Same-store sale is a comparative financial metric that is used to measure the sales growth of a company’s retail stores over a particular time, say a financial year or a quarter. This metric acts as a tracker for revenues where investors can assess the performance of stores that have been operational mainly for more than a year.

These comparative figures will then be used to extrapolate performance in the future. Same-store sales are normally given in percentages as they give a comparative growth or decline of sales based on the previous month, quarter, or year. However, the stores have to have been in operation for more than a year before they can be included in this metric.

Same-store sales can be defined as the percentage shift or change in sales- calculated in a year. A trader will first want to understand the total sales in the year of trading divided by the total sales of the previous year. Figure 1 should then be subtracted from the division result, and the resulting figure will be multiplied by 100 to turn into a percentage.

Calculation

For instance, a company may have 30 stores as of April 2020, but only 10 stores were existing in the year leading to December 2019. In calculating the same-store sales, only the 10 stores will be used, leaving out the remaining 20 stores. All 30 stores will then be used in the metric after December 2020.

Let us calculate the monthly same-store sales for the 10 stores between April 2019 and May 2020.

| Sales Amount ($) | |||

| Month | 2019 | 2020 | Same-store value |

| April | 350,000 | 450,000 | 28.57% |

| May | 330,000 | 500,000 | 51.52% |

| Same-store change | +22.95% |

The percentage of the change in sales for April 2020 can be calculated as follows:

[(450,000/350,000)-1] * 100 = 28.57%

The same-store sales performance for April 2020 was 28.57%.

The calculation for May 2020 is as follows:

[(500,000/ 330,000)-1] *100 = 51.52%.

The company management, as well as investors, will notice that same-store sales for this company had therefore increased by 22.95% into June 2020.

Store sales and revenue correlation

Investors in the retail industry will find it crucial to first understand the number of stores a company has before investing or increasing their investment in the venture.

Let us take the example of Lowe’s, a global home improvement retailer. In the first quarter of 2020, Lowe’s had 1,970 stores in the US and Canada dealing with home improvement and hardware retail services. Globally, it operated 2,200 stores.

The comparable sales for Lowe’s as of Q1 2020 increased 12.3% (from Q1 2019). Quarterly revenues as of Q1 2020 jumped 22.76% from $16.027 billion in Q4 2019 to $19.675 billion in Q1 2020. Revenues surged further in Q2 2020 to $27.302 billion in response to added sales into the second quarter.

Investors will use same-store sales to predict the future performance of the company. The natural inclination will be that an added number of stores will translate to additional revenue and more dividends for shareholders. However, in the example of Lowe’s, the occurrence of COVID-19 forced the company to close some of the stores to protect revenue growth.

As of Q4 2020, the comparable sales for Lowe’s US stores soared 28.6%. Total sales at the time were $20.311 billion, 8.94% down from Q3 2020. Stores operated by Lowe’s as of Q1 2021 were 1,974 stores in the US and Canada. The increase in the number of stores by Lowe’s may have led to an increase in the same-store sales, but it failed to have the same impact on the revenue growth.

Lowe’s performance in 2020 was exceptional due to the lockdown effect that meant many people spent most of their time indoors. The issuance of the stay-home order meant that many people were concerned about improving their homes for resale or personal pleasure.

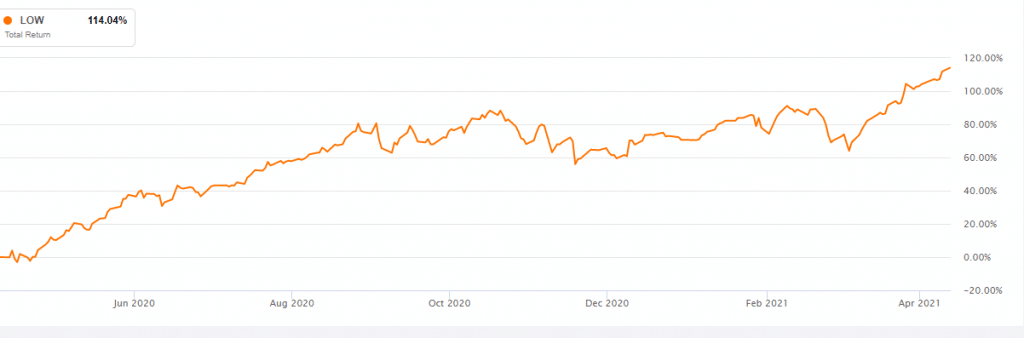

Lowe’s Total Return as of June 2020- April 2021

As of May 20, 2020, Lowe’s share price was $116.99 upon release of the quarterly results for Q1, 2021. As of February 24, 2021, when Q4 2020 results were announced, the share price had surged 38.74% to $162.31. The increase coincided with shareholder value.

Performance against expectations

The positive performance of same-store sales in the company does not always mean that investors have received value for money. It may indicate an increase in sales but not the overall strength of the company, especially when compared to investor expectations. These comparative sales do not include new stores that have been opened in less than a year. Therefore, same-store sales may be high, but the company may still register less performance due to declines from new stores not captured in the metric.

Let us consider the example of Lowe’s, the increase in same-store sales by 28.1% beat analysts’ expectations that had hinted at an increase of 22%. However, the decline in revenues despite the increase in same-store sales negatively affected earnings into Q1 2021.

Putting same-store sales into perspective

For many companies, opening new stores is not only a sign of expansion, but it resonates well with investors. Shareholders may be pleased with the prospect of increasing returns by expanding and adding the number of outlets available for sales. However, stockholders may be misled by the prospect of simply comparing the total sales of a company at two different points in time.

Further, there the exclusion of new stores from the same-store sales growth may give a wrong picture to a potential investor. For example, during the COVID-19 era, many companies shifted their way of operation as a response to the pandemic.

An increase in same-store sales indicates that a company has not only increased its customers but also maximized revenue with its current customer base. It also indicates a positive value for investment.

Therefore, a positive same-store value favors a company despite a decrease in total revenues. A decrease in the same-store value may work as a disadvantage that wants to focus on store expansion as a criterion before investing in a company’s stock. A positive score indicates growing customer demand as sales increase per store.