- Q2 earnings and revenues expected to top estimates

- Prime subscriptions on the spotlight

- Focus on growth on Amazon Web Service

- Smart devices portfolio growth

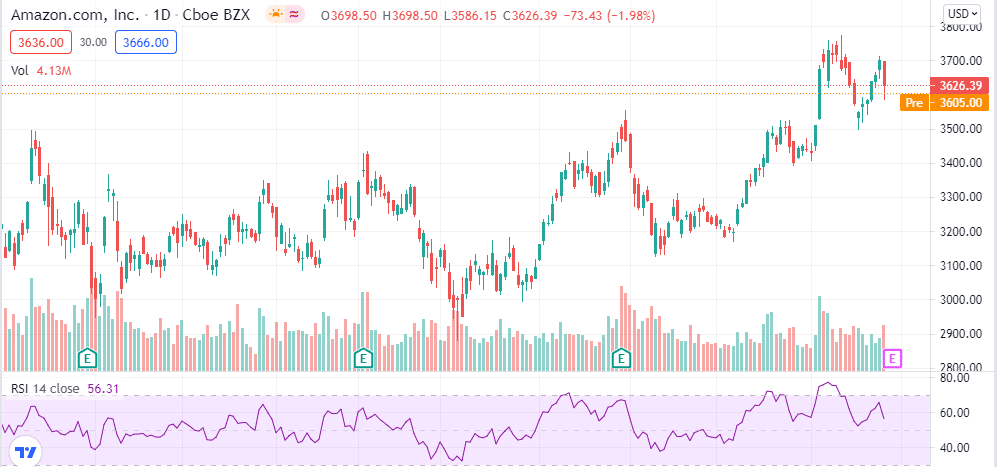

Amazon.com, Inc. (NASDAQ: AMZN) will report its second-quarter results on July 29, 2021, amid heightened revenues and earnings beat expectations. The company has been on an impressive run over the past year, benefiting from booming online sales and growth on the cloud unit.

The stock is up by about 10% year to date after a stellar performance that saw it rally by more than 70% in 2020. While the upward momentum has cooled off, the company’s growth metrics and long-term prospects remain intact.

The company heads into the earning session, as it expanded the distribution network to enhance online sales. Prime enabled fast delivery and robust grocery delivery services are also fuelling Amazon’s e-commerce business. During the quarter, the tech giant expanded its garage grocery delivery service to every location in the country, expected to have had a significant impact on revenues.

Q2 earnings expectations

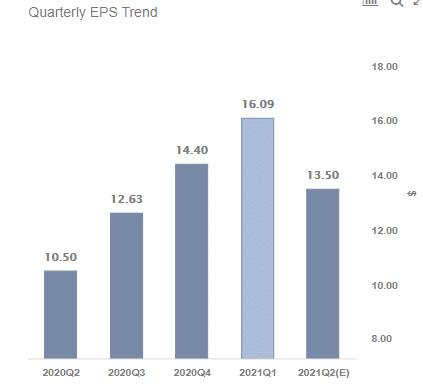

Wall Street expects Amazon to deliver a 29% increase in Q2 sales to highs of $115.1 billion compared to $88.9 billion reported last year in the same quarter. The company, on its part, is projecting sales of between $110 billion and $116 billion. In the first quarter, revenues were up 44% to $108.5 billion, topping consensus estimates of $104.5 billion.

A 28.50% increase in earnings per share to $13.50 could be in the offing according to analyst’s expectations. Management also expects operating income to range between $4.5 billion and $8 billion.

What to look out for?

Amazon has been one of the biggest beneficiaries of booming online sales as the pandemic forced people to order items and have them delivered at their doorsteps. The expansion of the distribution network allowed the company to strengthen its logistics network, therefore, reach the wider target market.

Therefore, robust prime-enabled fast delivery and grocery services should have benefited the company’s top line in Q2. When the company reports focus will be on the Prime Free One Day service, Amazon Fresh, and two-hour delivery service that is increasingly fuelling sales growth.

The company also held the Prime Day event in a number of countries expected to have a significant impact on revenues. Robust prime day sales and momentum among small and medium sellers should have a significant impact on top-line numbers.

In addition to the core e-commerce business, the market will also analyze the traction the company is gaining in the streaming business. Solid momentum across Prime video in recent quarters has been encouraging, waiting to see if it continued in the quarter.

Amazon has expanded its original content slate on Prime Video as it looks to rival other streaming giants. A revamped content library is expected to drive prime subscription numbers. Gains from the Amazon Music segment could also come into play. The company has made Amazon Music HD available to all Amazon Music Unlimited subscribers.

The Amazon Web Services portfolio will also be in the spotlight. The company has affirmed its competitive edge in cloud offerings. Amid the increased digitization spree worldwide, AWS is expected to benefit from Q2 results.

In the recent past, the company has strengthened the AWS segment with new products to attract more customers. For starters, Amazon DevOps Guru is now easily accessible. Amazon FinSpace for simplifying, preparing, and analyzing financial data has also been made available.

The market will also pay close watch to the smart devices portfolio led by the Echo smart speakers. During the quarter, it launched Echo show devices named Echo 8 and Echo Show 5. It also unveiled the Fire Kids tablet for kids.

Bottom line

Amazon is poised to report at a time when it is firing on all angles, right from e-commerce to content streaming and Cloud offering. Its diversified revenue base is further affirmed by its smart device segment, all of which are expected to affirm top-line growth.