings and revenue to show decelerating growth.

- Focus to be on the impact on changing mobility patterns.

Zoom Video Communications Inc. (NASDAQ: ZM) is scheduled to deliver its Fiscal Q3 2022 results after the market close on Monday, November 22. The company heads into the earning session amid growing concern that pandemic era driven growth is over.

The stock’s sentiments have taken a significant hit ever since the global economy reopened and people started going back to school and offices. Demand for video offerings is no longer that high compared to when the pandemic triggered lockdowns and travel restrictions.

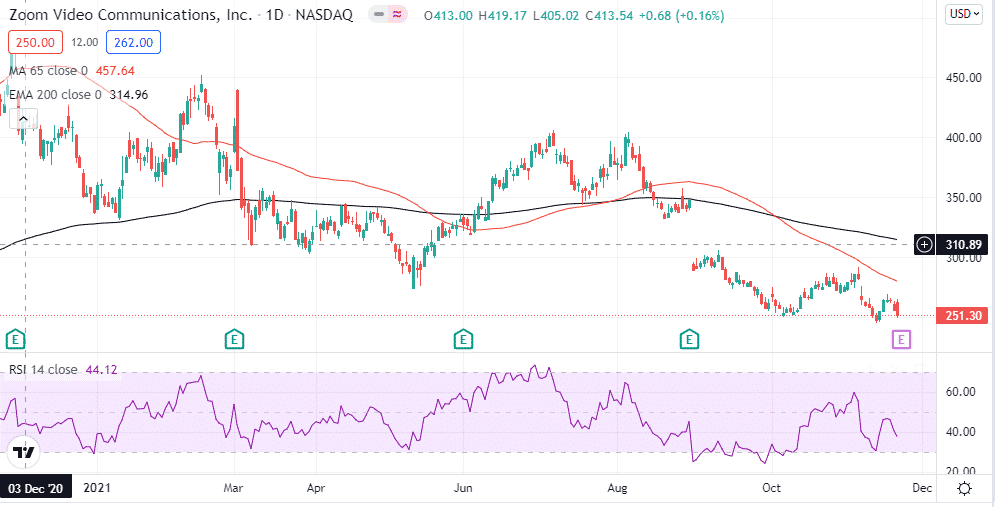

The stock has underperformed the overall market going down by about 28% year to date ahead of the earnings. In contrast, the S&P 500 is up by more than 25% year to date. In addition, Zoom Video Communications has shed more than 40% in market value from highs registered at the start of the year. In contrast, the shares surged fivefold last year.

Zoom Video Communications underperformance does not come as a surprise. Accelerated vaccination campaigns worldwide have triggered increased market concerns over the company’s ability to maintain the impressive growth rate registered last year.

The company has sought to affirm its growth prospects by diversifying its revenue streams with an expansion into the contact center space.

Q3 earnings expectations

Wall Street expects Zoom to deliver a year-over-year increase in earnings on a significant increase in revenues. Earnings is expected to land at $1.09 a share, a 10.1% improvement from earnings of 99 cents a share delivered the same quarter last year.

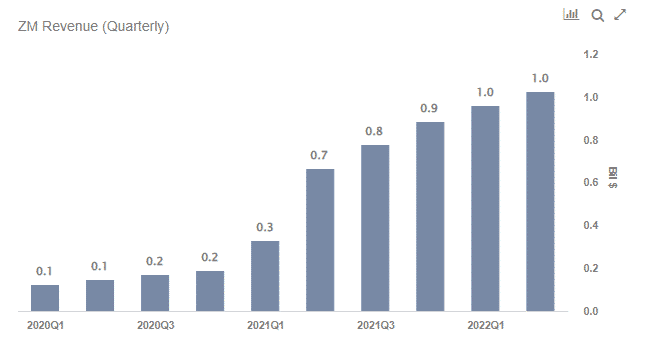

Revenue, on the other hand, is expected at 1.02 billion compared to $777 million delivered the same quarter last year, representing a 31% year-over-year increase. The revenue growth rate has been decreasing in the recent quarter, going by a 191% increase in the first quarter and 54% in the second quarter.

What to look for when Zoom Communication reports

When Zoom reports focus will be on whether the company will achieve a billion or more in revenue for the second time in its history. While the company could post revenues of $1.02 billion, representing a much slower growth rate year-over-year, it will be interesting to see if customers are taking up new offerings.

Zoom phone is one of the offerings that continue to affirm Zoom long-term and growth metrics. The offering registered triple annual recurring revenue growth last quarter. Additionally, investors will pay close watch to the enterprise market where further gains are expected going by contracts with over $100,000 annual that the company now boasts.

While the stock has underperformed amid growing concerns about Zoom Video Communications long-term prospects amid waning growth metrics, the focus will be on the short-term outlook. While the company did warn in the second quarter of the impending impact of people returning to normal mobility patterns, it will be interesting to see the kind of impact such changes will have on the Q4 outlook.

Amid the concerns, there is still the probability of the company delivering a solid Q4 outlook as long as consumers and businesses stay engaged on the platform. Wall Street expects the company to project over $4 billion for the fiscal year, representing a 51% year-over-year increase.

Bottom line

Zoom Video Communications is scheduled to report third-quarter results amid waning confidence about short-term growth. As more people transition back to working at the office, the company’s pathways to the impressive growth rate registered last year are looking gloomy by the day.

Consequently, a disappointing earnings report could be the catalyst to accelerate the sell-off after the recent pullback. Similarly, a better-than-expected report that affirms underlying growth could avert the fears and strengthen investors’ sentiments, a move that could result in the stock rerating higher.