A recent IMF blog post attempts to unbundle the reasons behind the ongoing supply chain disruptions. It says the Covid-19 pandemic necessitated lockdowns in many countries worldwide, and the resulting disruptions to logistics networks created labor shortages and capacity constraints.

The two most significant consequences of the supply chain disruptions are sharp increases in delivery times and freight costs. As such, essential commodities like natural gas and crude oil cannot reach the market in good time, spawning an energy crisis.

The problem is that more governments are falling back to dirty power sources like coal to plug shortages. However, some view the current global energy crunch as an opportunity for alternative energy sources like nuclear plants to flourish.

Can nuclear energy seize the moment?

Since Chernobyl, nuclear energy has unsuccessfully attempted to shake the monkey of a bad reputation from their back. People seem to be in a constant state of nuclear angst.

But nuclear energy now has a clear chance to get at the top of the agenda in the debate for the ideal energy source of the future. The current supply chain disruptions help make the case. Even more, the consequences of fossil fuels – climate change – are reshaping the way people think about nuclear power plants.

Some knowledgeable observers are now encouraging policymakers to consider nuclear energy. Because of the change of heart, nuclear energy ETFs have strengthened over the trailing twelve months.

A glance at an industry-specific index (Solactive Global Uranium & Nuclear Components Total Return Index) tells you that investors have had their eyes on the nuclear energy sector for some time.

The index is up 166% over the past trailing 12 months (TTM, with a considerable spike over the past three months.

Apparently, the spike in market activity regarding nuclear energy stocks happened when the threat of a global power shortage began to materialize in countries like China and Brazil. Considering that electricity demand is on the uptick, there is no better time for nuclear energy to claim the global energy industry.

Which nuclear energy ETFs should you consider in 2021 and 2022?

But direct investment in nuclear power is impossible for retail investors. That is why the equity market is a red-hot attraction for capital. Even better, exchange-traded funds (ETFs) provide a low-risk avenue to gain exposure to this clean energy source. Below, we discuss the best nuclear energy ETFs for your consideration in 2021 and 2022.

A quick side note: we outline the best nuclear energy ETFs based on year-to-date (YTD) returns.

NorthShore Global Uranium Mining ETF (URNM)

Summary (as of 26 October 2021):

- Assets Under Management: $901.8 million

- Expense Ratio: 0.85%

- YTD Return: 120.72%

URNM is among the most expensive ETFs in the market, but the returns justify the premium. The fund is a uranium-focused play whose holding is predominantly uranium mining companies.

The ETFs top is heavy, but it distributes weight better than rivals like URA. Specifically, Cameco Corp and Kazatomprom account for close to 30% of the fund’s weight.

While the fund has been a top performer since its inception in December 2019, this year’s performance is record-breaking. Interestingly, URNM now claims $901.8 million assets under management, up from about $48 million at the close of 2020, a 1,778.75% jump.

Its year-to-date return is also massive, 120.72% at writing, making it the best performer. Also, URNM’s net asset value (NAV) for the trailing year is up 171.36%. This indicates just how much 2021 is a special year for nuclear energy.

Global X Uranium ETF (URA)

Summary (as of 26 October 2021):

- Assets Under Management: $1.396 billion

- Expense Ratio: 0.69%

- YTD Return: 89.03%

Uranium is the primary raw material for nuclear reactors. Thus, mining companies are the biggest beneficiaries of the uptick in demand for nuclear energy.

Global X launched the Global X Uranium ETF in November 2010 to track uranium mining companies. It later added equity from companies producing nuclear components.

This ETF is the largest targeted play with over $1.396 billion assets under management. Remarkably, the ETFs assets are up 474% year-to-date, far outweighs the YTD return of 89.03%.

At writing, URA’s portfolio had 44 companies (most being uranium miners), and the largest holding is Cameco Corp (NYSE: CCJ), claiming 23.58% of the portfolio’s net assets.

But as with all other thematic funds, URA exposes investors to substantial concentration risk. A quick glance at the portfolio composition is telling in that regard. In fact, the top five holdings make up 53.18% of the ETF’s weight.

VanEck Uranium + Nuclear Energy ETF (NLR)

Summary (as of 26 October 2021)

- Assets Under Management: $30.8 million

- Expense Ratio: 0.60%

- YTD Return: 15.61%

NLR is the cheapest of the three ETFs in the nuclear energy niche. But, as with the other funds, NLR’s assets swelled this year, growing roughly 65% year-to-date.

One might wonder why the VanEck Uranium + Nuclear Energy ETF’s performance does not mirror the other two. Well, it helps to look under the hood.

According to the fund’s description on its website, it tracks the MVIS Global Uranium & Nuclear Energy Index. The managers intend to earn their subscribers a return equal to the index’s performance but minus expenses and fees.

In other words, NLR tracks the overall performance of companies involved in uranium mining, construction and maintenance of nuclear reactors and facilities, production of electric power from nuclear sources, and providing technology, services, and equipment to the nuclear power industry.

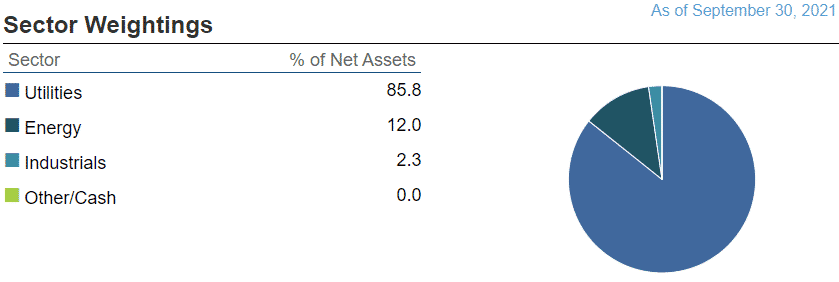

The fund has 25 holdings, and the top 10 account for 59.20% of the total weight. Thus, NLR avoids the concentration risk that URA and URNM expose to subscribers.

But some might find the fact that most of NLR’s assets are invested in utility stocks like Duke Energy Corp and Dominion Energy Inc. Some of these companies have superficial interests in nuclear energy. Thus, this explains why the ETF could not benefit from the recent surge in nuclear energy stocks.

Conclusion

Demand for nuclear energy stocks is surging, so are nuclear energy ETFs. However, only those funds with direct exposure to the sector, such as URNM and URA, are reaping the most rewards.