As 2020 comes to an end, let’s overview what tendencies have been out there and which ones will likely prevail as we enter 2021.

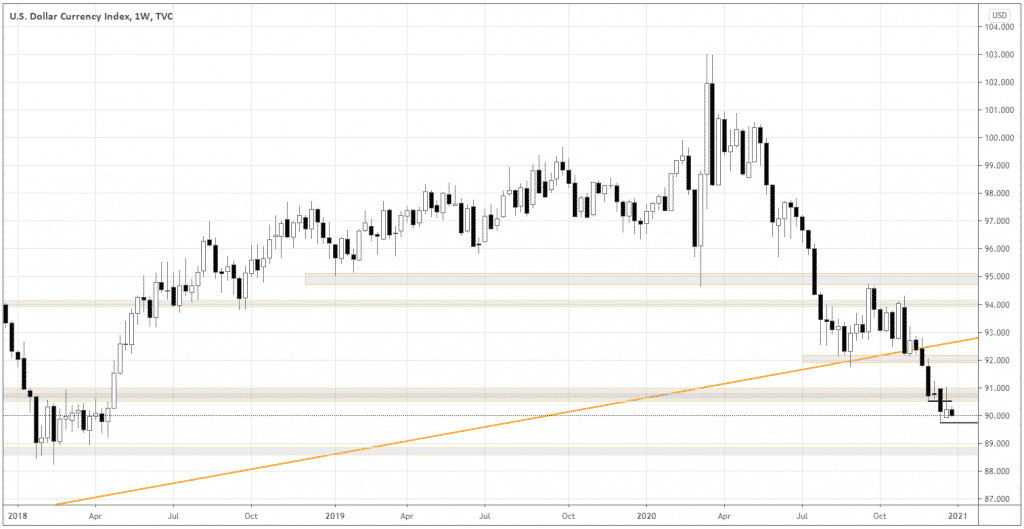

Looking at the DXY chart below, the US dollar has been in the downtrend and likely to continue until the first long-term possible support around 88.75. The trigger for further momentum continuation will be the breakdown of the local support around 89.75. Therefore, being long in risk assets is still actual.

As President Donald Trump eventually signed the COVID relief and government funding bill, the USD remains under pressure. Democrats intend to quickly push for another funding bill on January 20, after the new President Joe Biden takes office.

Forex sentiments line-up

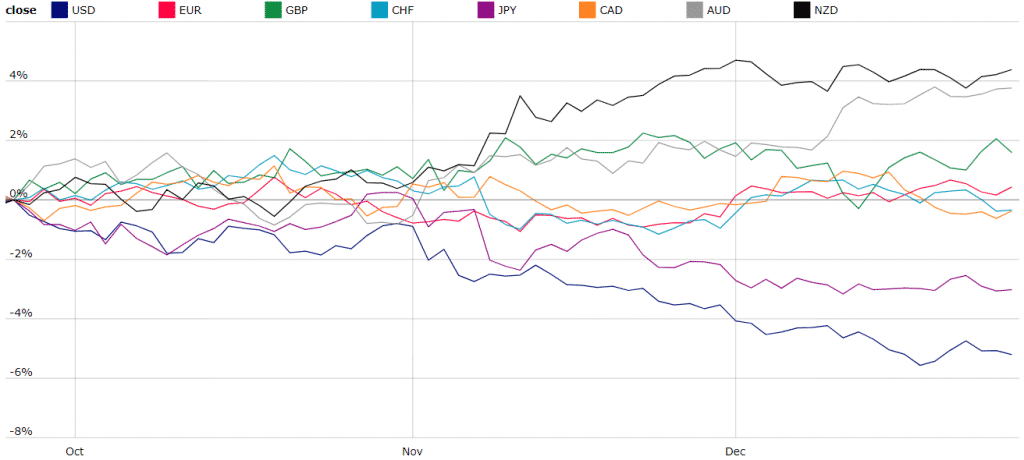

To get a bigger picture of what to expect as we enter 2021, let’s look at the Currency Strength Index below.

As you can see, the traditional risk assets like AUD and NZD are in a strong uptrend against the rest of the Forex market, with NZD historically slightly outperforming AUD.

Looking for solid trends?

