- Palantir stock up 4% ahead of the Q3 report.

- Palantir to deliver higher revenues but earnings decline.

- Focus on what the company plans to do to bolster the bottom line.

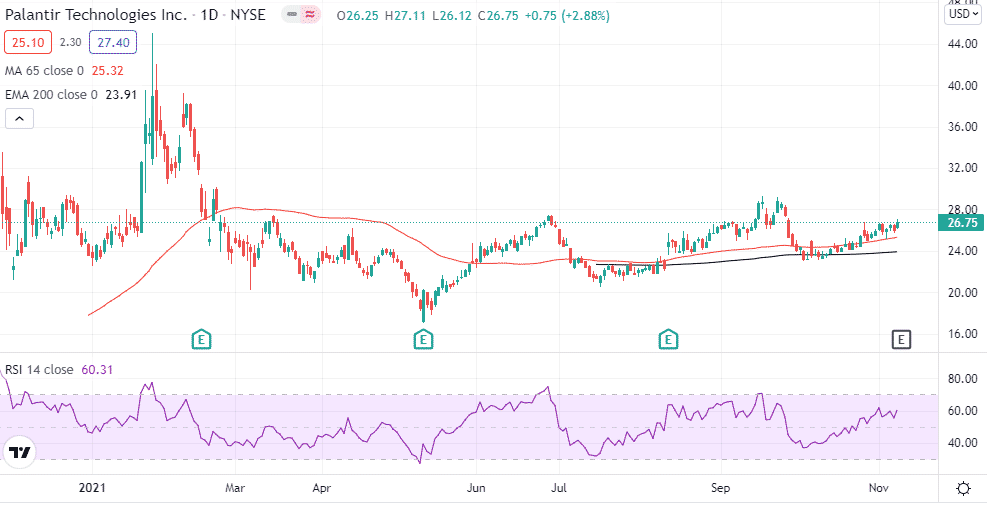

Palantir Technologies Inc. (NYSE: PLTR) is slated to report its Q3 2021 results before the market opens on November 9, 2021. The company heads into the session, having underperformed the indexes for the better part of the year. The stock is up by about 4% year to date compared to 20% plus gain for the S&P 500. Additionally, it is down by about 25% from all-time highs registered at the start of the year.

Founded in 2003, Palantir went public last year at $10 a share. Consequently, it is up by about 150%. The impressive run in the market stems from growing confidence about the company’s long-term prospects as a data analysis software company. As it stands, it boasts of a robust line of clients made up of government agencies and other companies in the defense and intelligence sectors.

Consequently, Palantir boasts of a solid recurring cash flow base. The fact that the company operates in the tech-heavy space affirms why its stock has held steady in recent days after a steep pullback from all-time highs.

One of the major headwinds that have curtailed the company’s prospects in the market is the lack of solid earnings. Palantir has been bleeding lots of cash in the recent past as it looks to strengthen its competitive edge in the data analysis space. However, the company has continued to generate significant revenue to sustain its operations.

Q3 earnings expectations

Wall Street expects the data analysis company to deliver earnings of $0.037 a share, a slight decline from earnings of $0.052 a share delivered the same quarter last year. The failure of the company to affirm its ability to generate significant earnings has been the biggest undoing on the stock’s sentiments in the market.

Sales, on the other hand, are expected to climb 33% to $385 million. This would be a slight decline considering that the company’s revenue has been growing by an average of 49% year-over-year for the better part of the year.

Consequently, it is becoming increasingly clear that Palantir is experiencing slow growth, which also explains why the stock has not performed as expected.

What to look out for when Palantir reports

When Palantir reports focus will be on Remaining Purchase Obligation and billings growth. As of the end of the second quarter, remaining purchase obligations stood at $671.9 million from the bunch; the company is expected to recognize about 49% of revenue over the next year.

Total deal values/contracts are another important metrics to pay attention to as a key driver of top-line when Palantir reports. The data analysis company had about $2.8 billion in total deals as of the end of Q1, representing a 40% year-over-year increase and $3.4 billion as of the end of Q2, representing a 63% year-over-year increase. A much higher value of contracts in the range of $4 billion all but increases the company’s prospects of generating significant revenues going forward.

While Palantir has affirmed its ability to register robust revenue growth, its inability to generate significant shareholders’ value on earnings has been its biggest undoing. While the company has generated significant cash flows while operating efficiently without dilution, finding ways to compensate employees without eating much into the free cash flow has always proved to be a problem.

Consequently, it will be interesting to see what it intends to do to shrink some of the losses, especially those pertaining to stock-based compensation.

Bottom line

Palantir is in a pivotal position ahead of the earnings report. Revenue growth of more than 35% and a guide of more than 27% on Q4 revenue growth could help strengthen investor sentiments on the stock. Additionally, the company will have top earnings estimates if the stock is to post a big move in the market.