Semiconductors have slowly become the backbone of the global economy. They are so important that billions of people are using them directly and indirectly. For example, it is estimated that over 6.8 billion people own a smartphone, which is about 83% of the global population today.

There are many other areas of the semiconductor industry. Cars have at least two dozen of chips, while ordinary items like home alarm systems have these items. As a result, the concept of investing in semiconductor stocks has become popular among investors. This article will look at some of the best semiconductor stocks to invest in for the long term.

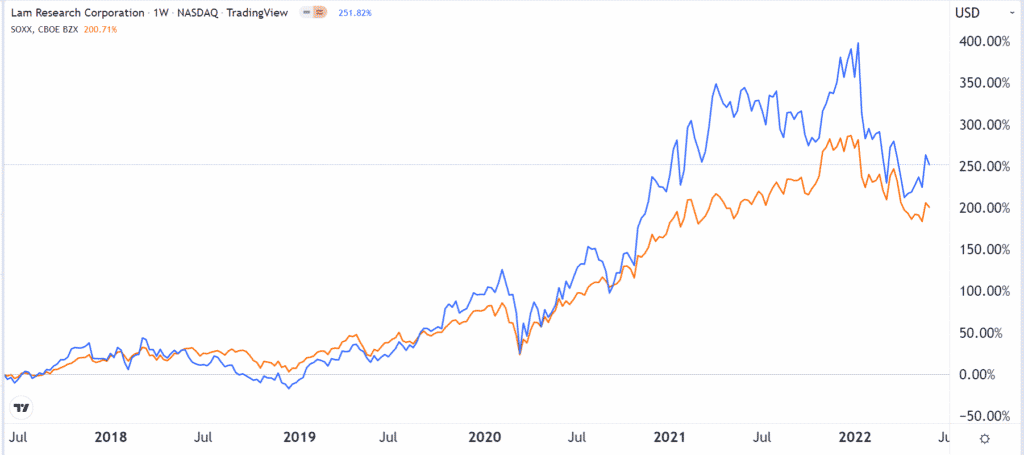

Lam Research

Lam Research is one of the best semiconductor chip stocks to invest in for long-term investors. It is a company valued at $70 billion, making it a key player in the sector. Lam has grown its revenue from $2.665 billion in 2012 to over $14.6 billion in 2021. Its profits have moved from just $113 million to over $4 billion.

Lam Research is a semiconductor company whose customers include other chip companies and fabricators who focus on non-volatile memory (NVM, dynamic random-access memory (DRAM), and logic devices.

Lam Research has products in multiple families such as Sabre, Altus, Vector, Sola, and Coronus among others. There are several reasons why Lam is a good semi-stock to buy. First, its growth has been strong n the past few years, and analysts believe that the trend will continue.

Second, Lam has a strong market share in industries that are difficult to enter. As a result, it faces no meaningful competition. Further, the company has a strong dividend track record, and the shares are reasonably priced. Finally, as shown below, the company has a close correlation with the iShares Semiconductor ETF.

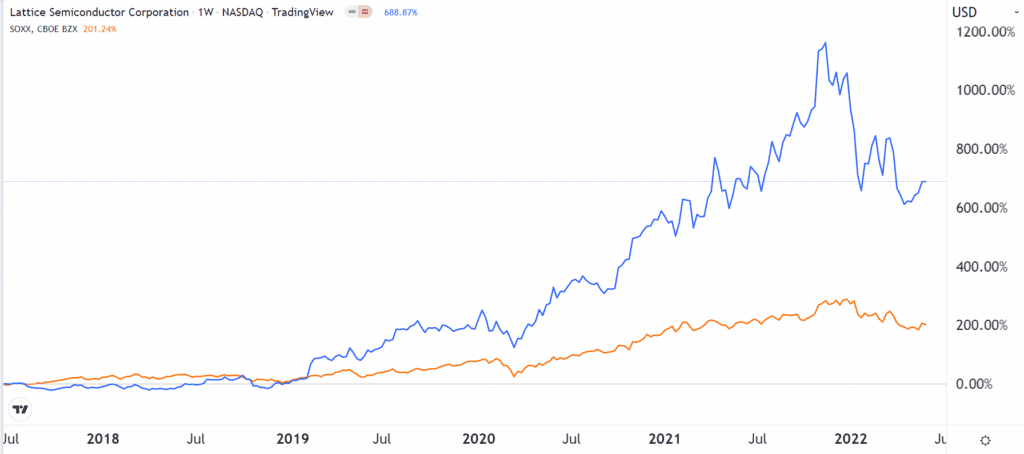

Lattice Semiconductor

Lattice Semiconductor is a relatively small semi company that has grown its annual revenue from $279 million in 2012 to over $550 million in 2021. In this period, it has moved from being a loss-making company to a highly profitable firm that is valued at over $7 billion.

