High investor and consumer interest in electric vehicles and alternative energy sources is a central theme. Lithium is increasingly taking over as a key component in batteries over lead-acid batteries, conversely fuelling strong demand for some stocks. Albemarle Corporation (NYSE: ALB) is a leading name, poised for tremendous growth amid the EV batteries revolution.

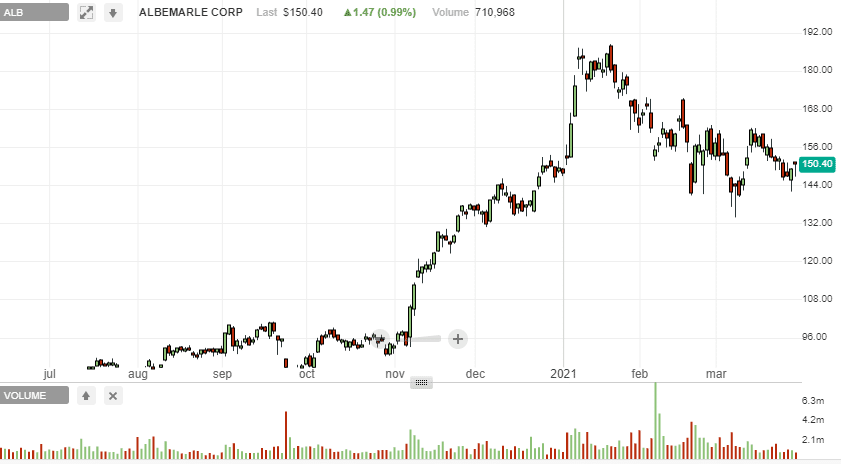

Price analysis

The stock has more than doubled in value, over the past 12 months, after a 150% plus rally in 2020. While the stock has pulled lower from record highs, there is no disputing that the pullback is a minor correction. The Charlotte-headquartered firm Albemarle is well-positioned to bounce back as the correction in the overall market comes to an end, and investors note the tremendous opportunities up for grabs.

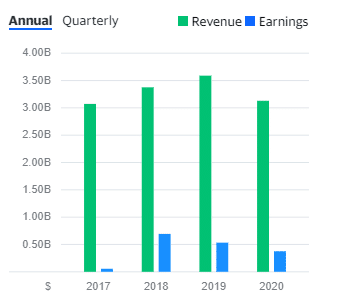

Solid financial results

The specialty chemical play is fresh from reporting solid Q4 and full-year financial results that affirm growth in the core business amid a challenging business environment owing to COVID-19 disruptions. According to the Chief Executive Officer, Kent Masters, the company is generating high returns in its key business segments led by lithium and Bromine business. The focus has also shifted towards keeping operational costs while also improving operational efficiency.

Net sales in Q4 totaled $879.1 million, down by $113.5 million from 2019 levels. The decline can be attributed to lower results in the catalysts and lithium business segments. However, the declines were offset by improvements in the bromine and other business segments. Adjusted net income was also down by $73.6 million to $221.1 million due to lower net sales offset by productivity and cost improvements.

Bromine Specialty revenues were up 8% to $263.4 million. The catalysts unit posted a 31% decline in revenues that totaled $195.7 million.

During the year, the company was able to cut its operational costs by $80 million. It expects cost savings to top $120 million by 2021.

Likewise, revenues are expected to average between $3.2 billion and $3.3 billion, with adjusted EBITDA averaging $810 to $860 million in 2021.

Albemarle prospects

A decline in revenues and adjusted net income does not come as a surprise, given the impact of the COVID-19 that took a significant toll on industrial operations. Its long-term prospects are looking increasingly bullish with the pandemic situation being brought under control given the lifting of the lockdown restriction.

The fact that the stock fared well amid the disruptions triggered by the pandemic underscores the strengthened investors’ confidence about its long-term prospects. Soaring interest in EVs is the reason the company is well-positioned for tremendous expansion in the future.

As a chemical company, Albemarle has made a name for selling a key material used in electric vehicles, batteries, bromine specialties, and catalysts. It is one of the world’s largest producers of the compound commonly used in powering EVs.

Albemarle Lithium revenues have grown steadily from around $3.1 billion in 2017 to the highs of $3.6 billion in 2019. The growth trend is not expected to ease anytime soon, given the strong demand for the compound highly needed for electric power vehicles and other devices.

Growth opportunities

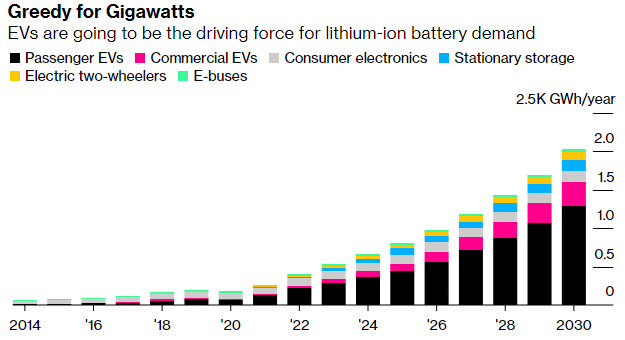

Electric vehicle volumes jumped 43% in 2020 to highs of 3.24 million units. The global market share of EVs increased to 4.2% from 2.5% in 2019. This year, EV volumes are expected to reach record highs of 4.6 million units, with most revenue opportunities coming from the US and China.

Strong interest in EV cars can only translate to one thing, a tremendous rise in demand for lithium, the key metal used in powering electric vehicle batteries. Given the expected demand jump, Albemarle might be approaching an inflection point.

While lithium accounts for nearly 40% of its total sales, its business empire is also well-diversified. The company also manufactures highly engineered specialty chemicals. Its advanced materials, bromine specialties, and refining solutions are also expected to generate significant value going forward.

Besides, the company does not rely on Lithium sales to manufacturing companies for sales. Its customers come from various industries. Some of its biggest customers come from petroleum refining, consumer electronics, and energy storage. It also generates orders from construction and the automotive industry.

Valuation

The stock is currently trading with a price-to-earnings ratio of about 40, well above its historical average of 15 — the high P/E signal the stock is overvalued at current levels. A forward price to earnings growth of 3.5 also affirms the overvaluation concerns, given that the industry average stands at 1.

While the metrics signal overvaluation, that should not be a point of concern. Albemarle is operating in a sector with tremendous expansion opportunities. With EVs accounting for just 4% of the total auto sales, there is room for growth.

The expected expansion in electric vehicle sales is one factor that affirms the company’s growth and long-term prospects. As EV car sales and interest increase, so does the demand for lithium. The company is well-positioned to meet the interest with the essential supplies conversely generate significant sales from the same.

Bottom line

Albemarle is well-positioned to benefit from an increase in interest and sales for EVs. With supply expected to struggle to meet demand over the next decade, the company should see its revenues surge significantly on an uptick in prices.

Management forecasting a 6% increase in revenue in 2021 affirms the expected growth given that industrial activity is only but picking up in the aftermath of the pandemic.

Valued at over $250 billion as of last year, The EV industry is projected to clock record highs of $5 trillion by 2030. The rapid expansion should benefit not only electric vehicle manufacturers but also producers of the much sought-after compound.