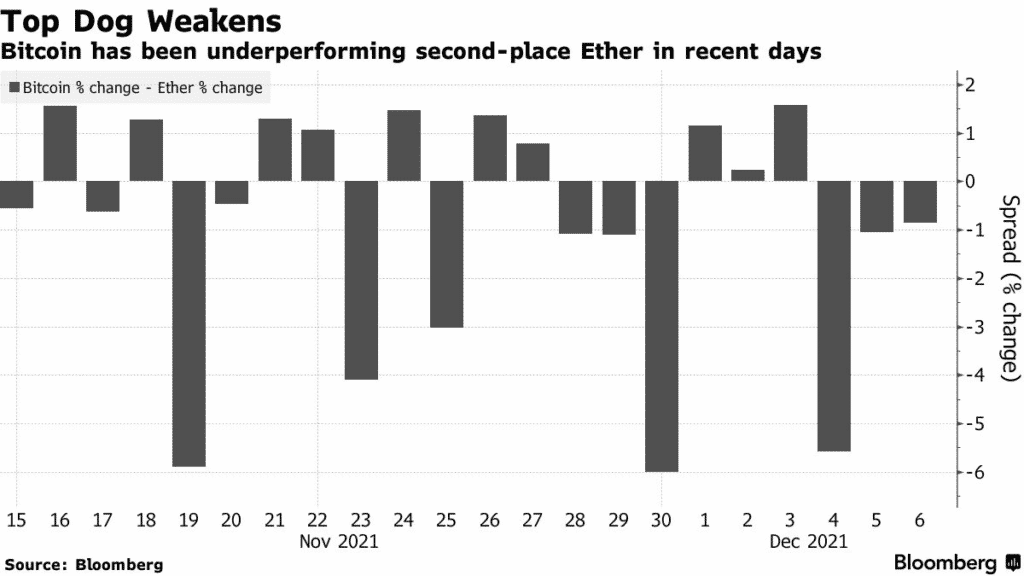

(Bloomberg) Fundstrat head of digital-asset research Sean Farrell opines that the huge drop of Bitcoin and its slow recovery compared to its closest rivals such as Ether is related to its macro link.

Farrell says the crypto market recovers faster than Bitcoin since the latter gets affected more by events that build macro uncertainty. The analyst links the drop over the weekend to the omicron concerns, likely Fed bond tapering, and jitters in the derivatives market.

The strategist says the involvement of big investors in crypto and mostly in favor of Bitcoin has institutionalized the world’s largest cryptocurrency making it susceptible to macro events.

Farrell says that Bitcoin’s sell offs on Friday evenings is also explained by the rising institutionalization compared to other cryptocurrencies.

Stephane Ouellette, co-founder and CEO of FRNT Financial Inc. says Ether is less likely to be affected by macro events as its growth has been more linked to the booms in decentralized finance space and non-fungible tokens.

Bitcoin fell by up to 21% on Saturday, while Ether was down about 17% the same day before both cryptocurrencies started to recover.

BTCUSD is up +1.34%, ETHUSD is up +0.74%.