Lattice is a semi company that operates in three key segments: communications and computing, industrial and automotive, and consumer. Most of its top products are known as Field Programmable Gate Arrays (FPGA), which are semiconductors that can be programmed by customers. The biggest firm in the FPGA industry is Xilinx, which was recently acquired by AMD.

Lattice Semiconductor is a good investment because of the growing market of FPGAs and the fact that autos are getting more tech-heavy. The company has also executed well and created a launchpad for future growth and profitability. The chart below shows that the LSCC stock price has done well in the past few years.

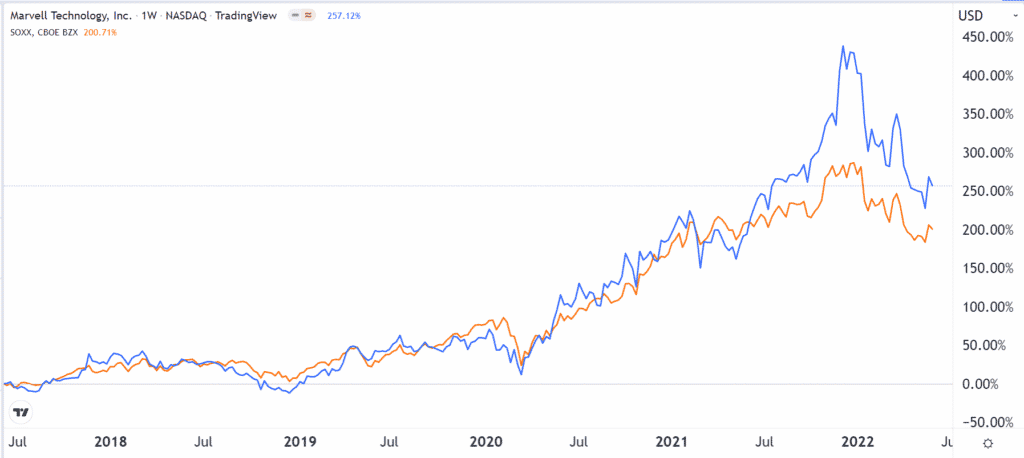

Marvell Technologies

Marvell Technologies is another important semiconductor company. It is a giant firm valued at almost $50 billion. The company operates its business in four key segments — data centers, carrier infrastructure, enterprise networking, consumer, and automotive.

In these businesses, the company offers several products, including advanced driver-assistance systems, in-vehicle networking, cloud, and on-premise servers, and digital subscriber line access multiplexers.

Marvell’s business has been growing rapidly in the past few years. Its revenue has grown from $2.6 billion in 2016 to over $4.4 billion in 2021. However, unlike many semiconductor companies, its losses have also grown as the company focuses more on growth.

While Marvell is a loss-making semi company, it makes a good investment for several reasons. First, the management is now focusing on lowering costs while boosting growth. Second, the company is managing the supply chain crisis well. Lastly, Marvell has a strong market share in its key industries, which makes it a good company to own.