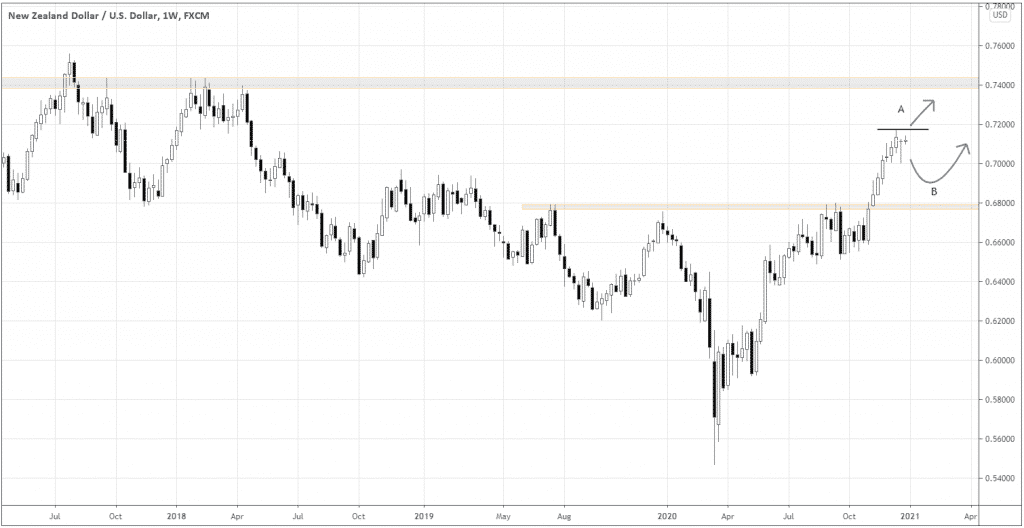

If you’re into steady trends with moderate volatility, you want to buy NZD/USD in 2021, aiming to hold the strongest against the weakest currency. Let’s look at the NZD/USD chart below.

In the chart above, we see two possible bullish scenarios of the pair. Scenario “A” offers the breakout and proceeding short-term momentum opportunities. In contrast, scenario “B” takes into account a decent move from the breakout of the previous key level 0.6800 and possible correction.

The scenario “A” fits more for swing and day traders, as the breakout of the local high (horizontal black line) is very likely, but the closest profit target (0.74000) is too close for the longer-term position traders. The protective stop can be under the low of the candle that closes above the local high.

Scenario “B” suggests that the traders with the longer holding period will benefit more if the pair corrects and shows the rejection price action signal between 0.6800 and 0.7000. We can set the stop loss below the local low or 0.6800 price level.

Some of the fundamental reasons for the NZD strength are the economic indicators. The New Zealand economic data of quarterly retail sales and GDP is positive, reporting 28% and 14% respectively.

Waiting for the powerful breakouts?

If you seek possible aggressive price movements, look into the bundle of the currencies that didn’t go far from a 0% change in the Currency Strength Index during the last quarter of 2020.

The area around 0% change represents the state of the increased uncertainty. No wonder, as the Brexit implications around the trade deals loom, European currencies are in disagreement about the future outlook – that’s where we can find the most powerful breakout opportunities.

Besides, CAD, which actively reacts to the oil volatility, adds some spice of uncertainty to the mixture.

How do we select the most attractive pair to deal with? I wouldn’t mess with CHF and GBP, by selling them anyhow, according to my previous outlooks. EUR/CHF isn’t so volatile historically, so it’s not the best choice either.

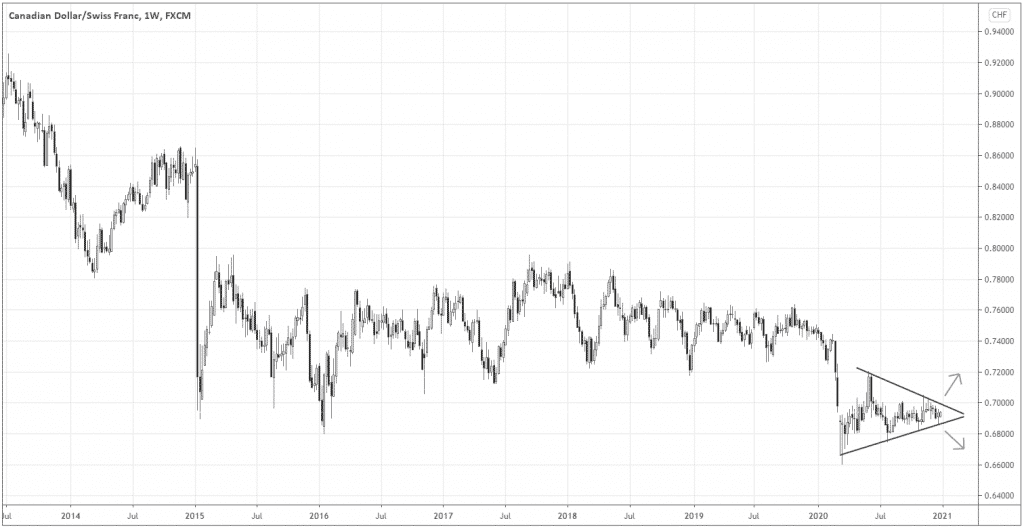

Below are good examples of the current range breakout opportunities. We bet on the highly uncertain but historically outperforming GBP and CHF against the oil-dependent CAD.

The symmetrical triangle pattern traditionally offers entries in either direction. However, based on the CHF relative strength that we discussed before and the long-term downtrend of the CAD/CHF, I prefer shorting the pair if the Weekly or Daily candle closes below the downward pattern boundary.

During the last meeting of OPEC, the members and allies agreed to gradually increase the daily oil production beginning in January. The increased oil supply is likely to put pressure on oil and eventually on CAD.

Final words

As the downward pressure on the USD continues, the upcoming year 2021 may offer us steady trends, and the uncertainty in Europe can trigger aggressive breakouts. Awaiting the new trading year, we can prepare by understanding the big picture better.