In financial markets, all assets and subsets of assets are often categorized into different types. Within currencies, there are high yield and safe haven currencies; within fixed income, there are government bonds, investment-grade bonds and junk bonds; within equities, there are value stocks and growth stocks.

The reason for this categorization is the fact these assets have fundamentally different risk to reward ratios under different scenarios.

This categorization became especially important during the Covid-19 crisis over the past several months. During the initial stages of the pandemic, investors flocked to the safe haven assets. This is because as the governments imposed lockdowns to control the pandemic, economic activity saw a sudden plunge.

The airlines and tourism business was completely shut, restaurants and hospitality sectors too were out of action and a lot of consumer demand also went away as people were forced to sit at home.

Unsurprisingly, lockdowns plunged economies across the globe into recession. Safe haven assets like gold and government bonds saw a massive jump in value. Similar situations had played out in previous economic slowdowns as well, such as during the 2008 financial crisis.

Understanding reflation

During a recession phase, the main focus is on consumer demand because that is the main driver of growth. In the Covid-19 induced recession, lockdowns caused factories and shops to shut, leading to a breakdown in production and employment. This subsequently led to a fall in demand for goods and services.

When the demand goes down, the prices go down as well and which is why inflation remains low or even falls into the negative territory.

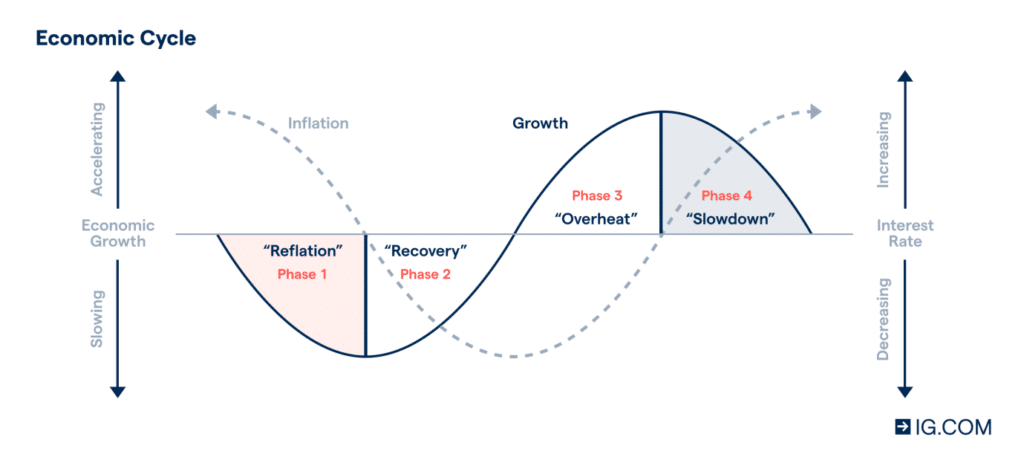

The exact same cycle repeats in reverse when the economy comes out of recession. As demand starts picking up, factories require more raw materials, and shops need more finished goods. This drives up the prices and hence leads to a pickup in inflation which is what is termed as ‘reflation’.

Inflation and growth over the economic Cycle

Over the past few months, global economies have also witnessed the reflation. With the rollout of vaccines and the prevalence of herd immunity, governments started opening up their economies to various degrees. This brought back demand into the system as there was no fundamental reason for recession apart from the government-mandated lockdowns.

Many consumers, in fact, went on a spending binge after being locked up in their homes for several months, leading to a sharp rebound.

How to trade reflation?

So, now that we understand the economic side of reflation let us go through how it can play out in the financial markets. As discussed earlier, during times of a slowdown, safe haven assets see a sharp rise in value.

On the other hand, cyclical assets such as commodities and consumption stocks are heavily beaten down due to their high dependence on demand. Along with the cyclicals, riskier assets also see a drawdown as they are most susceptible to getting bankrupt or closing down.

High yield bonds and small-cap stocks are the riskiest categories in their respective asset classes and hence bear the brunt of the markets during a downturn.

But as the saying goes, what goes down also comes up. The assets that were beaten down during a recession also tend to outperform during an economic recovery. This effect has especially been magnified in recent times due to the massive support provided by central banks.

During the 2008 recession and also in the Covid-19 induced recession, central banks across the globe purchased hundreds of billions of dollars worth of bonds, pumping a commensurate amount of liquidity in the system. This was also coupled with record low-interest rates and bond yields.

So, with ample money in the system and extremely low cost of funds, investors are incentivized to take more risks. Consumers, too, are incentivized to spend more with more funds in their hands. As a result, these risky and cyclical assets see a sharp bounce which often sustains over several years. Betting on this bounce back is what is known as the ‘reflation trade’.

Changing dynamics of reflation

Similar reflation trade was seen during the recent recovery. During the lockdowns, shares of FAANG and other tech stocks such as Zoom saw massive jumps because of a spike in their usage. On the other hand, stocks of financials and energy sectors were under pressure. Airlines and hospitality were trading at deep discounts compared to their historical prices.

So, when the vaccine news came out, the immediate market reaction was to reverse these trends. Tech stocks saw some correction while reflation stocks jumped up. However, surprisingly, this time around, this trend reversal was limited only to a few months.

After leading the market higher for most of 2021, the reflation stocks began to struggle in July as the 10-year treasury yield and real rates, which effectively accounted for inflation, fell. The tech-heavy Nasdaq 100 Index started moving up, while the cyclically oriented Dow Jones Industrial Average began coming off, putting a lid on the gains of relation trade.

Many market participants believe that the reason for this was the notion that the recovery of economic growth was already a thing of the past. Among other factors was a shift by the US Federal Reserve in which it began discussions about tapering its bond-buying stimulus program.

The new Delta variant of the coronavirus, which wreaked havoc in Asia this year, has also started spreading worldwide. Recent reports are suggesting that the Pfizer and Moderna vaccines, which were the primary vaccines administered in the US, are much less effective in stopping the spread of the delta variant. This raised fears of virus resurgence and might have dampened the recovery spirit of the financial markets.