- The US dollar bounces back amid interest rate talks.

- EURUSD bounces back under threat.

- GBPUSD rally stalls below 1.3500.

- Oil prices are steady amid the US reserves release push.

- US indices rally persists.

The US dollar is in recovery mode on Friday, recouping some of the losses accrued over the last two days. The dollar index measures the greenback strength and has powered through the 95.62 level after coming under pressure at 16-month highs of 96.22.

The dollar sentiments have been bolstered by solid economic releases that have fuelled monetary policy tightening expectations. Discussion of the Federal Reserve interest rate hike aimed at curtailing runaway inflation continues to fuel dollar strength.

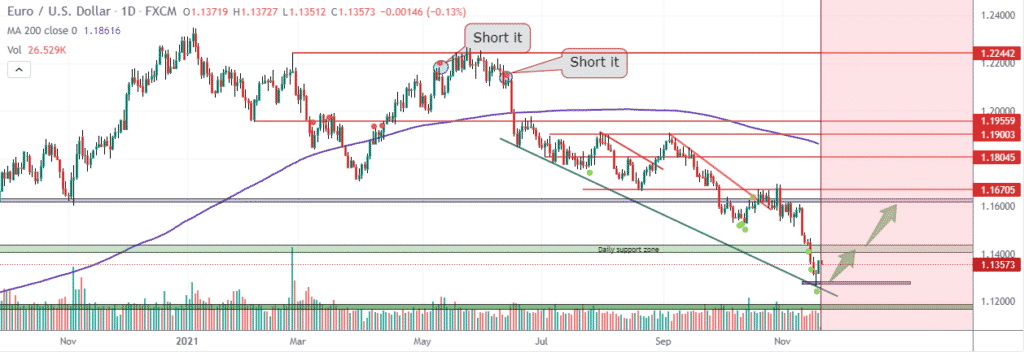

EURUSD sell-off

The euro has been the biggest casualty of the dollar, strengthening to 16-month highs. The EURUSD plunged to 16-month lows of 1.1263 on Wednesday. While the pair has bounced back to the 1.1350 level, it remains susceptible to further losses.

The EURUSD remains pressured at the 1.1350 level as strong US data, and hawkish comments from the FED continue to fuel dollar strength. Chatter around US stimulus continues to fuel inflation-linked rate hikes expected to continue fuelling dollar strength which should keep EURUSD pressured.

GBPUSD bounce back stalls

The GBPUSD is another pair under immense pressure after the recent bounce back stalled. The pair has struggled to find support above the 1.3500 level. It remains subdued and struggling for direction at the psychological level.

The British pound has been on the front foot in recent days amid expectations that rising inflation will force the Bank of England into raising interest rates. Inflation in the country has surged to 10 year high of 4.2%, fuelling expiations of rate hikes to curb further increase.

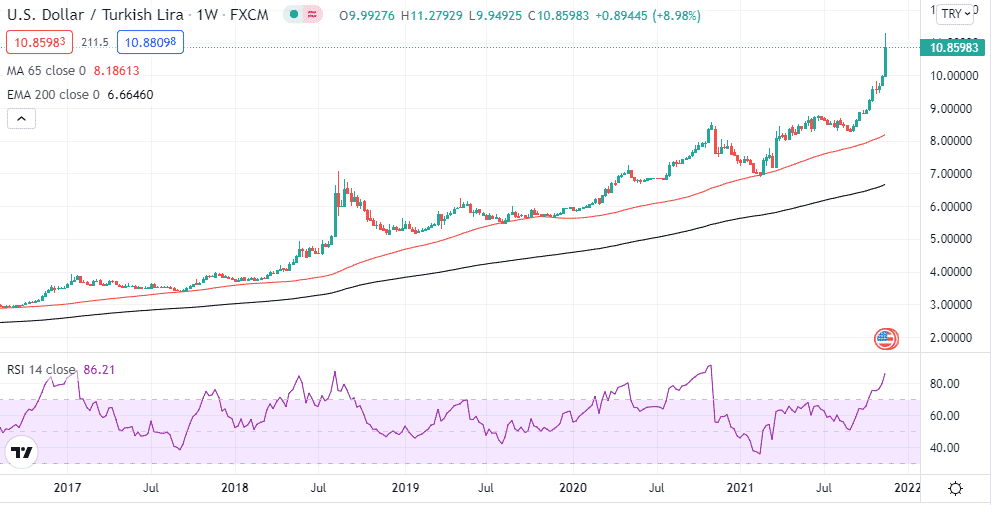

Turkish lira implosion

In the emerging markets, the Turkish lira remains under immense pressure amid political interference on monetary policy. The lira has plunged to its lowest level against the dollar following a move by the central bank to cut rates despite inflation surging to highs of 20%.

