Overview

- Dr. Yan Li, the CEO of Niu Technologies (NASDAQ: NIU), said that NIU 2.0 strategy was in full swing during the most recent earnings call. The key pillars of the strategy are to expand the company’s product portfolio and expand the reach of its retail sales network. The latter is critical, especially noting that a substantial chunk of the NIU’s sales occurs in China.

- Yan Li and his team put NIU 2.0 strategy into play starting early 2020, and the results are noticeable. During the year, NIU added four new electric bicycle models to its product portfolio in China. Also, the company added 150 new products to its accessory portfolio both in China and internationally.

- NIU’s international market is now also larger. The company added 46 countries to its market coverage despite the challenges wrought by COVID-19. No wonder the company recorded substantial sales growth for the full year of 2020.

Q4 2020 performance shows NIU 2.0 strategy is working

A constant theme during the Q4 2020 earnings call was that Niu Technologies posted impressive numbers in sales and revenue. Niu Technologies’ e-scooter sales jumped by 41.6% year-over-year in the fourth quarter, and revenue topped $103 million, representing a 25% increase compared to the year 2019.

Full-year performance was also on song as NIU divulged that its scooter-sales grew by 42.8%, which brought full-year revenues to the tune of $373.74 million. This implies a 17.7% year-over-year increase. Nonetheless, the revenue increase could not manage to raise NIU’s full-year net income above that of the previous year. NIU reported $25.79 million in full-year 2020 net income as opposed to $29.07 million for 2019.

China remains NIU’s primary market, where the company sold about 570,000 units of the 600,000 units sold in 2020. However, Yan Li said during the earnings call that full implementation of the NIU 2.0 strategy should open up more space for units sold internationally.

Li further divulged that channel expansion is not their sole strategy for expanding international sales. He said the company is showing great resolve towards achieving potential B2B engagements. Niu Technologies is now in agreement with major scooter-sharing operators to provide them with scooters.

About Niu Technologies

NIU is a leader in the global e-scooters sector with a particular focus on enabling smooth urban mobility. The company is pretty new, but so is the e-scooter industry it serves. NIU is self-contained, taking care of operations from design to selling. Major products under the NIU brand currently in the market are e-scooter series such as NQi, UQi, and MQi, e-motorcycle series such as TQi and RQi NIU Aero – a performance bicycle series. The company has tailored each series to a segment of the market based on the needs.

Besides e-motorcycles, e-scooters, and performance bicycles, NIU offers scooter accessories. They include knee pads, raincoats, backrests, and more. Other accessories fall into the lifestyle category, and they have hats, jewelry, bags, t-shirts, and jeans.

NIU also provides a range of smart services via the NIU app. Users can report theft, request repairs, locate service stations, as well insurance services. Niu Technologies started operations in Beijing, China, in 2014, also this is where it is headquartered. Its international market includes 46 countries and close to 1,500 franchised stores.

If the e-boom holds, NIU’s fundamentals could strengthen

Last year seems to have been the best thing that happened to the e-bike sector because of increased uptake. According to a New York Times report, the rise of the e-bike boom was catalyzed by trends towards sustainability and accessibility and social-distancing regulations that made public transport in crowded vehicles untenable.

Globally, e-bikes sales increased by about 145% in 2020 compared to the previous year. During the same period, sales of all kinds of bikes grew by just 65%. NIU’s management hopes that the boom will continue into Q1 2021 especially considering that the world is not yet ready for post-pandemic life. If the boom holds and NIU’s expansion into international markets goes according to plan, the company is likely to match or even surpass the financials posted in Q4 2020 during this quarter.

During the earnings call, Yan Li revealed that the company’s R&D expenses increased by about $1.53 million in Q4. Most of the funds went to design spend and staff. For this reason, NIU has more products in the R&D pipeline than any other period. The company expects to launch many of the products in the second quarter of this calendar year. NIU stands to gain a massive revenue boost if the product launches coincide with a mature boom cycle.

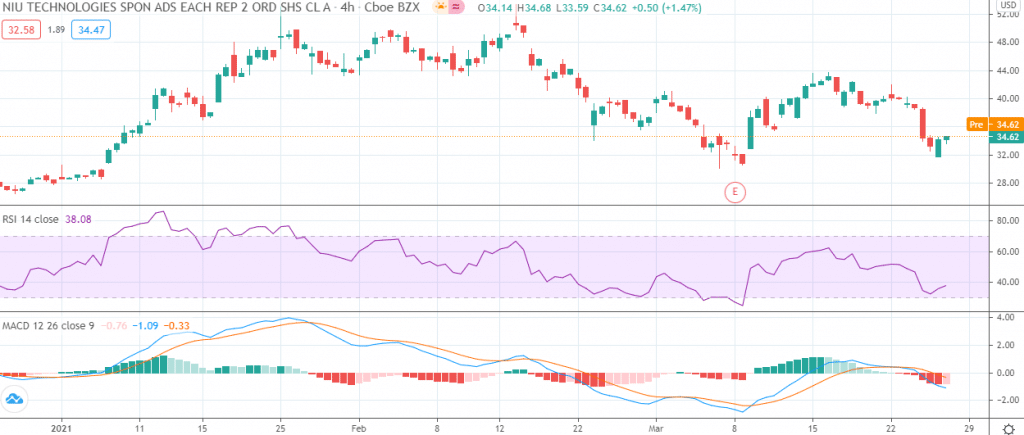

NIU’s technicals are firming

NIU stock is down 7.33% over the past month. Curiously, the stock price softened when the company announced substantial gains in sales and revenues. Just 24 hours after the release of the financial results, the stock declined by 33%. This trend would have been worrying if the stock had not soared by about 278% over the past 12 months.

Perhaps the main reason why the stock fell after the release was management guidance, which seemed downbeat. During the earnings call, Hardy Peng Zhang, NIU’s Chief Financial Officer, said they expect a downtick in revenue for Q1 2021. Zhang explained the rationale for the guidance that China’s operations for the quarter are expected to be interrupted by the Chinese New Year celebrations, which often renders factories shut.

But the technicals are now firming. NIU stock is up 23.49% year-to-date, and the MACD shows a reduction in the selling pressure. Simultaneously, the RSI is starting to climb out of the oversold zone, and a little more push will see the RSI cross the 50-point mark in an uptrend.

Figure 1: NIU stock price

Conclusion

NIU is a long-term value stock, and by the look of things, it is very inexpensive at the moment. The stock has strong fundamental backing, and the technical indicators indicate a turnaround is happening, which is why we recommend NIU as a BUY.