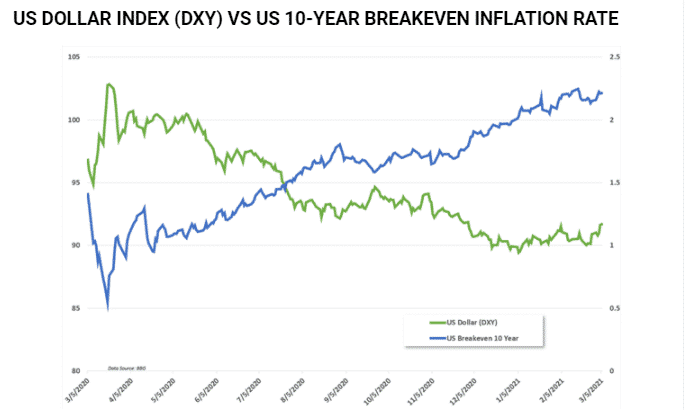

- After weeks of gains at the back of Treasury yields rising to one-year highs, the US dollar held firm. The dollar strength looks set to persist as a technical point to further upside action.

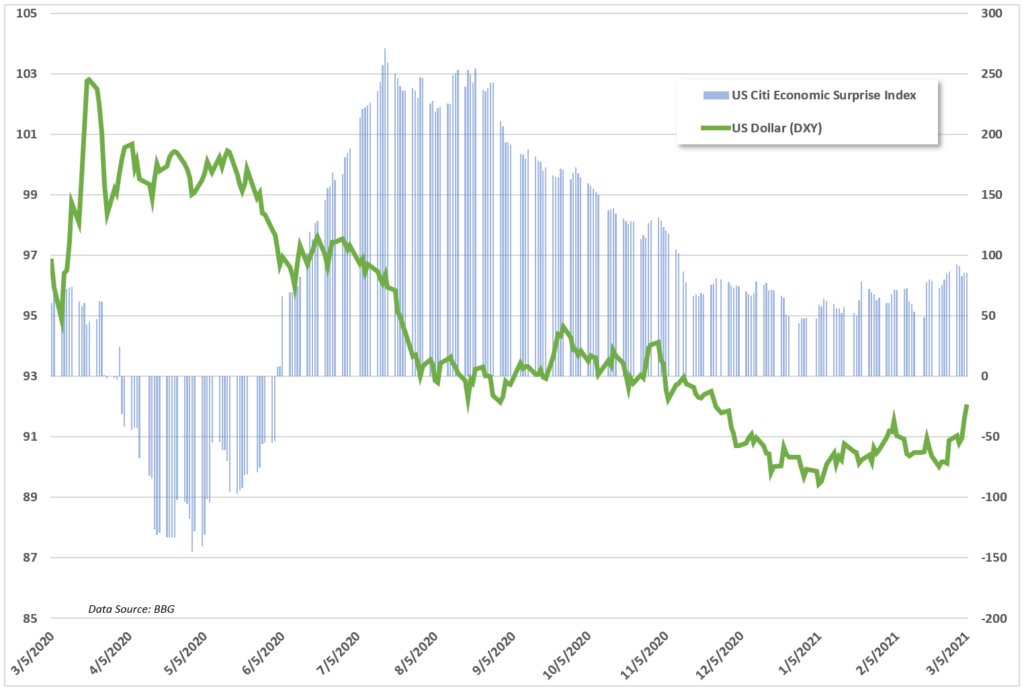

- Impressive economic releases signaling a bounce back in economic activity continue to offer support to dollar strength. A stimulus package at the back of better than expected jobs data also continues to work to dollar strength.

- Commodity currencies have since taken a beating after starting the week on a roll. The sell-off can be attributed to dollar strength.

The US dollar held firm against the majors at the start of the week, rallying to three-month highs. The rally coincided with the surging bond yields, which have been the catalyst behind the greenback strength in recent weeks. The Federal Reserve reiterating it won’t do much to tighten policy in view of rising yields did little to curtail dollar strength in the market.

Similarly, the US dollar index, which measures the strength of the greenback against other majors, rose by 0.38% to 92.33, having received a boost on the passing of the $1.9 trillion stimulus package.

The dollar index is closing in on its 200-day moving average. A rally followed by a close above the moving average should reaffirm the uptrend, gaining momentum in recent weeks. Trader’s sentiments on the dollar have improved significantly in response to improving the US economic health.

After dropping by more than 4% in the last quarter to two-year lows, the dollar has come out fighting, rallying by more than 2.5% since the start of the year. The rally has come on growing expectations that US bond yields will weigh on stretched equity valuations.

US yields have already risen to a striking distance of above 1.62% amid growing expectations of accelerated economic recovery from the COVID-19 pandemic. In contrast, German yields continued to edge lower, tanking by 5-basis points the past week, leading to the euro dropping to four months’ low against the dollar.

The dollar demand has edged higher, with equity markets tanking amid growing valuation concerns. As the equity markets have retracted by more than 10%, so has the dollar continued to elicit a bid tone in the market.

A better-than-expected job data indicated the addition of 379,000 jobs in February against 182,000 expected – that all but affirmed ongoing recovery in the aftermath of the pandemic. The dollar rallied despite the unemployment rate remaining steady at 6.3%.

The solid employment rates catapulted the dollar index past the 92 price level last registered in September of last year. Bulls remain in firm control as the greenback remains well-supported by surging Treasury yields that continue to fuel the bid tone.

The passing of the $1.9 trillion stimulus package is expected to significantly impact the economy, likely to continue fuelling further dollar strength. As part of the stimulus package, checks of $1,400 will be issued to families earning less than $160,000. Individuals earning less than $80,000 per year are also entitled to the $1400 checks.

A mix of a stimulus package, faster reopening, and increased consumer spending should be a clear positive for the dollar, which looks set to continue strengthening on economic recovery.

The dollar strength is once again taking a toll on commodity currency which started on a roll, on commodity prices edging higher. Oil prices edging past the $70 a barrel level offered support to the Canadian dollar, which was up early Monday morning.

After initially powering to highs of 1.2700, the CAD/USD has given up all the gains tanking to the 1.2600 handles attributed to the dollar strength.

The Australian dollar and New Zealand dollar have also come under pressure despite rallying early Monday morning on a spike in commodity prices. The two had rallied on the growing confidence in international trade. However, it appears the dollar strength has come back to bite, resulting in pullbacks. The Australian dollar weakened 0.3% to 0.7658 as the New Zealand dollar fell 0.8%.

Similarly, the dollar held firm near a one-month high against the British Pound’, as it continued to strengthen against the Japanese Yen near a nine-month high of 108.645.