(FT) Energy Aspects’ director of research, Amrita Sen, has termed the release of 50 million barrels of crude by the US as a “a symbolic move,” with negligible impact.

Sen says the release will occur over a span of six months, diminishing its immediate impacts.

BCG Center for Energy Impact director Jamie Webster says the release of the oil stocks is already having less impact than it was hoped, with the market expecting bigger releases than 50 million barrels from the US.

Jason Bordoff, co-founding dean of the Columbia Climate School, says the US’s release of crude stockpiles is understandable given the current price pressures and dislocations in the economic recovery.

The US has said it has a range of other tools to tame oil prices and a ban on exports is one consideration that could be put in place.

Investors are now keen on OPEC+ meeting on December 2 which will outline the crude output policy. The cartel has recently objected to US calls for more oil in the market, with the latest move by White House likely to heighten tension with other oil producers.

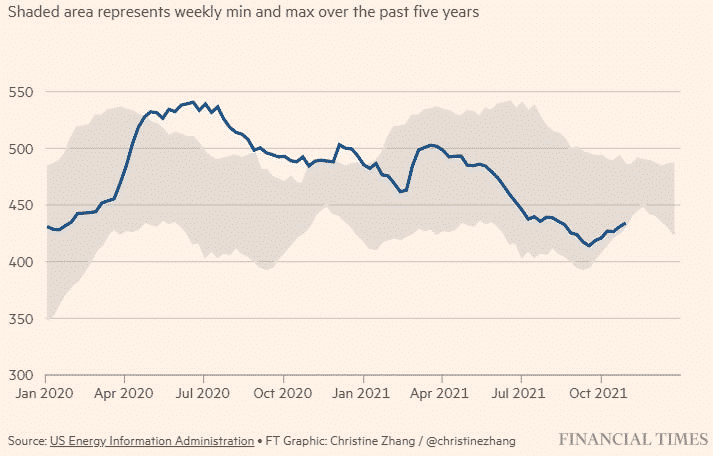

The 50 million barrels of crude released by the US covers about half a day of global consumption, which is currently around 100 million barrels a day. US crude stockpiles run about 600 million barrels.

CL1! is down -0.38%.