Rivian Automotive Inc. (NASDAQ: RIVN), dubbed the Tesla Inc. (NASDAQ: TSLA) – Killer, is a force to reckon with in the burgeoning electric vehicle space. The company has got loads of attention as investors take note of its technology that has sparked widespread attention from industry watchers and analysts.

Some analysts reiterating that Rivian Automotive could be a worthy competitor capable of taking Tesla head-on underscores its growing credentials. The company is eliciting strong interest and attention after going public recently. It is also yet to commence mass deliveries, as is the case with peers.

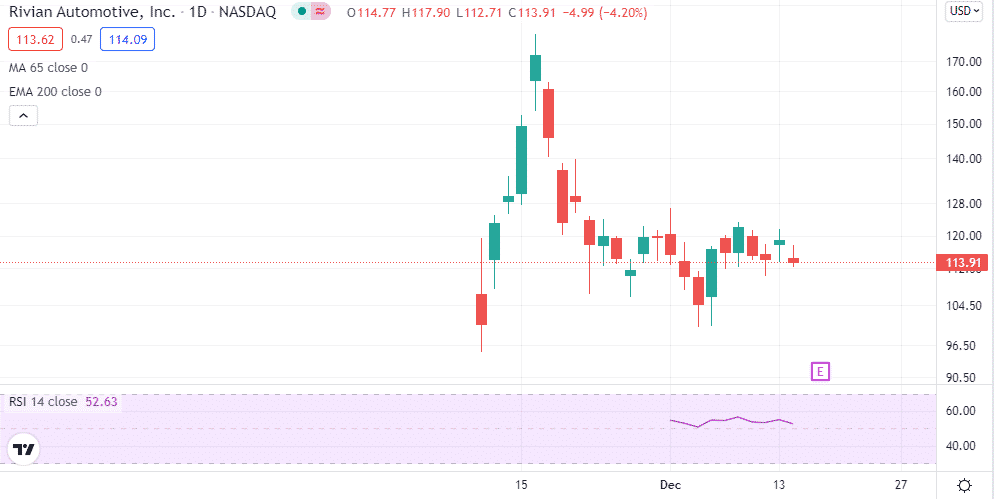

Rivian Automotive went public on November 10, 2021, with its stock priced at $78 a share. The stock did rally to record highs of $179 a share a few days after going public. Nonetheless, a deep pullback did come into play, with the stock shedding more than 40% in market value from all-time highs.

Fast forward, the stock has recouped a substantial amount of losses following the pullback and is currently up by more than 30% from its IPO price. The bounce-back has come as investors take note of Rivian Automotive’s solid underlying fundamentals that affirm long-term prospects and growth metrics.

All-electric pickup

Rivian Automotive is already sending shockwaves on the launch of an all-electric pickup truck. The feat is the first of its kind in an industry where the focus has always been on the likes of Tesla, Ford Motor Company (NYSE: F), and General Motors Company (NYSE: GM).

The fact that the newly listed electric vehicle company has already attracted more than 55,000 pre-orders for the all-electric pickup truck underscores strong demand in the market. The first-mover advantage with the all-electric pick-up should allow the company to generate significant value on ramping up production.

Production capacity

Rivian has already made it clear of its intention to focus on the electric pickup truck that continues to elicit strong demand. While it did deliver 156 vehicles year to October, it has started commercial production of the R1T pick truck and plans to begin production of the SUV R1S and an electric delivery van.

Its production facility in Illinois currently boasts an annual production capacity of 150,000 units. The massive capacity should allow the company to fulfill the 55,000 pre-order for R1T and R1S without delays and with ease by late 2023.

The company has also inked a deal with Amazon in which it is expected to deliver 100,000 electric delivery vans by 2030. While the deadline looks far off, the automaker has already confirmed it is on course to deliver all the vans by 2025.

With deliveries expected to increase significantly next year, Rivian Revenues are expected to clock highs of $3.5 billion. Revenues could double each year until 2025, going by the strong Demand and the delivery deals that the company has already signed. Going by the $3.5 billion revenue estimate, the company currently commands a sales multiple of 30.

In addition, Rivian Automotive has set sights on the US, Canada, and Western Europe markets, from where most of the demand continues to come from. Nevertheless, the automaker intends to venture into new markets while also developing new products to diversify its product line.

Rivian’s automotive edge

Rivian competitive edge in the electric car space that is eliciting strong interest and investments stems from its focus on a distinct market segment. The company has already carved a niche in the development of pickup trucks and SUVs

Pickup trucks and SUVs command the highest volume in the automotive industry and account for the biggest profits. In addition, robust e-commerce growth is also expected to strengthen the company’s long-term prospects, given the growing demand for electric delivery vans.

Demand for delivery cars is on the rise as retailers look to enhance their delivery logistics. Amazon booking up to 100,000 delivery vans affirms the strong demand in the market. Consequently, Rivian remains well-positioned to benefit given its fast-mover advantage, having already hit the road going on the production front.

Robust charging network

Rivian also boasts of a robust charging network that should be one of the factors to attract customers. The charging network should build confidence in the company’s brand, which should see it attract more big deals going forward.

The company has already embarked on an ambitious plan to install charging stations in adventurous destinations in addition to interstates in the US. It plans to install more than 3,500 fast chargers at over 600 sites by the end of 2023. It also plans to install more than 10,000 level 2 chargers by 2023.

Enhanced customer experience is another competitive edge that could help Rivian win big against its peers. Instead of letting customers deal with dealers, the automaker will deal directly with customers as it seeks to ensure the best experience. In the long run, it hopes to offer high-value services and subscription opportunities.

Competition threat

While Rivian appears to have an edge in developing fully electric pickups, it still faces stiff competition. Big players in the name of Tesla, Ford, and General Motors are already ramping investments as they look to address the emerging market need.

Ford has already secured nearly 200,000 reservations for its F-150 Lightning electric pickup truck. Similarly, Tesla is also working on electric pickups expected to rival Rivian offerings going forward. As it stands, the company will have to prove it has what it takes to deliver vehicles without delays and profitably. It might also have to scale up its production capacity.

Bottom line

Rivian Automakers is firing on all angles going by the solid underlying fundamentals. An annual capacity capable of producing up to 150,000 units means it is well-positioned to address the market need and generate significant value. Inking a deal with Amazon affirms the company’s underlying technology that is already eliciting strong interest.

While the automaker is still in the early stages of expansion, its Amazon delivery deal provides the much-needed impetus to ramp up production. With Amazon owning 20% of the company, room for growth amid the strategic partnership is big.