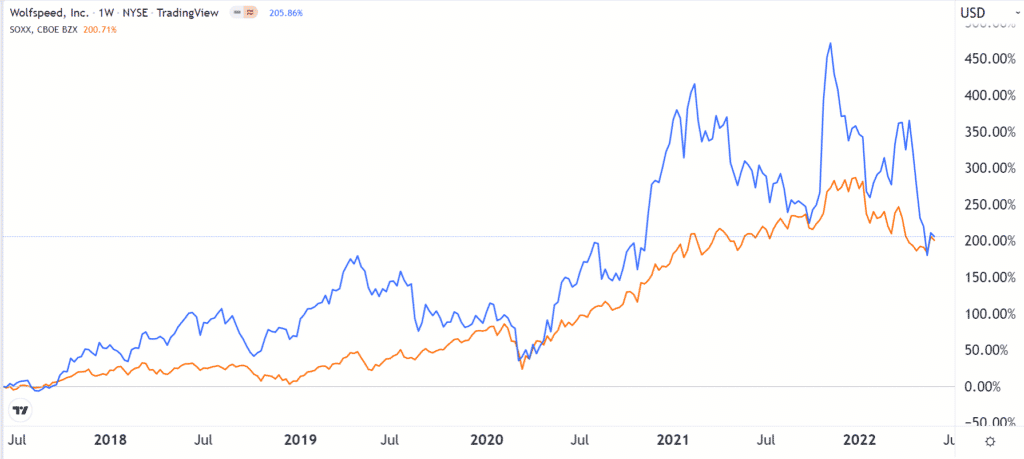

Wolfspeed Inc

Wolfspeed is another loss-making semiconductor company you should consider investing in. It is a company that was previously known as Cree. In 2021, the company sold some of its business that dealt with Led lighting solutions to SMART Global Holdings.

The remaining company, which is now known as Wolfspeed, deals with carbide and GaN materials, power devices, and RF products. This means that most of its business now provides solutions to companies in the semiconductor industry. Some of its most important customers are firms like Sumitomo Corporation, ST Microelectronics, and Arrow Electronics.

Wolfspeed has seen its total revenue slow from over $1.1 billion in 2012 to $525 million in 2021. This slowdown was mostly because of the weak performance in its lighting business that it recently exited. What remains now is a fast-growing business that has a reliable customer base and steady growth. Still, the biggest risk is that three customers represent about 30% of its revenue.

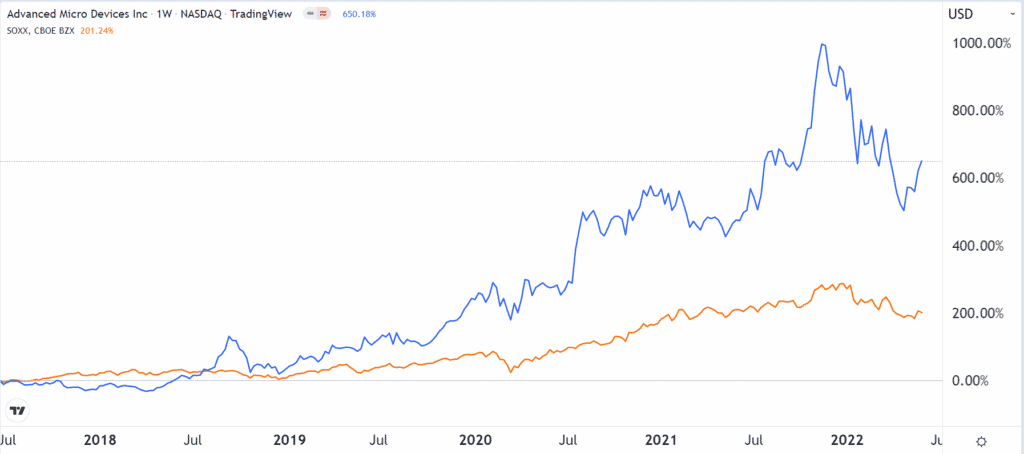

AMD

AMD is another semiconductor stocks that you should consider investing in. It is one of the best-known companies in the sector. In the past few years, under the leadership of Lisa Su, it has moved from an unknown company to one of the leading players in the sector. It is even battling companies like Intel and Samsung for market share.

AMD sells its chips to PC makers like Dell and HP and to companies that operate data centers like Microsoft, Amazon, and IBM. In the past few years, the company has also expanded by acquisitions. It bought Xilinx and Pensando. Its chips are the most preferred by most gamers.

AMD is a good semi stock because of its market share in the industry, quality of its products, its share buybacks, and its leadership of Lisa. In addition, the shares have pulled back slightly, making them a bit undervalued.

Summary

The semiconductor industry is large and extremely diverse. In this article, we have looked at some of the best companies in the industry to invest in. Other notable names to consider are Qualcomm, Nvidia, ON Semiconductor, and Applied Materials among others.