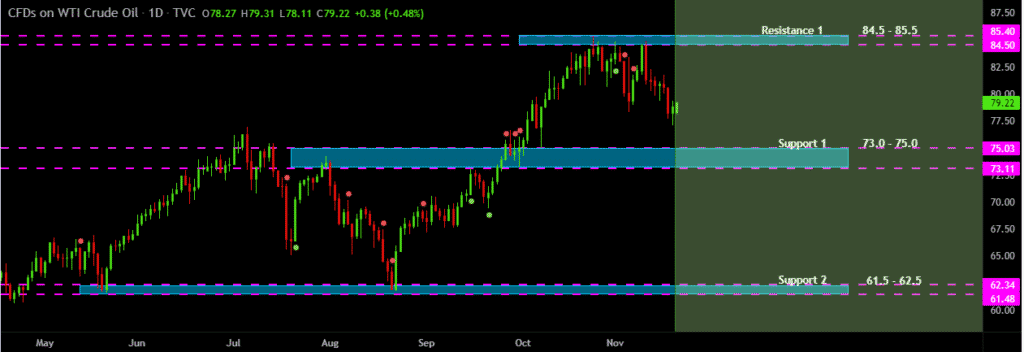

Oil prices steady

In the commodity markets, oil prices steadied on Friday morning after two days of heightened volatility. Brent crude found support above the $80 a barrel level after a 0.65% surge to $81.77. US oil was also in recovery mode at $78.96 a barrel.

The oil markets continue to digest a request by the US for China, Japan, and other big oil importers to release some crude stocks from reserves to curtail further spike in prices. Investors also continue to digest data showing oil exports from Saudi Arabia hit an eight-month high.

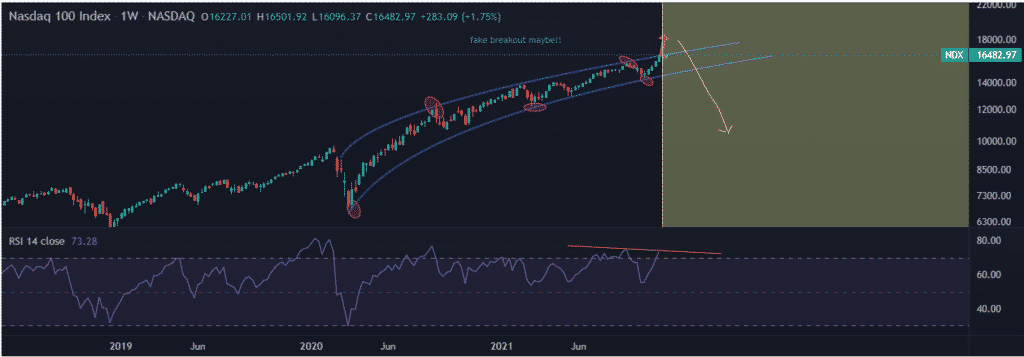

US equity indices rally

Major benchmark indices continue to edge higher in the equity markets as investors continue to digest solid quarterly results that offset concerns about runaway inflation. The S&P 500 rose 0.3% on Thursday as the NASDAQ gained 0.5%, with all the indices ending the session at record highs.

The S&P 500 and the NASDAQ are on course for a weekly gain. The Dow Jones industrial average, on the other hand, remains under pressure after recording its third day of losses for the week on Thursday. Amid the mixed sentiments, the focus will shift towards inflation over the next few weeks as a good number of companies have posted quarterly earnings. The prospect of the FED hiking interest rates to curb inflation could trigger increased volatility.

Crypto sell-off persists

Bitcoin and Ethereum remain under pressure in the cryptocurrency market as a sell-off from record highs gathers steam. BTCUSD has already slid to lows of 56,456, with bears eyeing the $50,000 level after rejection from highs of $68,900.

ETHUSD also remains under pressure, with bulls under pressure near the $4,000 psychological level. The pair remains at risk of sliding to the $3,900 level, a crucial support level.