As the governments across the globe enforced lockdowns to curb the Covid-19 pandemic, people were forced to sit at home. One major group of beneficiaries of this pandemic have been the technology companies. With more time at hand, time spent on home entertainment (NFLX) and social media (FB, TWTR) jumped up by multiple times. Smartphones (AAPL) and laptops (NVDA, INTL, MSFT) became critical for people working from home. Online communication (GOOG, ZM) suddenly rose in prominence and nearly everything that people consumed was ordered online (AMZN).

As a result, while the rest of the businesses suffered and the stock market plunged, tech stocks climbed new highs throughout the pandemic. So while the S&P 500 gained 36% in 2020, Nasdaq 100 posted 47% returns for the year, outperforming by more than 10%.

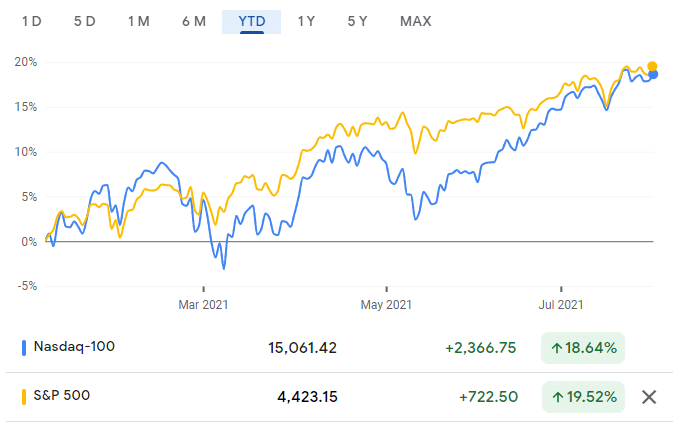

However since the start of this year, the tables have somewhat turned. In late 2020, vaccine companies like Pfizer and Moderna announced successful trials of their vaccines and early 2021 saw a massive vaccination drive. As active cases dropped, several states announced varying degrees of relaxation. This led to many offices and businesses reopening, offering a strong push to non-tech businesses. The stocks of these companies that were heavily beaten down also saw a good bounce back. This led to the S&P 500 outperforming the Nasdaq 100 by more than 5% around May and June.

YTD Chart of Nasdaq 100 and S&P 500

Market perception is that as things go back to normal, tech usage, which was artificially inflated due to the lockdown will go back to its pre-pandemic level. On the other hand, companies which suffered during the pandemic will mark a healthy comeback and hence their stocks too will perform well. Entire sectors such as airlines and hospitality were completely shut down during the initial phase of the pandemic. Their stocks were trading at a deep discount vs their trading history. It is quite natural that these stocks have significant upside potential even from current levels as these industries make a comeback. This is also being termed as ‘reflation trade’ as consumer demand makes a comeback leading to a return of ‘healthy inflation’. This is likely to benefit cyclicals and other non-tech industries.

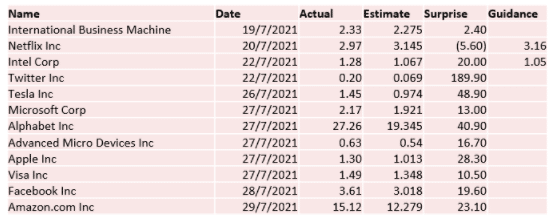

However if we see the recent earnings posted by some of the major tech stocks, it paints us a different picture. If you see the table below, all names barring Netflix posted a healthy EPS surprise in their Q2 results. Twitter EPS was nearly 3 times the consensus estimates while Google and Tesla posted earnings nearly 50% higher than expected. Even Amazon which fell after weak sales numbers beat EPS estimates. Q2 represents the April to June quarter when the economy was significantly opened up. This means that despite the lockdowns being rolled back, the tech companies have managed to post healthy numbers and in fact beat consensus estimates by a significant margin.

Q2 Earnings Surprise for Major Tech Companies

Nasdaq 100 too scaled new highs post the results and in fact closed the gap in terms of YTD returns with S&P 500. What this shows is that consumer behaviour is rather sticky and the customers that the tech companies have acquired over the pandemic are likely to stay. Internet usage continues to remain high among users. On the other hand, employees of several companies, having realized the benefits of ‘work from home’ protocols, are demanding that this become a permanent feature. Many companies too have realized the benefits of working from home and are offering this option to their employees. This would mean that even with restrictions being removed, a part of the workforce will still stay at home.

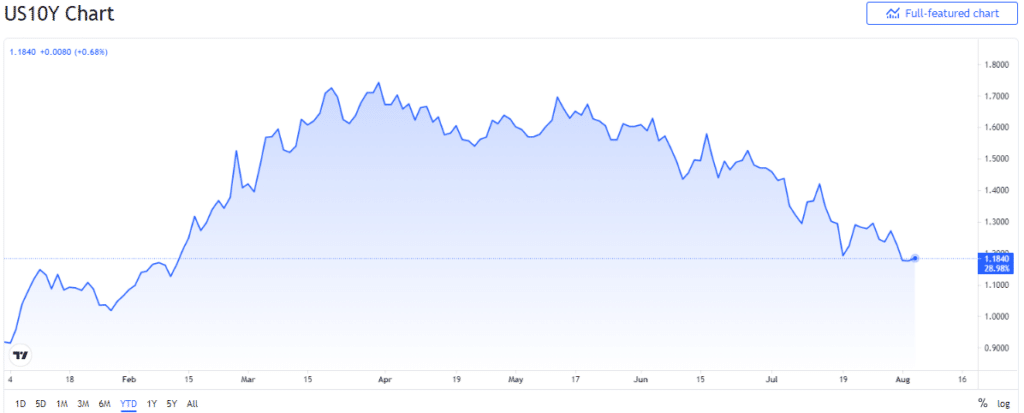

Another point worth noting is the direction of the US 10Y yields. With the massive spending under the Biden administration in the form of handouts and infrastructure projects, US debt is and is expected to rise to record highs. The spending is also expected to entail a rise in inflation which contributes to a rise in yields. In fact, in the first quarter of 2021, the 10y yields did see a massive spike, going from around the 0.9 levels at the start of the year to above 1.7.

High yields raise the borrowing cost for companies. This is generally bad for stocks and hence investors go into a risk-off mode where they tend to avoid high growth stocks and invest in value stocks. Nearly all tech stocks are classified as growth stocks given their high earnings multiple and growth. As a result this caused a rotation trade where investors moved out of growth stocks and into value stocks. This also heavily contributed to Nasdaq 100’s underperformance against S&P 500 in the 1st half of the year.

US 10Y Yield YTD Chart

However, over the past couple of months, the treasury yields have reversed their direction and in fact are trading at the lowest level in the past 5 months. This was a major surprise for market participants and in fact Wells Fargo’s director of rates strategy called it outright “confounding”. This is partly being attributed to the Federal Reserve which wants to keep a lid on the yields and keep borrowing costs low. As a result, lower yields are expected to sustain in the near future. Low yields offer another tailwind for the tech stocks which hugely benefit as investors once again make a reverse rotation out of value stocks and into the growth stocks.

Thus the underlying reasons driving Nasdaq 100’s outperformance over the past few weeks, namely sticky consumer behaviour and low yields are factors that are likely to sustain in the near future. So the tech heavy index can be expected to outperform the benchmark S&P 500 index over the next few months.