- The Canadian dollar is trying to shrug off dollar strength in support of a spike in oil prices.

- The yen continues to strengthen across the board amid building risk aversion.

- Silver is trading at three weeks highs, well supported by dollar weakness

- Ethereum continues to outperform Bitcoin going by an increase in active addresses on its network

USDCAD sees some strong buying pressure after hitting support at the 1.2300 level. The rally early on Tuesday follows the formation of a bearish engulfing pattern on Friday as the dollar came under pressure, and the Canadian dollar strengthened across the board.

Keep an eye on other quality candlestick patterns that the market may form around the critical levels.

USDCAD bounce back

After a bounce-back off the 1.2300 support level, USDCAD is trading near a key resistance level at 1.2368, below which it remains bearish.

While the pair has moved to positive territory after the bounce back, it ought to close above the 1.2370 level to have any chances of rallying. Diminished odds of the Federal Reserve tightening monetary policy is one of the headwinds that could take a toll on the greenback consequently avert further gains on USDCAD.

Additionally, the Canadian dollar remains well supported on a spike in the oil price to multi-year highs. OPEC members failed to reach an agreement to increase the oil production is a factor that should continue to drive oil prices higher which could work in favor of the CAD, consequently pushing the USDCAD lower

EURJPY slide

Additionally, the euro is losing ground against the Japanese yen, which is strengthening across the board supported by a number of factors. EUR/JPY has slid to two-week lows and looks increasingly bearish near the 131.00 support level.

A breach of the support level could accelerate further losses towards the 130.60 level.

The Japanese yen is the subject of increased bidding tone in the forex market as a safe haven, as traders remain wary of the spread of the contagious Delta coronavirus variant. On the other hand, the euro remains under pressure amid growing concerns that the Delta variant could trigger a new wave of lockdowns that could affect the ongoing economic recovery.

Silver consolidation

In the commodity market, silver is trying to hold on to gains above the $26.60 level after the recent spike. XAGUSD is currently flirting with three-week highs as the precious metal remains the subject of increased binding tone on dollar weakness.

The dollar index edging lower in the aftermath of mixed June employment data is one factor that continues to offer support to XAGUSD price gains. Weakness in the dollar could see silver moving to the $26.85 level, closely followed by the $27.00 level.

On the flipside, silver failing to stabilize above the $26.60 level could result in a sell-off to the $26.30 level before the $26.00 critical support level.

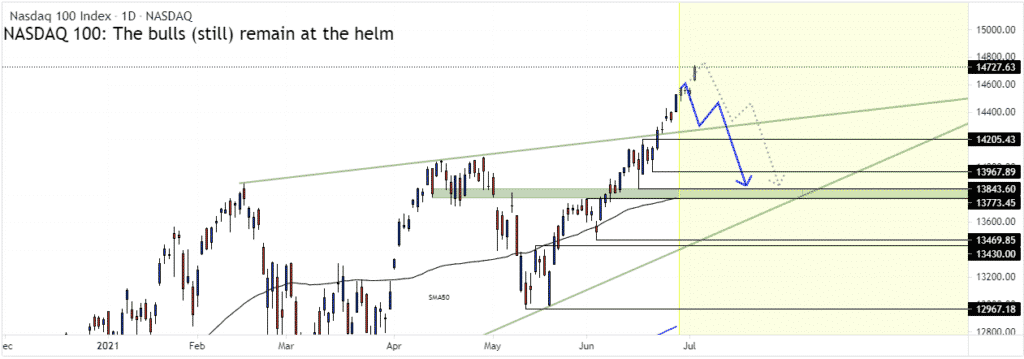

US indices at record highs

In the equity markets, the US stock future is pointing to a muted return following the July 4 long weekend. However, they look set to continue flirting with record highs achieved last week. At the start of the trading week in the US, the S&P futures wavered between gains and losses as the Nasdaq 100 slid by 0.1% before the open.

Equities remain well supported by a mixed June employment data that eased fears of the FED hiking interest rates, let alone embarking on a tapering process. However, equities could be choppier in the coming weeks as fresh data affirm ongoing economic recovery, which could fuel talk of rate hikes.

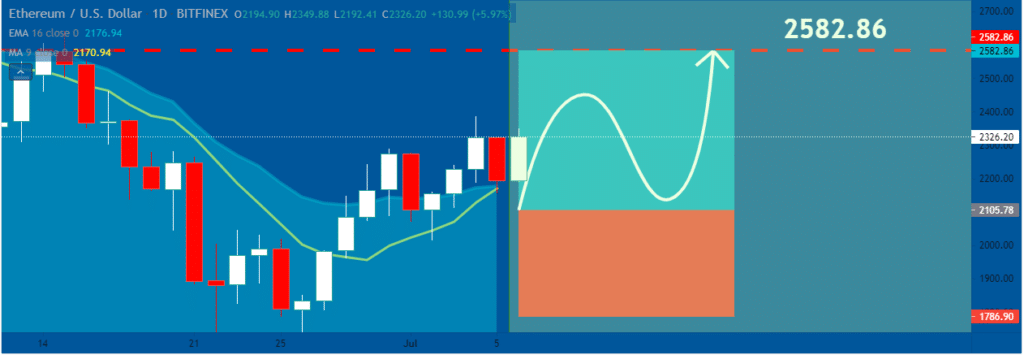

Ethereum outperforms Bitcoin

In the cryptocurrency market, Ethereum continues to outperform Bitcoin, ETHUSD having stabilized above the $2,000 level. Above the $2,150, the pair remains well supported for further price gains after recent consolidations.

On the flip side, the pair faces strong resistance near the $2353 level after a recent rejection. A rally followed by the close above the resistance would reaffirm a continuation of the bounce back. Ethereum is receiving support as it continues to draw attention to the number of daily active addresses on its network surpassing Bitcoin’s.

Over the last three months, active addresses on Bitcoin have dropped by 38%, something that continues to weigh heavily on Bitcoin sentiments and price.