The Adobe stock price declined by more than 4% on Tuesday’s extended session as investors reflected on the company’s quarterly results. The stock declined to $619, which was about 9% below its all-time high. This drop brought its total market capitalization to about $300 billion.

Adobe earnings

Adobe is a fast-growing technology company that has reinvented itself over the years. In the past, the company was known for selling its software through DVDs. Today, the company makes a bulk of its revenue through subscriptions.

Adobe released its quarterly results on Tuesday after the regular session. The results were generally better than what most analysts were expecting. Its revenue rose by 22% in the quarter to $3.94 billion. Its earnings per share rose to $2.52.

The biggest catalyst for the company was its digital media division, which rose by 23% to more than $2.87 billion. Its new digital media business had an annual run rate of more than $11.67 billion while its creative revenue rose to more than $2.37 billion. Its Document Cloud business also did exceptionally well while the Digital Experience division rose to more than $985 million.

These results showed that Adobe is firing on all cylinders as more companies use its services. It has also benefited from the relatively small businesses that are using its services. For example, many YouTube creators are known for using its software in video and photo editing.

Unlike most SAAS companies, Adobe has a relatively low churn because it provides essential services to businesses of all sizes. Also, while the company faces strong competition, most developers are already used to its ecosystem.

Still, the Adobe stock price declined after the earnings for two reasons. First, the stock has already been in a strong bullish trend. As such, the shares declined as investors sold the news of the strong results. Second, the company’s shares declined because of worries about future growth.

Is Adobe a good investment?

From a fundamental perspective, Adobe is a good stock to invest in. The company’s creative cloud has a strong market share in its business. Most creators regularly use one of its many products like PhotoShop and InDesign to design their products.

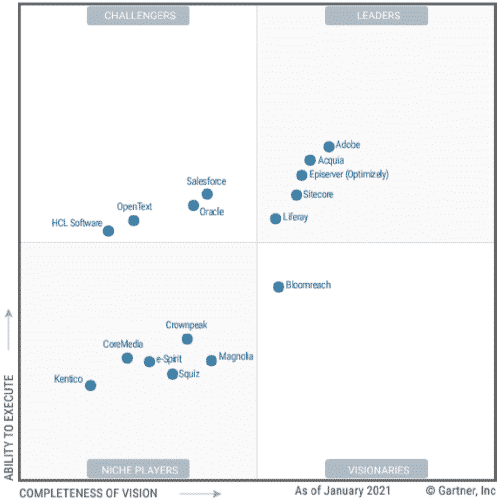

At the same time, the company has grown its market share over the years. For example, as shown below, the company has a leading share in Digital Experience platform by Gartner.

Gartner report on digital experiences

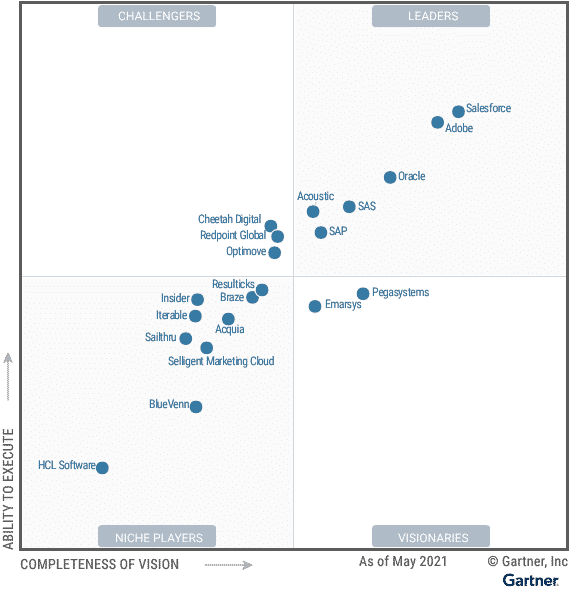

At the same time, the company is the second in terms of multichannel marketing hubs. As shown below, it comes second to Salesforce. This is notable since the company launched the division a few years ago.

Gartner quadrant on multichannel marketing hub

Meanwhile, analysts are generally optimistic about the Adobe stock price. Data compiled by WeBull shows that there are 29 analysts who cover the company. Of these, 51% have a buy rating on the stock while 34% have a strong buy rating. The rest have a hold rating. The most optimistic analysts are from Argus, who expect the stock to rise to $765.

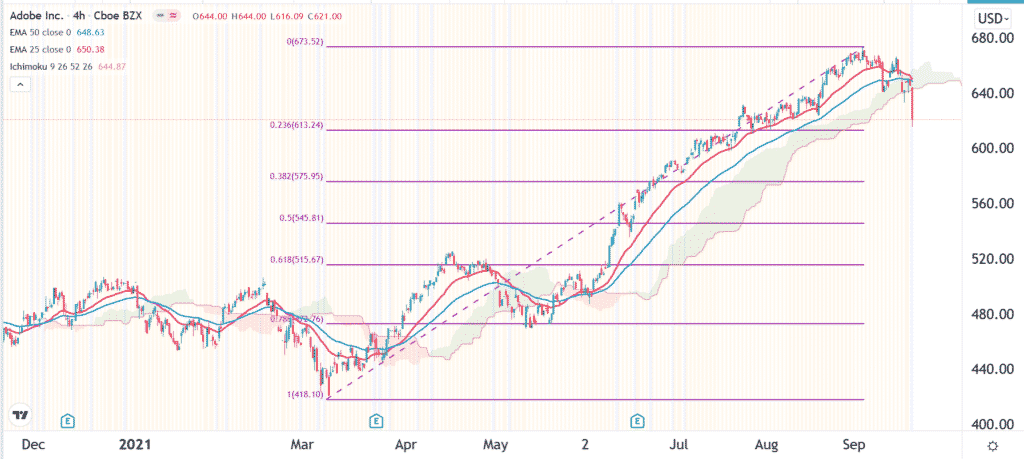

Adobe stock price forecast

The four-hour chart shows that the ADBE stock crashed by more than 4% after the impressive third-quarter results. It moved close to the 23.6% Fibonacci retracement level at $613. Also, it managed to move below the 25-day and 50-day moving averages and the Ichimoku cloud.

It also seems like it has formed a double-top pattern. Therefore, the stock will likely keep falling as bears target the 38.2% retracement level at $575. In the long-term, however, the shares will likely keep rising, supported by the strong growth.