The International Business Machines (NYSE: IBM) stock price has been under pressure recently as investors reflect on the company’s initiatives. The stock is trading at $130, which is about 9.10% below the highest level this year.

IBM earnings preview

IBM, the giant technology company, will be among the many companies that will publish their results this week. Other firms to watch will be giants like Tesla, Microsoft, Johnson & Johnson, Intel, and Kimberly-Clark.

Analysts expect that the company’s results will paint a picture of a company that is continually evolving its business. Data compiled by SeekingAlpha shows that the company’s revenue came in at $15.89 billion in the fourth quarter of 2021. The revenue will be lower than the $17 billion it delivered in the previous quarter.

In terms of profitability, analysts expect that the company had an earnings-per-share of $3.29 in the quarter. It had an EPS of about $2.52 in the third quarter.

There is a likelihood that IBM’s results will be better than what analysts expect. Besides, it has surpassed their revenue expectations in the past three straight weeks.

Analysts will be watching the performance of the company’s cloud computing platform, which has become pivotal to IBM’s business.

IBM turnaround

IBM, once the biggest tech company in the world, has gone through a difficult patch in the past few years. It was late to the cloud computing industry that is currently controlled by the likes of Microsoft and Amazon. Other companies quickly gaining market share in the industry are Alphabet and Alibaba.

IBM has benefited from its long-standing relationships with some of the biggest companies in the world. For example, it has served some of the biggest banks and insurance companies globally for decades.

In the past few years, IBM’s management has been attempting to turn around the business. For example, the company acquired Red Hat, a company that offers open-source technology products. The deal was valued at $34 billion.

The turnaround continued in 2021 when the company exited its large but low-margin technology solutions business. The new company, Kyndryl, is now a publicly-traded company valued at about $5 billion.

Is IBM a good investment?

And last week, IBM announced that it would sell its Watson Health business for $1 billion. That was an important deal for IBM, considering that it had invested billions of dollars more in the business. The sell to a private equity company was a sign that the company was scaling down its artificial intelligence ambitions.

The IBM stock price is trading at $129, and analysts are optimistic that it will soon bounce back. According to Marketbeat, the average estimate of the stock is at $148, which is a few points above the current level.

Those at Credit Suisse expect that it will rise to about $172 while those at Jefferies and Goldman Sachs expect it will rise to $160 and $140, respectively. According to TipRanks, the average estimate for the stock by a diverse group of analysts is at $150.

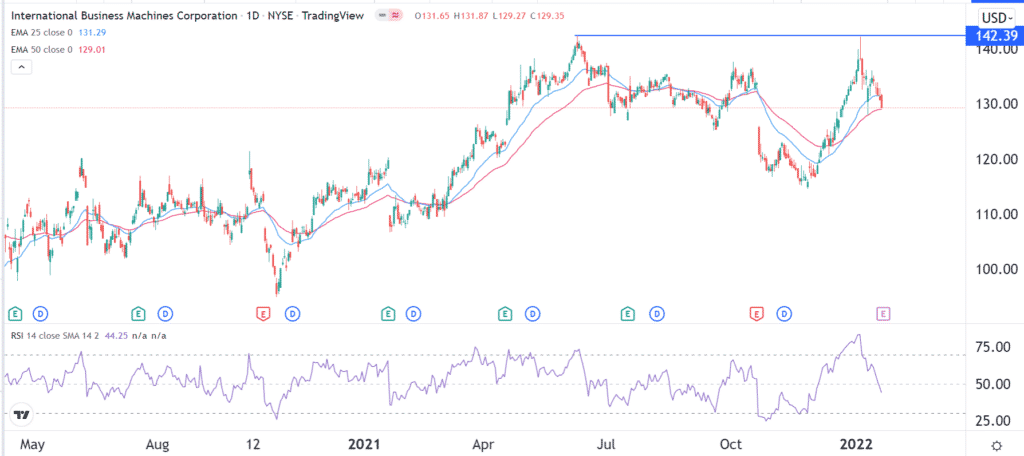

IBM stock price forecast

The daily chart shows that the IBM stock price found a strong top at about $142 in 2021 and this year. It has moved between the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved from the overbought level to the current 44. It is also a few points below the key support at $130.

Therefore, the stock will likely keep falling after its quarterly results. If this happens, the next point to watch will be at $120.