The Airbnb stock price tilted higher on Monday as investors waited for the upcoming quarterly earnings. The shares are trading at $169.66, about 26% above the lowest level this year, giving it a market capitalization of more than $104 billion.

Airbnb earnings preview

Airbnb is the biggest vacation rental company in the world. It has millions of users every month from around the world.

The firm’s business model is simple. It lets anyone list their property on the site, and then it receives a small commission whenever a customer pays.

Like all companies in the hospitality industry, Airbnb and its competitors went through a difficult period in the past few years. The business shrunk dramatically as governments announced Covid-19 protocols. At the same time, the firm suffered as more countries closed their borders.

Therefore, with the world economy reopening, analysts expect that its business will do well. For example, many cities have abandoned most of the measures they implemented in a bid to slow Covid. Similarly, many countries like Australia and New Zealand have announced plans to reopen their borders.

Analysts expect that Airbnb’s revenue declined from $2.24 billion in Q3 to $1.46 billion in Q4 because of the Omicron variant. They also see the earnings per share dropping from $1.23 to a loss of 3 cents.

In addition to the headline figures, the market will be focusing on the number of active users and their quality. Most importantly, the focus will be on the average daily rate (ADR). In the previous quarter, the ADR jumped by 41% to $161 even as the average trip length remained at 28 days.

Further, the balance sheet will be in focus. Airbnb ended last quarter with $7.4 billion in net cash. It also had about $6.3 billion of funds held with its clients and about $1.5 billion in unearned fees.

Is Airbnb a good investment?

Airbnb has had a difficult time as a public company. Its stock remains solidly above where it opened when it went public. But it is also about 22% below its all-time high. Still, in this period, its asset-light business model has seen it outperform many hotel stocks like Marriott and Hilton.

Analysts believe that Airbnb is a good investment because of its strong market share in its industry. While competition from the likes of VRBO, Booking, and HomeAway has increased, it maintains a strong market share. Estimates are that ABNB has a 20% market share in its industry.

Another catalyst for the Airbnb stock price is that demand for its services is expected to do well in the coming years. As people normalize Covid-19, demand is expected to keep rising.

Moreso, cities are expected to reopen this year. As such, people who did not travel in the past two years will start moving again.

The average analyst estimate is that the stock will climb to $192.50, which is above the current $169. Some of the most optimistic analysts are from companies like Credit Suisse and Evercore.

Airbnb stock price forecast

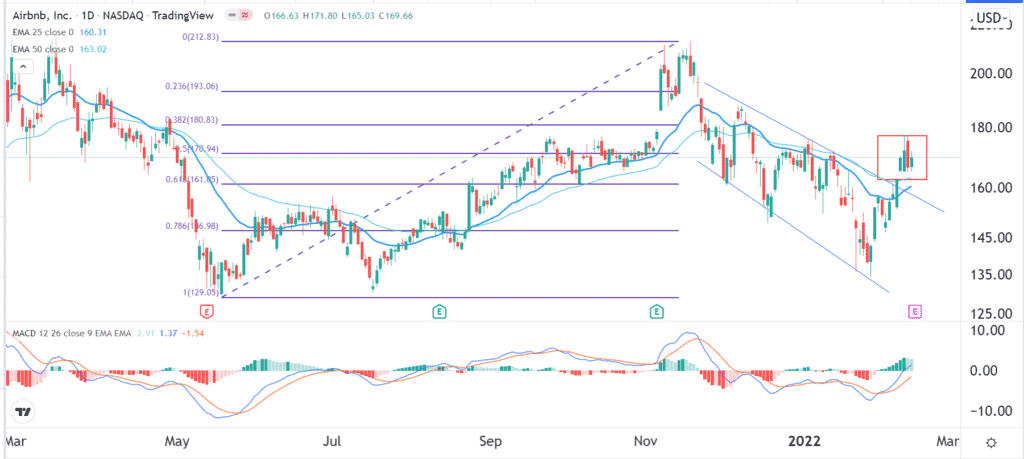

The daily chart shows that the ABNB stock price has bounced back lately. Along the way, the shares have moved above the upper side of the descending channel. It has also moved above the 25-day and 50-day Moving Averages and is slightly below the 50% Fibonacci retracement level.

However, the stock has also formed an island reversal pattern that is shown in red. Therefore, there is a likelihood that it will retreat after reporting its quarterly results.